FINEOS Corporation Holdings And 2 Other High Growth Tech Stocks In Australia

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating futures on the ASX and recent highs in U.S. indices like the S&P 500, Australian investors are keenly evaluating their positions as late earnings reports roll in, potentially steering local market sentiment. In this dynamic environment, identifying high-growth tech stocks such as FINEOS Corporation Holdings becomes crucial for investors seeking to capitalize on innovation and expansion potential within Australia's tech sector.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 21.20% | 24.78% | ★★★★★☆ |

| Kinatico | 13.76% | 49.24% | ★★★★☆☆ |

| Immutep | 74.89% | 47.70% | ★★★★★★ |

| Pro Medicus | 19.62% | 21.46% | ★★★★★☆ |

| GTN | 5.61% | 87.47% | ★★★★☆☆ |

| BlinkLab | 51.29% | 56.62% | ★★★★★★ |

| PYC Therapeutics | 17.39% | 36.85% | ★★★★★☆ |

| Xero | 12.82% | 23.77% | ★★★★☆☆ |

| FINEOS Corporation Holdings | 10.00% | 57.30% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers, as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market cap of A$1.02 billion.

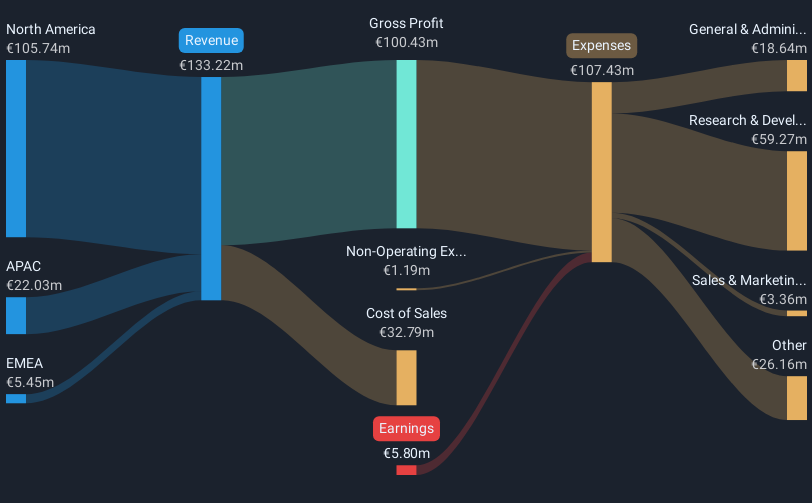

Operations: The company generates revenue primarily from its Software & Programming segment, which reported €135.90 million. Its business focuses on providing specialized software solutions tailored for insurers and benefits providers across various regions.

FINEOS Corporation Holdings has shown resilience with a notable recovery in its financial performance, evidenced by a reduction in net loss to €1.26 million from €5.32 million year-over-year and an increase in sales to €67.16 million. This improvement aligns with the company's strategic enhancements, including the deployment of innovative solutions like the Personal Injury Portal for Nationale-Nederlanden, which leverages FINEOS's robust API technology. Despite current unprofitability, FINEOS is expected to see revenue growth at 10% annually—outpacing the Australian market average of 5.3%. Moreover, earnings are projected to surge by 57.3% annually over the next three years, signaling potential upward momentum as operational efficiencies and client-centric innovations begin to yield financial gains.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including Asia Pacific, the Americas, Europe, the Middle East, and Africa with a market cap of A$890.19 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for A$221.50 million.

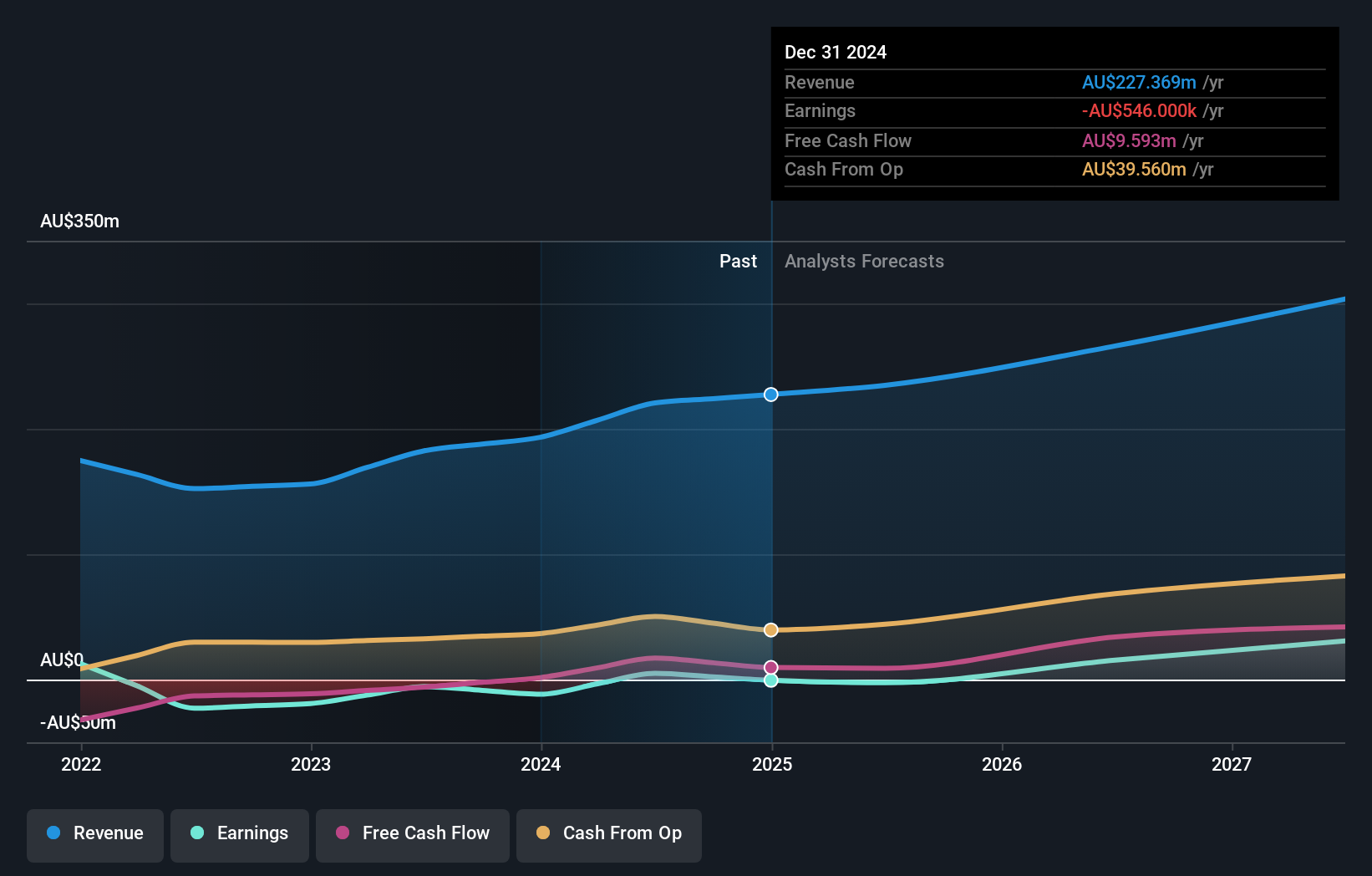

Nuix Limited, amidst a challenging fiscal year ending June 2025, reported a slight increase in sales to AUD 221.5 million from AUD 220.62 million the previous year but faced a notable shift from net income of AUD 5 million to a net loss of AUD 9.21 million. This financial downturn coincides with significant executive shifts, including the departure of Hon. Jeff Bleich from the board, potentially signaling strategic realignments ahead. Despite current unprofitability and revenue growth at 8.9% annually—below the high-growth benchmark but still outpacing Australia's average—Nuix is projected to pivot towards profitability within three years, with earnings expected to surge by an impressive annual rate of 44.2%. This forecasted recovery highlights Nuix’s potential resilience and adaptability in navigating its operational and market challenges.

- Click here to discover the nuances of Nuix with our detailed analytical health report.

Understand Nuix's track record by examining our Past report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$832.15 million.

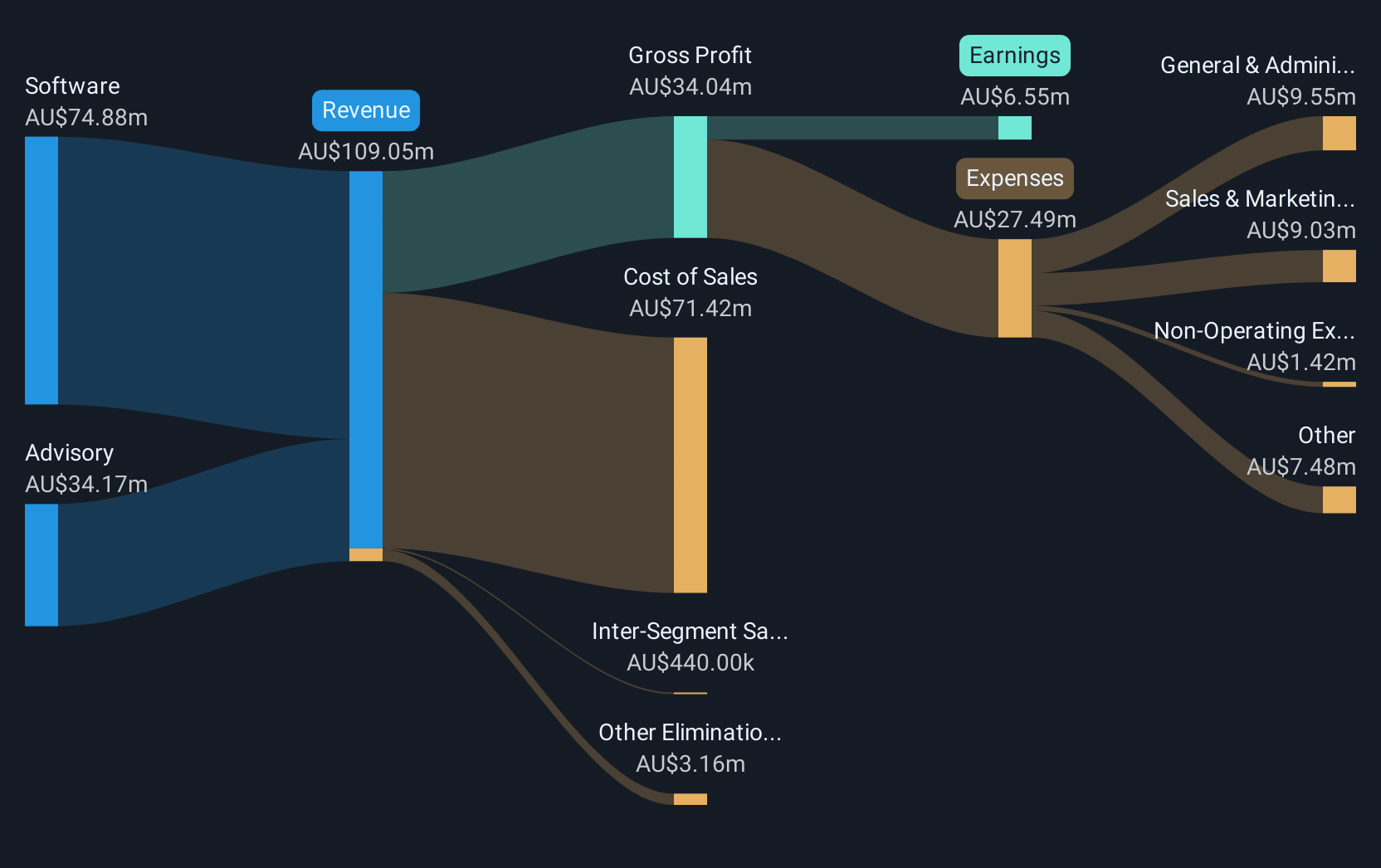

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, contributing A$73.96 million, and its Advisory services, adding A$24.77 million. The company's focus is on delivering specialized mining software solutions across multiple continents.

RPMGlobal Holdings has demonstrated a robust financial turnaround, with net income soaring to AUD 47.46 million from AUD 8.66 million in the previous fiscal year, reflecting an annual earnings growth of 83.9%. This surge is supported by strategic initiatives including significant participation in industry conferences such as the Mine Planning Forum Central Asia and Perth, enhancing its market presence and client engagement within the mining software sector. Additionally, R&D investments remain a priority for RPMGlobal, aligning with its commitment to innovation and competitive edge in technology development for mining operations. With revenue growing at 11.6% annually—outpacing the Australian market average—RPMGlobal's focus on expanding its technological offerings and maintaining strong industry connections suggests promising prospects for sustained growth.

Key Takeaways

- Get an in-depth perspective on all 21 ASX High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FCL

FINEOS Corporation Holdings

Engages in the development and sale of enterprise claims and policy management software for life, accident and health insurers, and employee benefits providers in North America, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives