If You Had Bought Audinate Group (ASX:AD8) Shares Three Years Ago You'd Have Earned 226% Returns

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Audinate Group Limited (ASX:AD8) share price is 226% higher than it was three years ago. Most would be happy with that. Also pleasing for shareholders was the 20% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Audinate Group

Given that Audinate Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Audinate Group saw its revenue grow at 18% per year. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 48% per year. It's hard to value pre-profit businesses, but it seems like the market has become a lot more optimistic about this one! It would be worth thinking about when profits will flow, since that milestone will attract more attention.

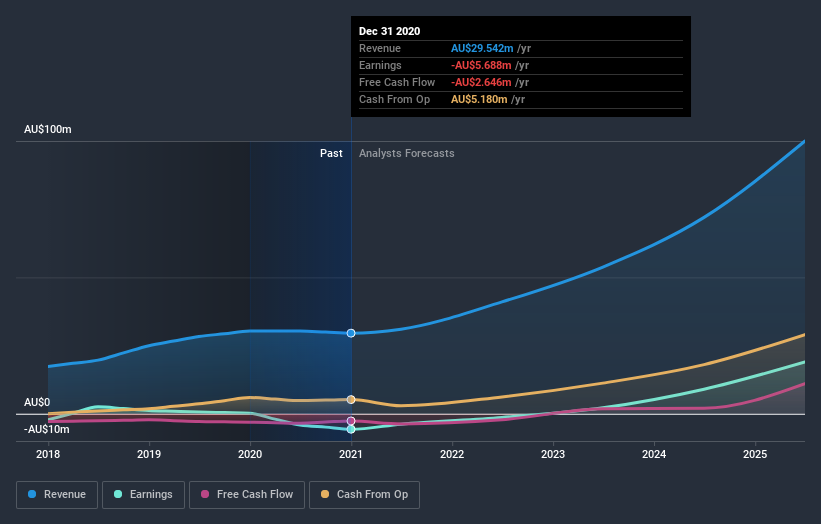

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Audinate Group's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Audinate Group rewarded shareholders with a total shareholder return of 28% over the last year. That falls short of the 48% it has made, for shareholders, each year, over three years. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Audinate Group , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Audinate Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AD8

Audinate Group

Engages in develops and sells digital audio visual (AV) networking solutions Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives