WiseTech Global (ASX:WTC): Reassessing Valuation as Growth Outpaces Recent Share Price Levels

Reviewed by Kshitija Bhandaru

WiseTech Global (ASX:WTC) has caught attention as its multi-year revenue and profit growth stands out in the logistics software industry. Its current share price, now below historical valuation levels, is prompting fresh investor interest.

See our latest analysis for WiseTech Global.

This year has been a reset for WiseTech Global, with its share price slipping nearly 31% year-to-date and a one-year total shareholder return of -36%. Still, the company’s three- and five-year total returns of 61% and 216% remind investors that momentum can shift quickly when long-term growth persists and valuations compress.

If this shift in sentiment has you rethinking what else could be poised for a rebound, now is the perfect chance to broaden your scope and discover fast growing stocks with high insider ownership

The real question now, with shares trading below historical averages and growth still robust, is whether WiseTech Global is undervalued and set for a rebound or if the market is already factoring in all its upside potential.

Most Popular Narrative: 30.6% Undervalued

WiseTech Global’s most popular narrative sees a fair value considerably above its last close, hinting at meaningful upside if assumptions prove accurate. With analysts factoring in ongoing growth and product expansion, this narrative builds its case on the company’s strategic moves and operating leverage.

The industry-wide push for supply chain digitization, automation, and advanced logistics optimization, fueled post-pandemic by demands for resilience, efficiency, and transparency, continues to drive strong adoption of WiseTech's mission-critical SaaS solutions, increasing both net profit margins and long-term revenue through deepening integrations with major global logistics providers.

Want to know what makes analysts so bullish? This valuation hinges on forecasts of aggressive revenue expansion, margin improvements, and key moves with international partners. What secrets underpin these bold projections? Uncover the methodology powering one of the market’s most debated fair value calls. Click for the full narrative details.

Result: Fair Value of $123.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower organic growth and complexities in integrating E2open could challenge WiseTech Global’s outlook. These factors could potentially limit upside if execution falls short.

Find out about the key risks to this WiseTech Global narrative.

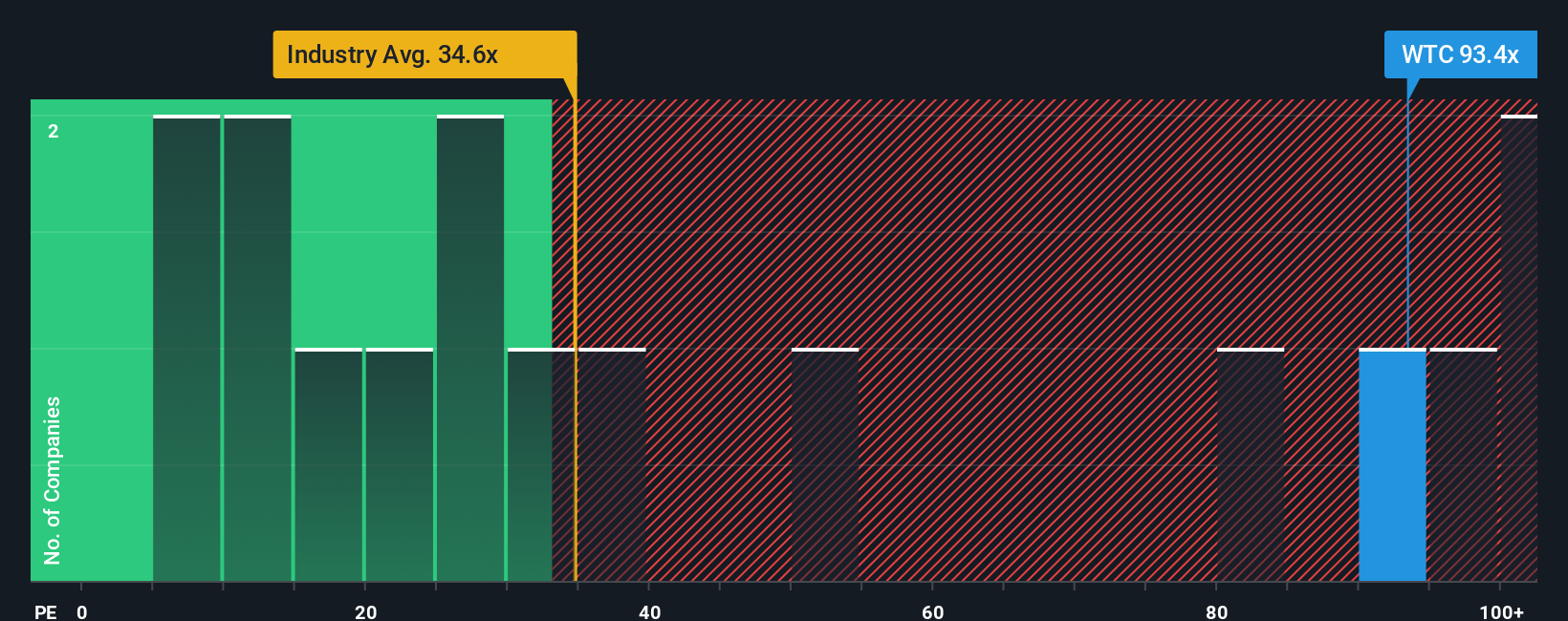

Another View: Multiples Paint a Very Different Picture

While many see WiseTech Global as undervalued based on future growth potential, its price-to-earnings ratio stands at 94.1x, which is much higher than both the Oceanic Software industry average of 38.1x and the peer average of 74.2x. The fair ratio is estimated at just 53.5x. This substantial gap suggests WiseTech shares are expensive by historic and sector standards, potentially increasing valuation risk for new investors if growth doesn't accelerate. Can WiseTech really grow fast enough to justify such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WiseTech Global Narrative

If you’ve got a different view or think the story could unfold another way, you can investigate the figures and shape your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding WiseTech Global.

Looking for more investment ideas?

Smart investing means always having a few fresh opportunities on your radar. Don’t miss your chance: these targeted screens could put your next winner in reach.

- Spot strong yield plays and enhance your portfolio’s cash flow through these 19 dividend stocks with yields > 3%.

- Tap into the fintech future by evaluating these 78 cryptocurrency and blockchain stocks with robust technology strategies and blockchain breakthroughs fueling tomorrow's growth.

- Jump ahead in the innovation race by assessing these 25 AI penny stocks shaping artificial intelligence and transforming entire industries right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives