Are Qoria's (ASX:QOR) Debt Pressures Reshaping Its Financial Sustainability Narrative?

Reviewed by Sasha Jovanovic

- Qoria (ASX:QOR) recently came under investor scrutiny following news coverage highlighting its elevated debt profile, balance sheet challenges, and ongoing cash flow pressures.

- This situation underscores how the company's liabilities now exceed its near-term assets, amplifying questions around financial sustainability and its ability to fund growth.

- We'll explore how concerns about debt levels and negative free cash flow are influencing Qoria's investment narrative amid these developments.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Qoria's Investment Narrative?

To be a shareholder in Qoria right now, one must believe in the company's capacity to turn revenue growth and index inclusions into long-term financial resilience. Recent news about Qoria’s elevated debt and negative cash flow puts the spotlight on its ability to fund further expansion, especially as its liabilities now outstrip near-term assets. This shifts the risk profile and raises the stakes surrounding Qoria’s next earnings release and AGM, both important potential short-term catalysts. While Qoria’s prior improvements in reducing net losses and securing index inclusions provided a supportive narrative for growth and higher visibility, the latest concerns about debt paint a less certain picture. The sustainability of growth ambitions may now hinge on management’s ability to shore up the balance sheet quickly, possibly through further capital raising or stronger operating results. On the other hand, the company’s elevated debt load is a new risk that investors should keep front of mind.

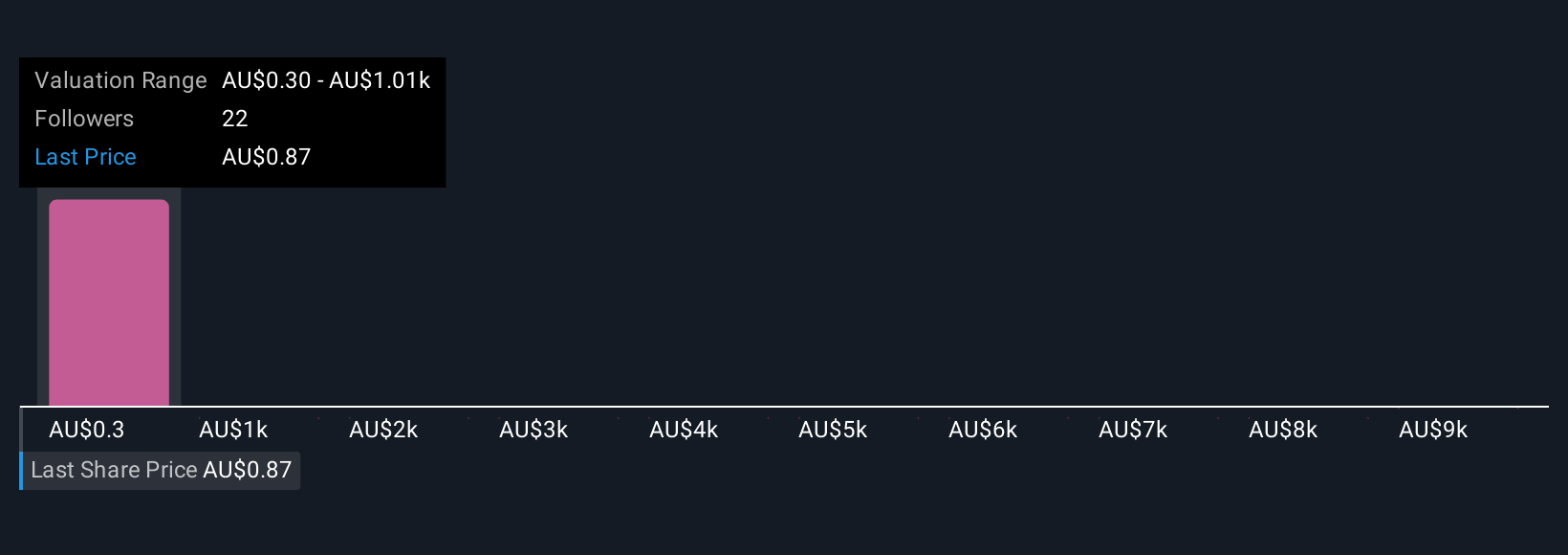

Qoria's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 6 other fair value estimates on Qoria - why the stock might be a potential multi-bagger!

Build Your Own Qoria Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qoria research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qoria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qoria's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qoria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:QOR

Qoria

Qoria Limited markets, distributes, and sells cyber safety products and services in Australia, New Zealand, the United Kingdom, the United States, Europe, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives