- Australia

- /

- Hospitality

- /

- ASX:WEB

ASX Penny Stocks To Consider In March 2025

Reviewed by Simply Wall St

The Australian market has shown resilience, with the ASX 200 closing above 7,900 points recently, driven by strong performances in the IT sector despite some lag in Materials. In this context of fluctuating sectoral performance, investors often look to penny stocks for their potential affordability and growth opportunities. While the term 'penny stock' might seem outdated, these smaller or newer companies can still offer intriguing prospects when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.64 | A$127.94M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$1.99 | A$146.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.795 | A$1.02B | ✅ 4 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.645 | A$77.6M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.38 | A$368.64M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.60 | A$117.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.08 | A$146.15M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.87 | A$962.59M | ✅ 4 ⚠️ 3 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.88 | A$1.32B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.375 | A$44M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 981 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bravura Solutions (ASX:BVS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bravura Solutions Limited is an international company that develops, licenses, and maintains software applications for wealth management and funds administration sectors across Australia, the United Kingdom, New Zealand, and other regions with a market cap of A$1.03 billion.

Operations: Bravura Solutions' revenue is derived from its software applications for wealth management and funds administration sectors, serving markets in Australia, the United Kingdom, New Zealand, and other regions.

Market Cap: A$1.03B

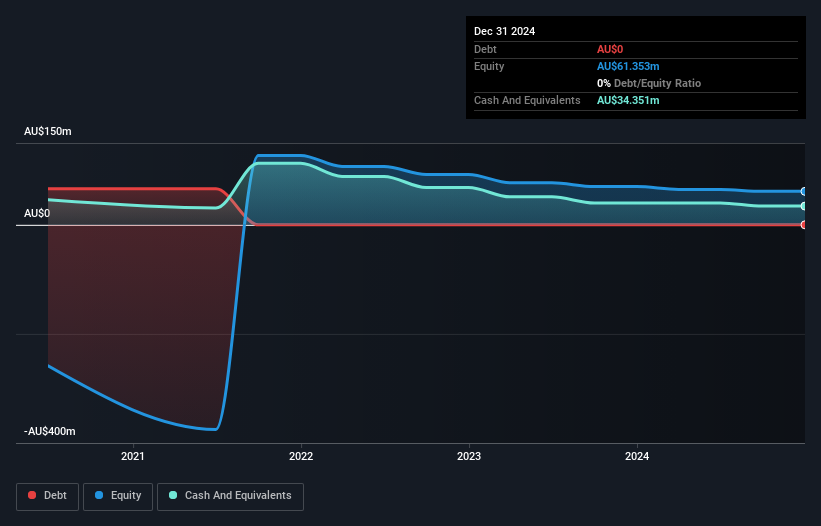

Bravura Solutions has recently shown a significant turnaround, reporting a net income of A$61.24 million for the half-year ending December 2024, compared to a loss previously. The company has no debt and boasts strong short-term asset coverage over liabilities. Its Return on Equity is outstanding at 56.2%, suggesting efficient use of equity capital. While management and board experience is limited with average tenures under two years, Bravura's price-to-earnings ratio of 14.4x indicates it may be undervalued relative to the broader Australian market. Recent guidance upgrades reflect positive revenue expectations between A$248 million and A$252 million for fiscal year 2025.

- Dive into the specifics of Bravura Solutions here with our thorough balance sheet health report.

- Gain insights into Bravura Solutions' future direction by reviewing our growth report.

SiteMinder (ASX:SDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SiteMinder Limited develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers globally, with a market cap of A$1.29 billion.

Operations: The company generates revenue through its Software & Programming segment, which amounted to A$203.65 million.

Market Cap: A$1.29B

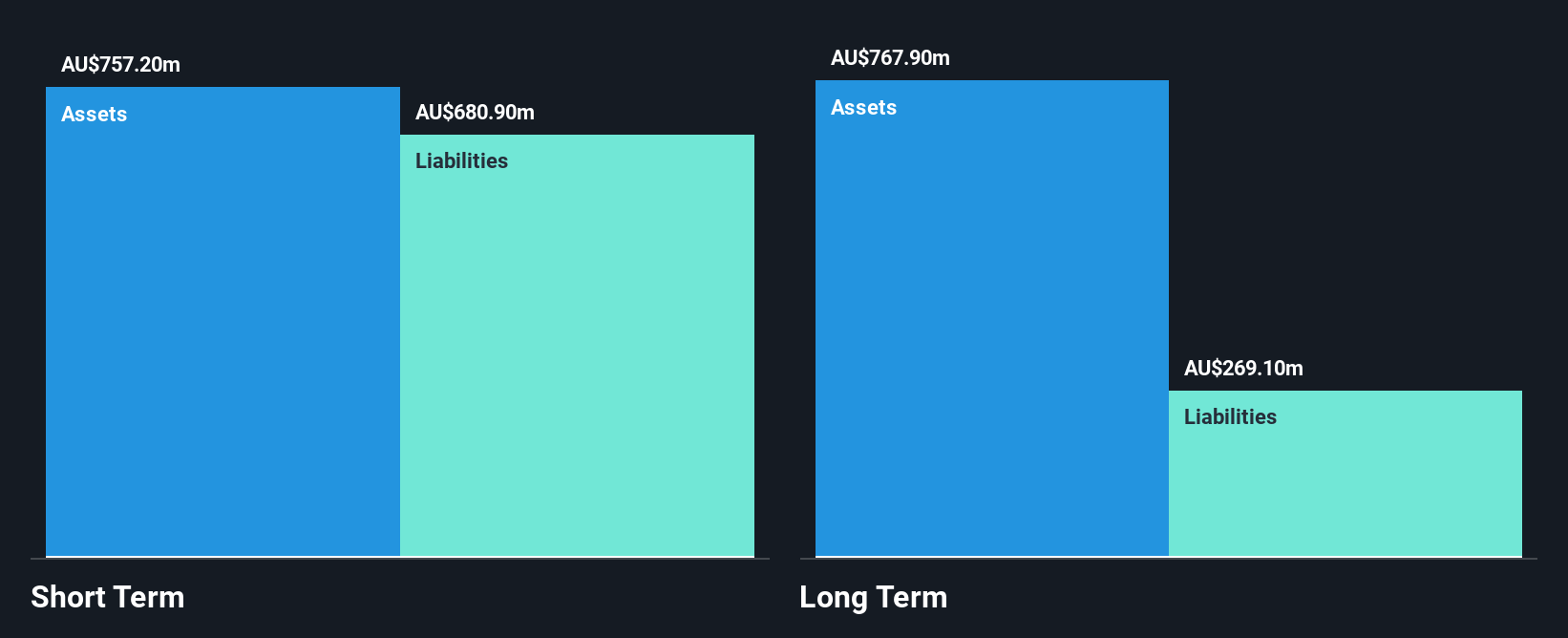

SiteMinder Limited, with a market cap of A$1.29 billion, remains unprofitable but has shown consistent revenue growth, reporting A$104.45 million in sales for the half year ending December 2024. Despite a net loss of A$13.89 million, losses have narrowed compared to previous years. The company is debt-free and maintains a stable cash runway for over three years based on current free cash flow levels. Analysts anticipate significant earnings growth at 65.36% per year, and the stock trades below fair value estimates with expectations of price appreciation by 47.5%. However, short-term liabilities slightly exceed assets by A$1.2 million.

- Unlock comprehensive insights into our analysis of SiteMinder stock in this financial health report.

- Gain insights into SiteMinder's outlook and expected performance with our report on the company's earnings estimates.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited offers online travel booking services across Australia, New Zealand, the United Arab Emirates, the United Kingdom, and internationally with a market cap of A$1.68 billion.

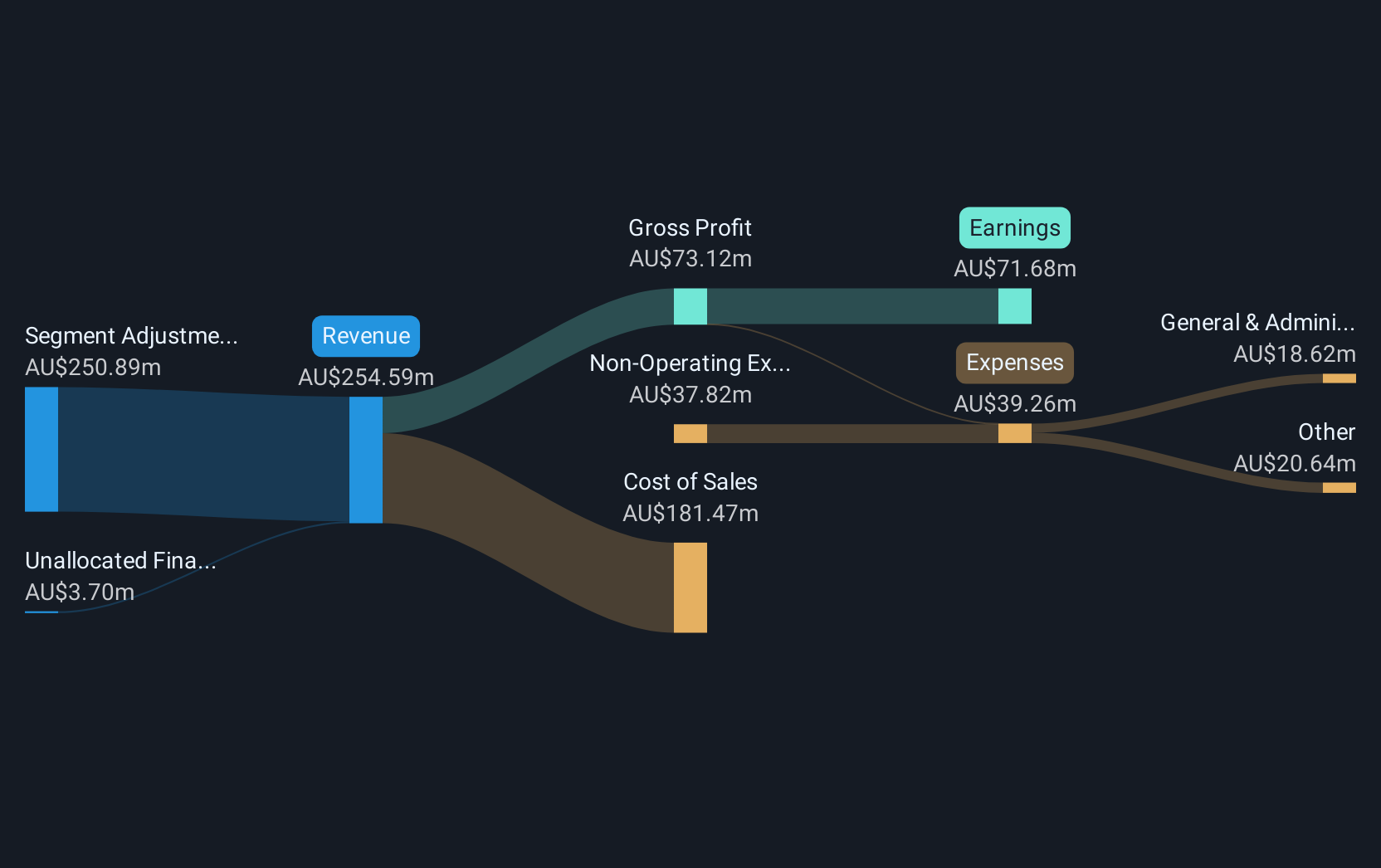

Operations: The company generates revenue primarily from its Business to Business Travel (B2B) segment, amounting to A$323.2 million.

Market Cap: A$1.68B

Web Travel Group Limited, with a market cap of A$1.68 billion, demonstrates strong financial health and growth potential. The company reported significant earnings of A$323.2 million from its B2B segment, showcasing high-quality earnings and improved net profit margins at 16%. Its short-term assets significantly exceed both long-term liabilities and short-term liabilities, ensuring robust liquidity. Despite a low return on equity at 10.5%, the company's debt is well covered by operating cash flow and interest payments are comfortably managed with an EBIT coverage of 93.3 times. However, the board's inexperience could pose governance challenges moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Web Travel Group.

- Explore Web Travel Group's analyst forecasts in our growth report.

Taking Advantage

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 978 more companies for you to explore.Click here to unveil our expertly curated list of 981 ASX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, New Zealand, the United Arab Emirates, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives