October 2025's Global Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

In October 2025, global markets are grappling with renewed U.S.-China trade tensions and concerns over a potential U.S. government shutdown, leading to declines in major indices such as the S&P 500 and Russell 2000. Despite these challenges, small-cap stocks can offer unique opportunities for investors willing to navigate the volatility, particularly those that show signs of being undervalued or have insider buying activity.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Aurelia Metals | 9.4x | 1.3x | 29.52% | ★★★★★★ |

| Speedy Hire | NA | 0.3x | 27.57% | ★★★★★☆ |

| Bumitama Agri | 10.5x | 1.5x | 48.59% | ★★★★☆☆ |

| Bytes Technology Group | 18.0x | 4.5x | 11.24% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.5x | 0.3x | 2.15% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.36% | ★★★★☆☆ |

| BWP Trust | 10.1x | 13.2x | 13.38% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 21.20% | ★★★★☆☆ |

| Sagicor Financial | 7.0x | 0.4x | -71.66% | ★★★★☆☆ |

| Cettire | NA | 0.4x | 15.13% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

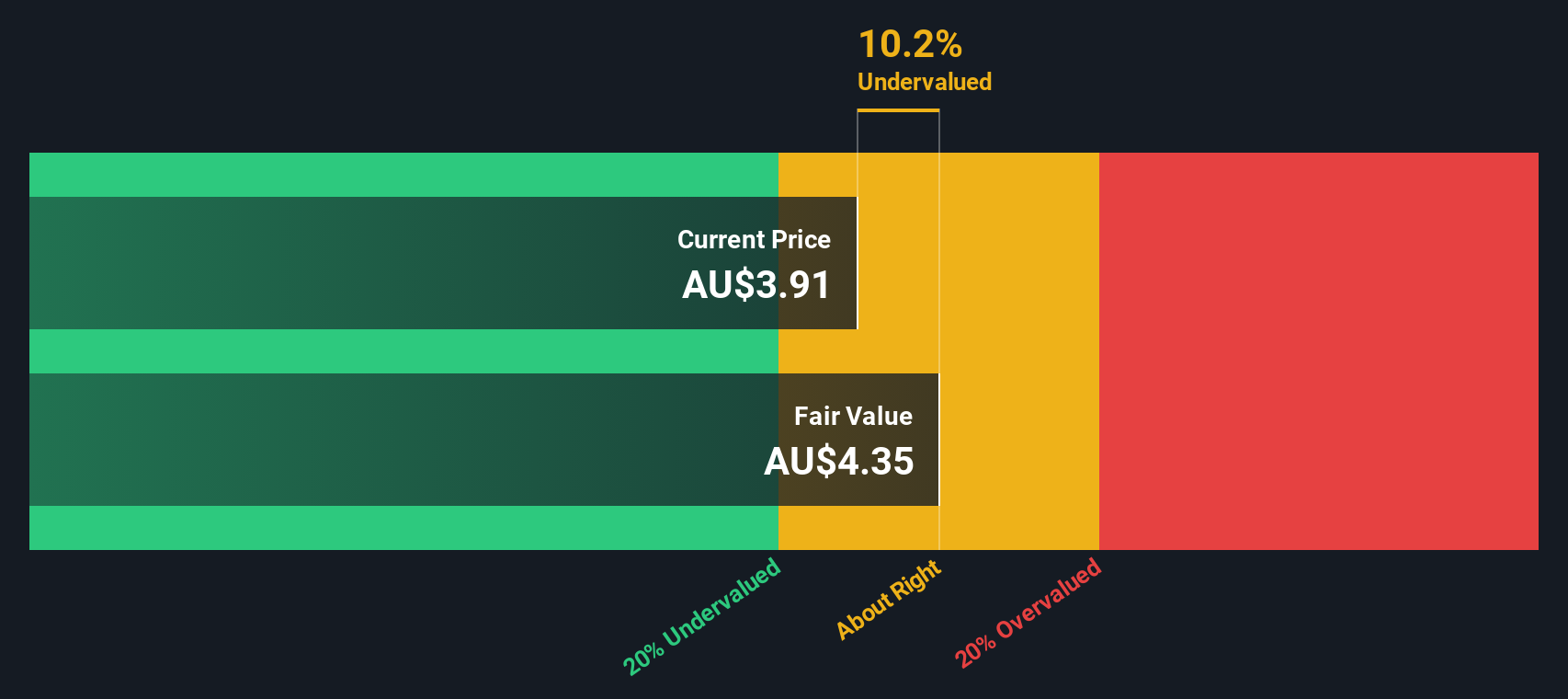

BWP Trust (ASX:BWP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BWP Trust is a real estate investment trust focused on investments in commercial warehouse properties, with a market capitalization of A$2.77 billion.

Operations: The company generates revenue primarily from its investments in commercial warehouse properties, with the latest reported revenue at A$203.30 million. The cost of goods sold (COGS) for the same period was A$21.27 million, resulting in a gross profit of A$182.03 million and a gross profit margin of 89.54%. Operating expenses were recorded at A$14.02 million, while non-operating expenses amounted to -A$97.57 million, impacting net income figures significantly over recent periods.

PE: 10.1x

BWP Trust, a smaller player in the market, recently announced its earnings for the year ending June 30, 2025. Sales rose to A$203.3 million from A$174.46 million, while net income increased to A$265.58 million from A$180.22 million previously. Despite these gains, future earnings are projected to decline by an average of 10.8% annually over the next three years due to large one-off items impacting results and reliance on higher-risk external borrowing for funding.

- Click to explore a detailed breakdown of our findings in BWP Trust's valuation report.

Understand BWP Trust's track record by examining our Past report.

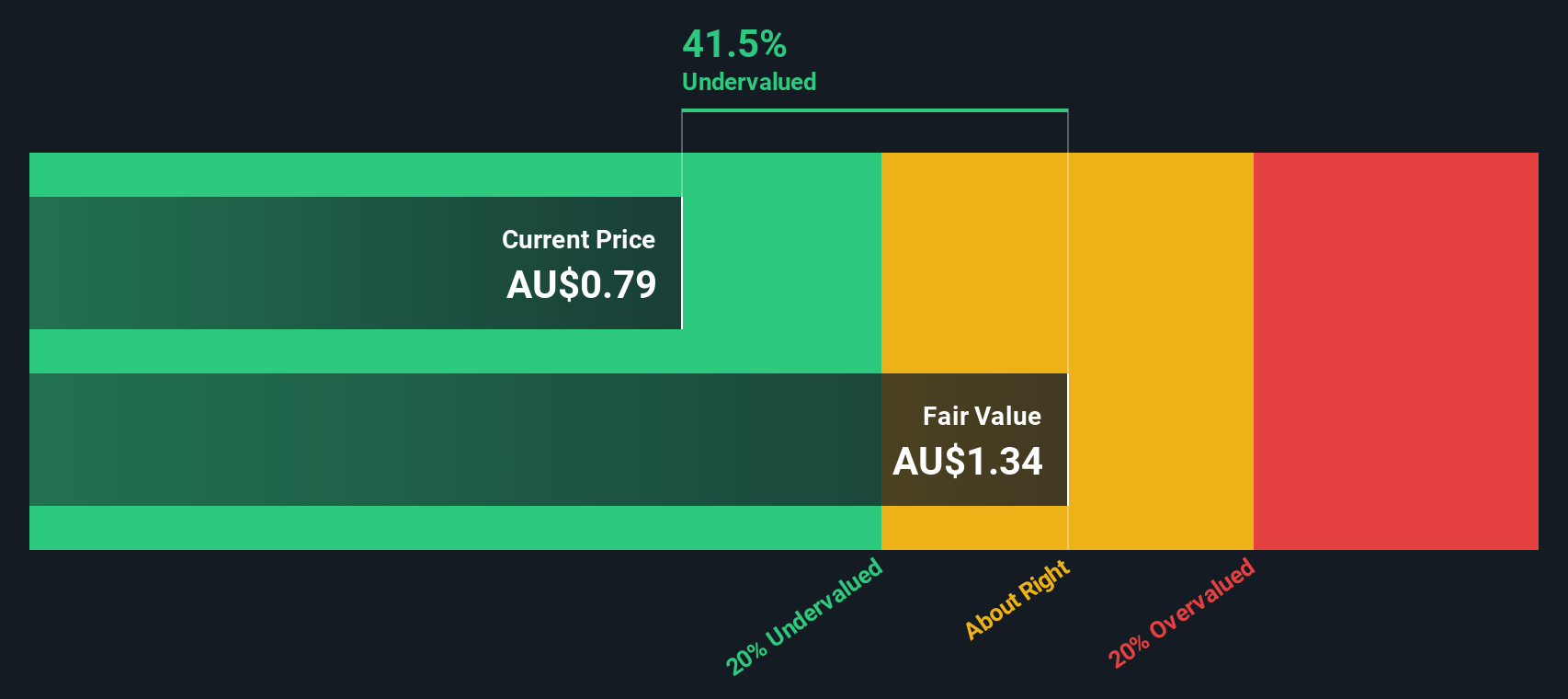

Praemium (ASX:PPS)

Simply Wall St Value Rating: ★★★★★★

Overview: Praemium is a company that provides software and programming services, with a market cap of A$0.81 billion.

Operations: Praemium generates revenue primarily from its software and programming segment, with a recent quarterly revenue of A$103.04 million. The company's cost of goods sold (COGS) stands at A$57.42 million, resulting in a gross profit of A$45.62 million and a gross profit margin of 44.27%. Operating expenses are reported at A$26.50 million, while non-operating expenses amount to A$5.55 million, impacting the overall profitability metrics such as net income margin which is recorded at 13.16%.

PE: 29.4x

Praemium, a company with increasing sales and net income over the past year, has recently been added to the S&P Global BMI Index. The appointment of Emma Stepcic as CFO brings extensive financial leadership experience from ASX-listed firms. Insider confidence is evident with Barry Lewin purchasing 150,000 shares for A$115,350, reflecting potential optimism about future growth. Despite relying on external borrowing for funding, Praemium's earnings are projected to grow by 15.84% annually.

- Get an in-depth perspective on Praemium's performance by reading our valuation report here.

Assess Praemium's past performance with our detailed historical performance reports.

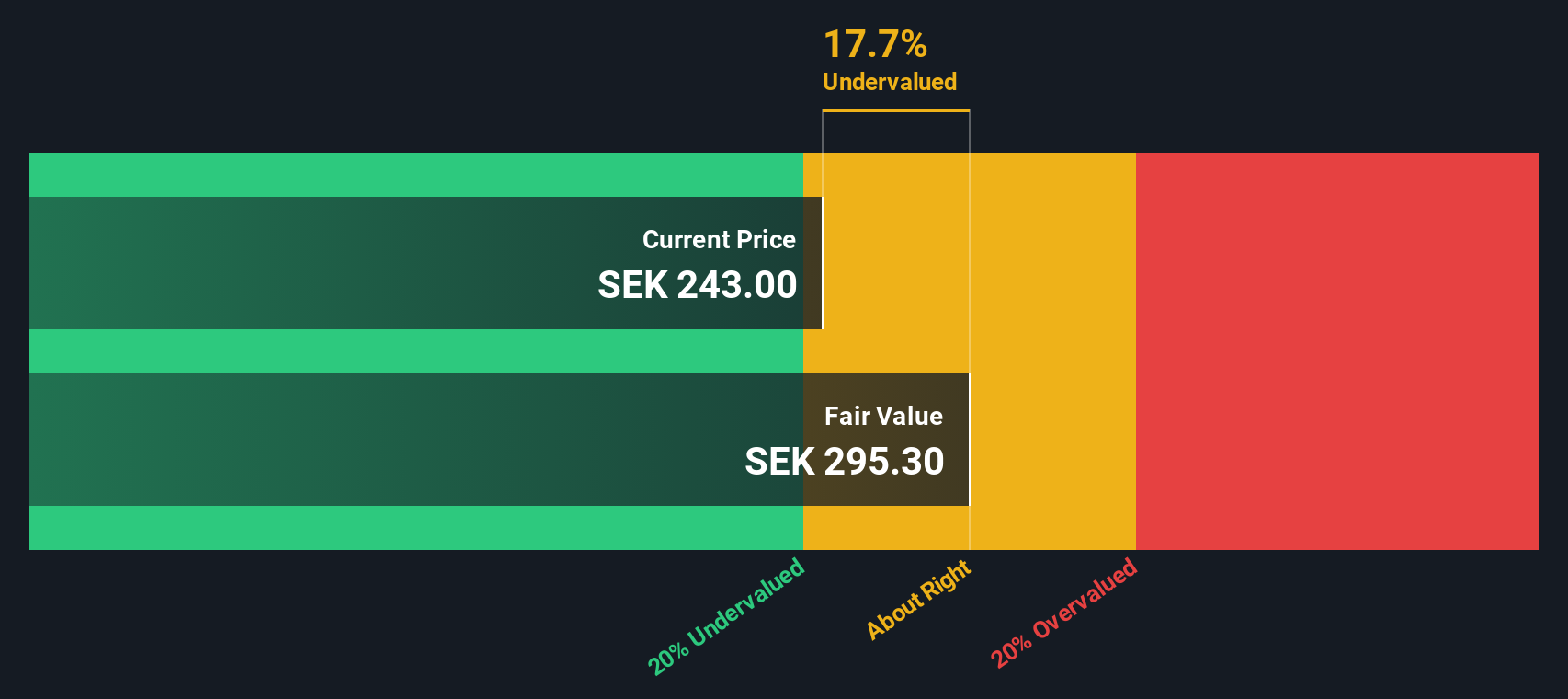

Beijer Alma (OM:BEIA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Beijer Alma is an industrial group that operates through its subsidiaries Lesjöfors and Beijer Tech, focusing on manufacturing springs, wire products, and providing technical solutions with a market cap of SEK 9.33 billion.

Operations: Lesjöfors and Beijer Tech are the primary revenue streams, contributing SEK 4.999 billion and SEK 2.489 billion respectively. The company's gross profit margin has shown variability, reaching up to 33.67% in recent periods before adjusting to around 30.75%. Operating expenses have consistently increased over time, impacting net income margins which have fluctuated between approximately 7% and just over 10%.

PE: 22.6x

Beijer Alma, a small company in its sector, recently reported sales growth with SEK 2,023 million in Q2 2025 compared to SEK 1,885 million the previous year. However, net income fell to SEK 82 million from SEK 142 million. Despite this dip, insider confidence is evident as Henrik Perbeck purchased shares worth approximately SEK 168,480 in July. The company's earnings are projected to grow by over 14% annually despite relying solely on external borrowing for funding.

- Take a closer look at Beijer Alma's potential here in our valuation report.

Explore historical data to track Beijer Alma's performance over time in our Past section.

Where To Now?

- Dive into all 114 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions in Australia and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026