Here's Why We Think WiseTech Global (ASX:WTC) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like WiseTech Global (ASX:WTC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for WiseTech Global

WiseTech Global's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that WiseTech Global has managed to grow EPS by 34% per year over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

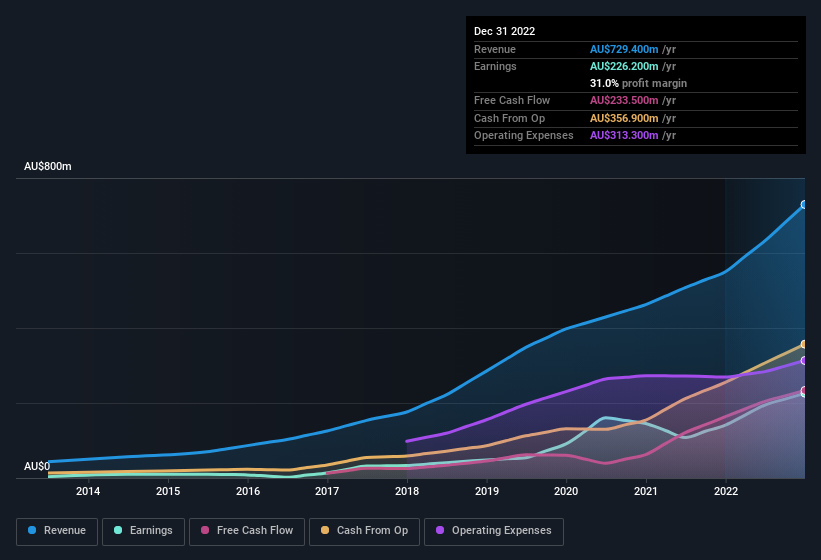

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. WiseTech Global shareholders can take confidence from the fact that EBIT margins are up from 35% to 42%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for WiseTech Global?

Are WiseTech Global Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a AU$29b company like WiseTech Global. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth AU$2.7b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations over AU$12b, like WiseTech Global, the median CEO pay is around AU$5.8m.

The CEO of WiseTech Global only received AU$1.1m in total compensation for the year ending June 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is WiseTech Global Worth Keeping An Eye On?

For growth investors, WiseTech Global's raw rate of earnings growth is a beacon in the night. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes WiseTech Global look rather interesting indeed. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing WiseTech Global's ROE with industry peers (and the market at large).

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if WiseTech Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WTC

WiseTech Global

Engages in the development and provision of software solutions to the logistics execution industry in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives