Qoria (ASX:QOR) Valuation in Focus Ahead of Q1 2026 Earnings Release

Reviewed by Simply Wall St

Qoria (ASX:QOR) has announced it will release its Q1 2026 results and host an earnings call on October 21. These events often prompt close attention from investors reviewing recent business trends and performance.

See our latest analysis for Qoria.

After a series of upbeat trading sessions ahead of the upcoming results, Qoria’s share price has climbed 30% over the past month and boasts a year-to-date return of 80%. Notably, its total shareholder return has more than doubled over the past year, which suggests strong momentum as anticipation builds around the company's next moves and growth signals remain robust.

If Qoria’s surge has you scanning for what else is catching investor attention, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such rapid gains and a surging one-year return, the real question for investors is whether Qoria’s impressive track record leaves room for upside or if the market has already accounted for future growth. Could there still be a buying opportunity?

Price-to-Sales Ratio of 9.8x: Is it justified?

Compared to its Australian Software peers, Qoria’s current price-to-sales ratio stands out at 9.8x, suggesting investors are pricing in a premium for its future growth despite recent losses.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of revenue generated and is especially relevant for software companies, where early profitability can be elusive but revenue growth and market share acquisition are highly prized.

At 9.8x, Qoria is priced well above the industry average of 4.2x and its own estimated fair price-to-sales ratio of 9.7x. This premium implies the market is betting on rapid revenue expansion or meaningful margin improvements ahead. If sentiment falters, multiples could compress toward the fair ratio, recalibrating expectations swiftly.

Explore the SWS fair ratio for Qoria

Result: Price-to-Sales of 9.8x (OVERVALUED)

However, risks remain if growth expectations disappoint or if market sentiment shifts. This could potentially lead to a sharp correction in Qoria’s currently elevated valuation.

Find out about the key risks to this Qoria narrative.

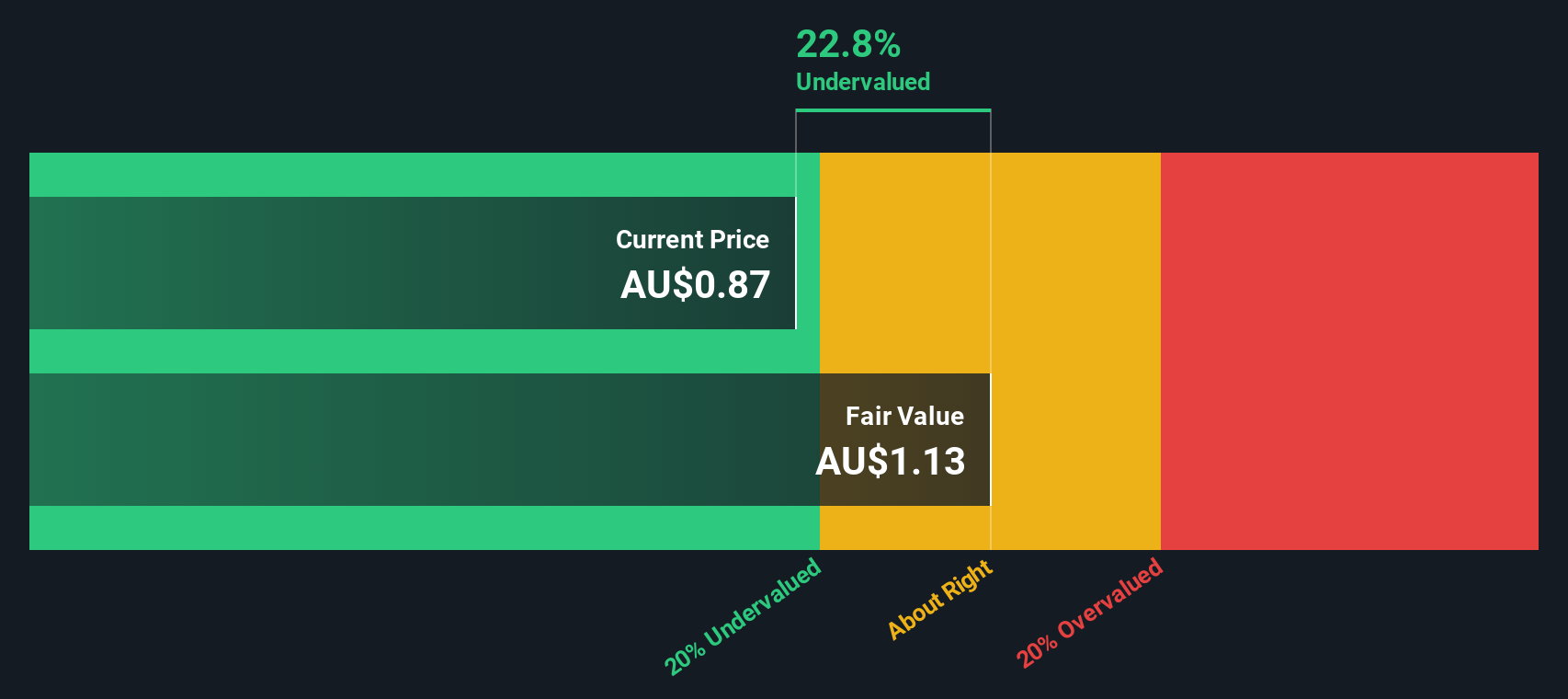

Another View: Our DCF Model Comes to a Different Conclusion

The SWS DCF model, which looks at Qoria's estimated future cash flows, paints a somewhat different picture. According to this approach, Qoria is trading right around its fair value, just 1% below our estimate. The take-away is that while the market is pricing in strong growth, this model suggests gains may already be reflected in the share price. Will the numbers finally settle the debate, or is there still more to the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qoria for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qoria Narrative

Don’t forget, if you want to dig into the numbers yourself or prefer hands-on research, you can shape your own data-driven view in just a few minutes, Do it your way

A great starting point for your Qoria research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Keep your edge in today's markets by looking beyond a single stock. The smartest investors are always on the hunt for fresh opportunities and emerging trends so make sure you don't miss out on discovering the next potential success.

- Tap into reliable income opportunities and spot companies offering high yields with these 17 dividend stocks with yields > 3%.

- Spot undervalued gems the market has overlooked by checking out these 875 undervalued stocks based on cash flows.

- Ride the wave of innovation in artificial intelligence and pinpoint tomorrow’s leaders with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Good value with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026