As the Australian market experiences a modest rise with the ASX200 up 0.5% at 8,582 points, attention turns to the Reserve Bank of Australia's impending rate decision, which is creating speculation and influencing market sentiment. In this environment where IT and Staples sectors are leading gains, identifying high growth tech stocks requires focusing on companies that demonstrate resilience and adaptability amidst economic shifts.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Pro Medicus | 21.96% | 22.68% | ★★★★★★ |

| Gratifii | 40.96% | 103.72% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Mesoblast | 49.04% | 54.89% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 44.16% | 98.46% | ★★★★★★ |

| Opthea | 52.56% | 60.35% | ★★★★★★ |

Click here to see the full list of 51 stocks from our ASX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$537.78 million.

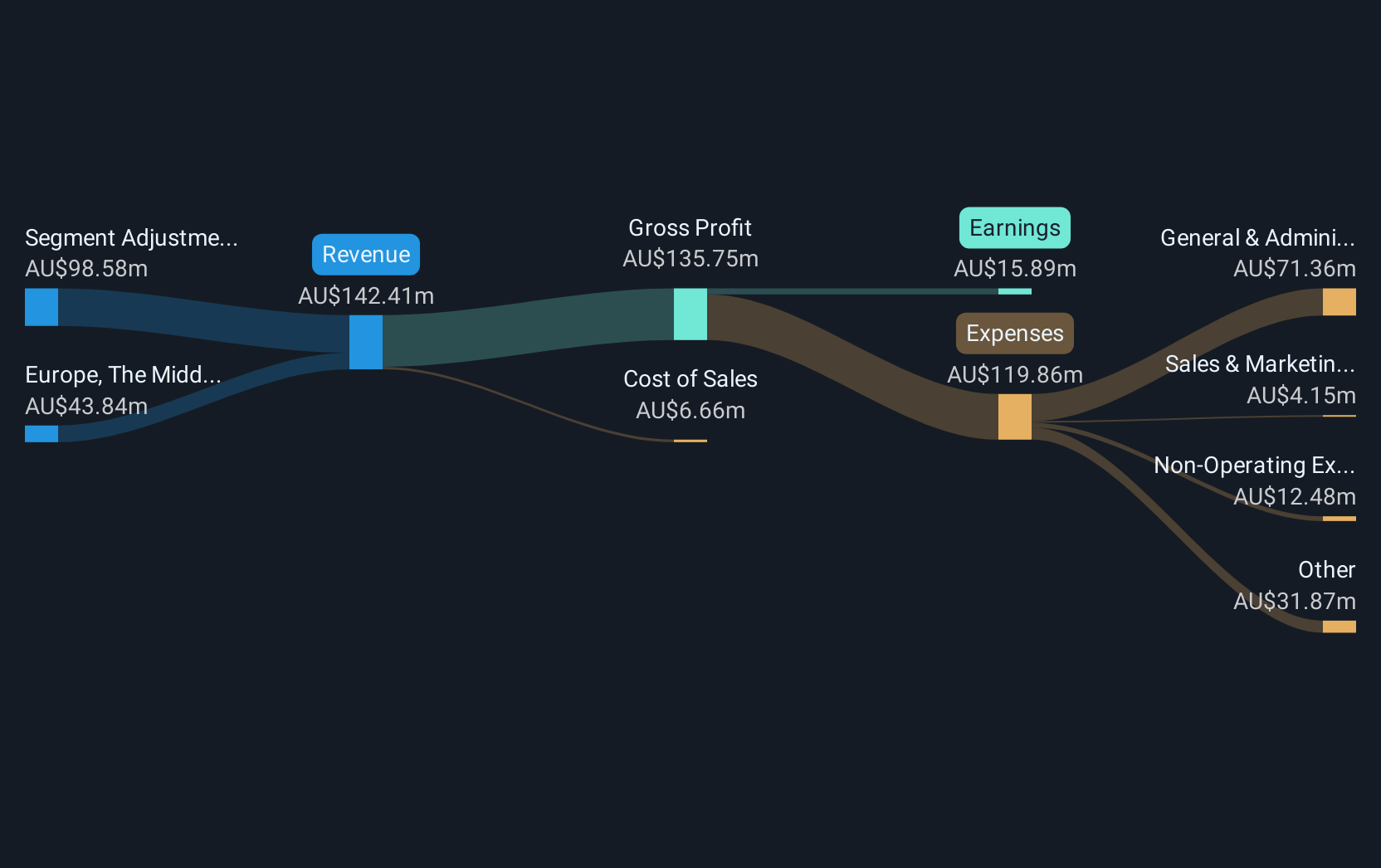

Operations: Infomedia generates revenue primarily from its publishing segment, specifically in periodicals, amounting to A$140.83 million. The company focuses on providing digital solutions for the automotive sector, leveraging its expertise in electronic parts catalogues and service quoting software.

Infomedia, navigating the competitive software landscape, is actively pursuing mergers and acquisitions to bolster long-term shareholder value, as highlighted by CEO Jens Monsees in November 2024. Despite a forecasted revenue growth of 6.8% per year, slightly above the Australian market average of 6%, its earnings have surged impressively by 32.4% over the past year—outpacing the industry's growth rate of 6.7%. This robust earnings momentum is expected to continue with an annual growth rate projected at approximately 21%, significantly higher than the broader market's 12.2%. Additionally, Infomedia maintains a strong free cash flow position and anticipates high return on equity at around 20.7% in three years' time, signaling efficient management and promising financial health amidst strategic expansions.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

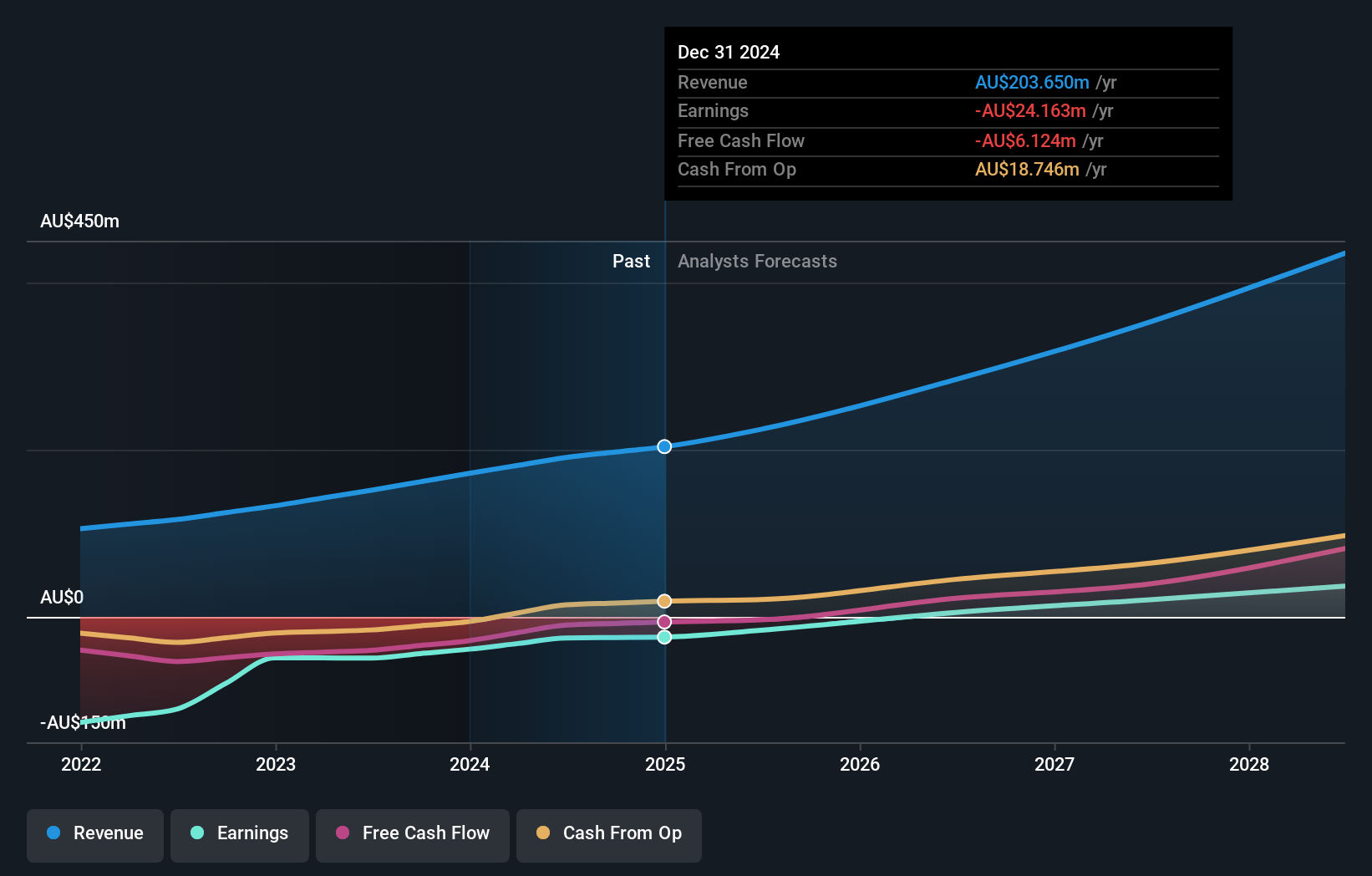

Overview: SiteMinder Limited is an Australian company that provides online guest acquisition platforms and commerce solutions for accommodation providers globally, with a market capitalization of A$1.76 billion.

Operations: SiteMinder generates revenue primarily from its software and programming segment, which brought in A$190.84 million. The company focuses on developing, marketing, and selling solutions that enhance online guest acquisition for accommodation providers both in Australia and internationally.

SiteMinder, amidst the bustling tech scene in Australia, stands out with its robust growth metrics. With an annual revenue increase of 19.5%, it significantly outpaces the general Australian market's expansion rate of 6%. This growth is complemented by a striking surge in earnings, forecasted to grow at 61.1% annually. Investing heavily in innovation, SiteMinder's R&D expenses have scaled up to enhance its competitive edge in the hotel booking software segment—a move that not only reflects its commitment to maintaining leadership but also secures future growth avenues in a digitalizing global hospitality industry.

- Click here to discover the nuances of SiteMinder with our detailed analytical health report.

Gain insights into SiteMinder's historical performance by reviewing our past performance report.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

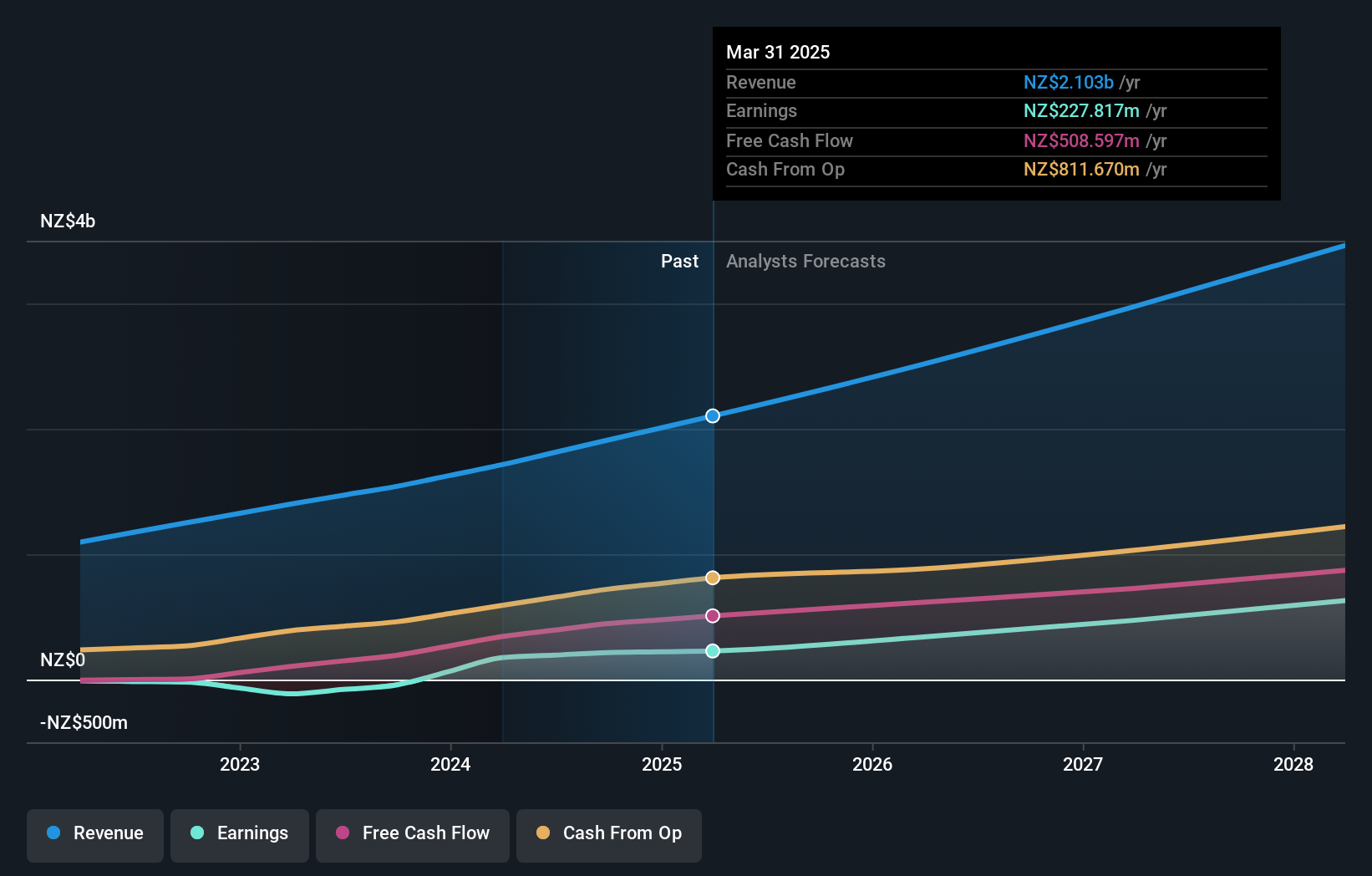

Overview: Xero Limited is a software as a service company offering online business solutions for small businesses and their advisors across Australia, New Zealand, and internationally, with a market cap of A$28.10 billion.

Operations: Xero generates revenue primarily from providing online solutions for small businesses and their advisors, with reported revenue of NZ$1.91 billion. The company's focus on SaaS offerings supports its operations across Australia, New Zealand, and international markets.

Xero, a standout in the Australian tech landscape, has demonstrated robust financial health with a 14.4% annual revenue growth rate, outpacing the broader market's 5.9%. This growth is supported by an impressive forecast of 26.4% in annual earnings expansion over the next three years. The recent appointment of Claire Bramley as CFO underscores Xero's commitment to strengthening its leadership amidst this high-growth phase; her extensive experience at global tech firms could enhance strategic initiatives and drive further innovation. Additionally, Xero's focus on R&D reflects its dedication to maintaining competitive advantage and securing future growth avenues in the dynamic software industry.

- Navigate through the intricacies of Xero with our comprehensive health report here.

Assess Xero's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 51 ASX High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IFM

Infomedia

A technology company, develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives