- Australia

- /

- Diversified Financial

- /

- ASX:SZL

The Sezzle (ASX:SZL) Share Price Is Up 178% And Shareholders Are Boasting About It

It hasn't been the best quarter for Sezzle Inc. (ASX:SZL) shareholders, since the share price has fallen 21% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 178% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Check out our latest analysis for Sezzle

Because Sezzle made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Sezzle grew its revenue by 468% last year. That's stonking growth even when compared to other loss-making stocks. And the share price has responded, gaining 178% as we previously mentioned. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

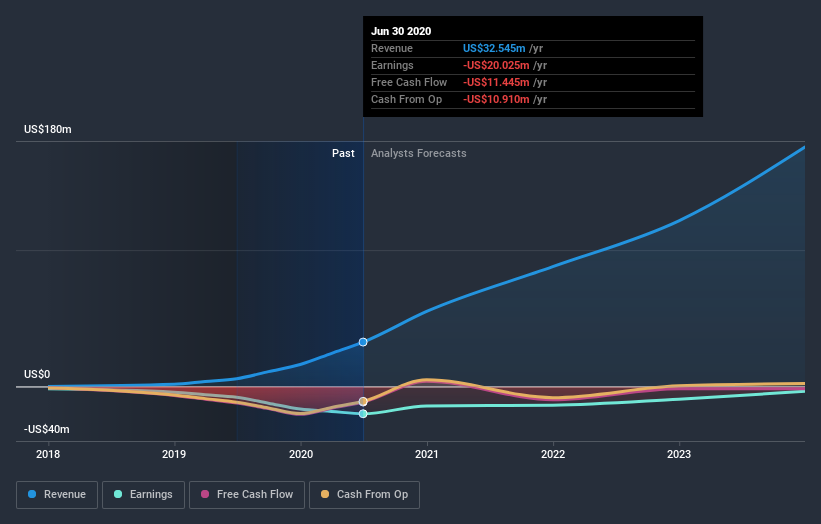

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Sezzle stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Sezzle boasts a total shareholder return of 178% for the last year. We regret to report that the share price is down 21% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Sezzle , and understanding them should be part of your investment process.

But note: Sezzle may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Sezzle, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:SZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Medium with questionable track record.

Similar Companies

Market Insights

Community Narratives