EMVision Medical Devices And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As Australian shares brace for potential shifts ahead of the Reserve Bank's first interest rate decision of the year, there is a palpable sense of anticipation across the market. In such uncertain times, investors often look to penny stocks as a way to uncover value in smaller or newer companies that may offer growth potential. Despite its somewhat outdated name, the concept of penny stocks remains relevant today, especially when these companies are grounded in solid financials and poised for long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$66.88M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.98 | A$247.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.21 | A$342.3M | ★★★★☆☆ |

| GTN (ASX:GTN) | A$0.53 | A$104.08M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.08 | A$338.66M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.02 | A$95.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.875 | A$103.72M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.33 | A$65.63M | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

EMVision Medical Devices (ASX:EMV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EMVision Medical Devices Ltd focuses on the research, development, and commercialization of neurodiagnostic technology for stroke diagnosis and monitoring in Australia, with a market cap of A$177.87 million.

Operations: The company's revenue segment is derived entirely from the Research and Development of Medical Device Technology, amounting to A$11.22 million.

Market Cap: A$177.87M

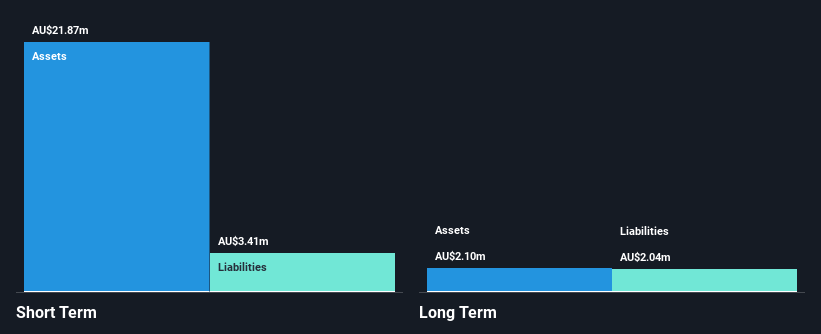

EMVision Medical Devices Ltd, with a market cap of A$177.87 million, is focused on neurodiagnostic technology and remains pre-revenue. The company has more cash than debt, with short-term assets (A$21.9M) comfortably covering both short and long-term liabilities. Although unprofitable, EMVision has reduced its losses over five years by 0.7% annually and maintains a stable weekly volatility of 5%. The firm’s management and board are experienced, providing stability as it navigates growth challenges typical for penny stocks in the biotech sector. Recent participation in the Bell Potter Healthcare Conference highlights ongoing engagement with investors.

- Take a closer look at EMVision Medical Devices' potential here in our financial health report.

- Review our historical performance report to gain insights into EMVision Medical Devices' track record.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$406.06 million, offers advisors and wealth management solutions through a seamless digital platform in Australia and internationally.

Operations: The company generates revenue through its Software & Programming segment, which accounts for A$82.73 million.

Market Cap: A$406.06M

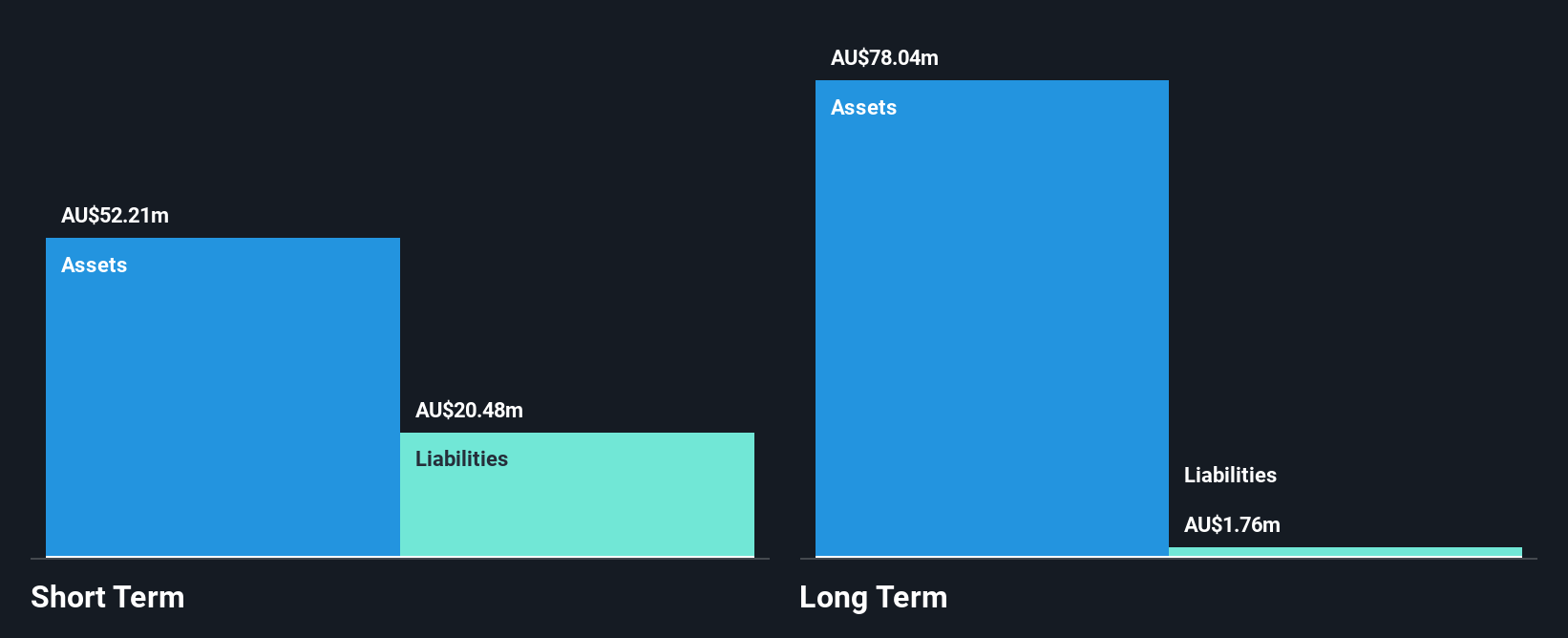

Praemium Limited, with a market cap of A$406.06 million, operates in the Software & Programming sector and has shown stable weekly volatility at 6%. Despite negative earnings growth over the past year, its earnings have grown significantly by 25.3% annually over five years. The company is debt-free and maintains strong financial health with short-term assets of A$57.9 million exceeding both short- and long-term liabilities. However, recent financials were impacted by a one-off loss of A$3.9 million, and profit margins have decreased to 10.6% from last year's 20.4%. Upcoming Q2 2025 results are anticipated on January 23, 2025.

- Get an in-depth perspective on Praemium's performance by reading our balance sheet health report here.

- Understand Praemium's earnings outlook by examining our growth report.

Wagners Holding (ASX:WGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wagners Holding Company Limited produces and sells construction materials across Australia, the United States, New Zealand, the United Kingdom, PNG & Malaysia with a market cap of A$305.95 million.

Operations: Wagners Holding generates revenue from several segments, including Construction Materials at A$224.39 million, Project Services at A$206.20 million, Composite Fibre Technology at A$59.38 million, and Earth Friendly Concrete at A$0.27 million.

Market Cap: A$305.95M

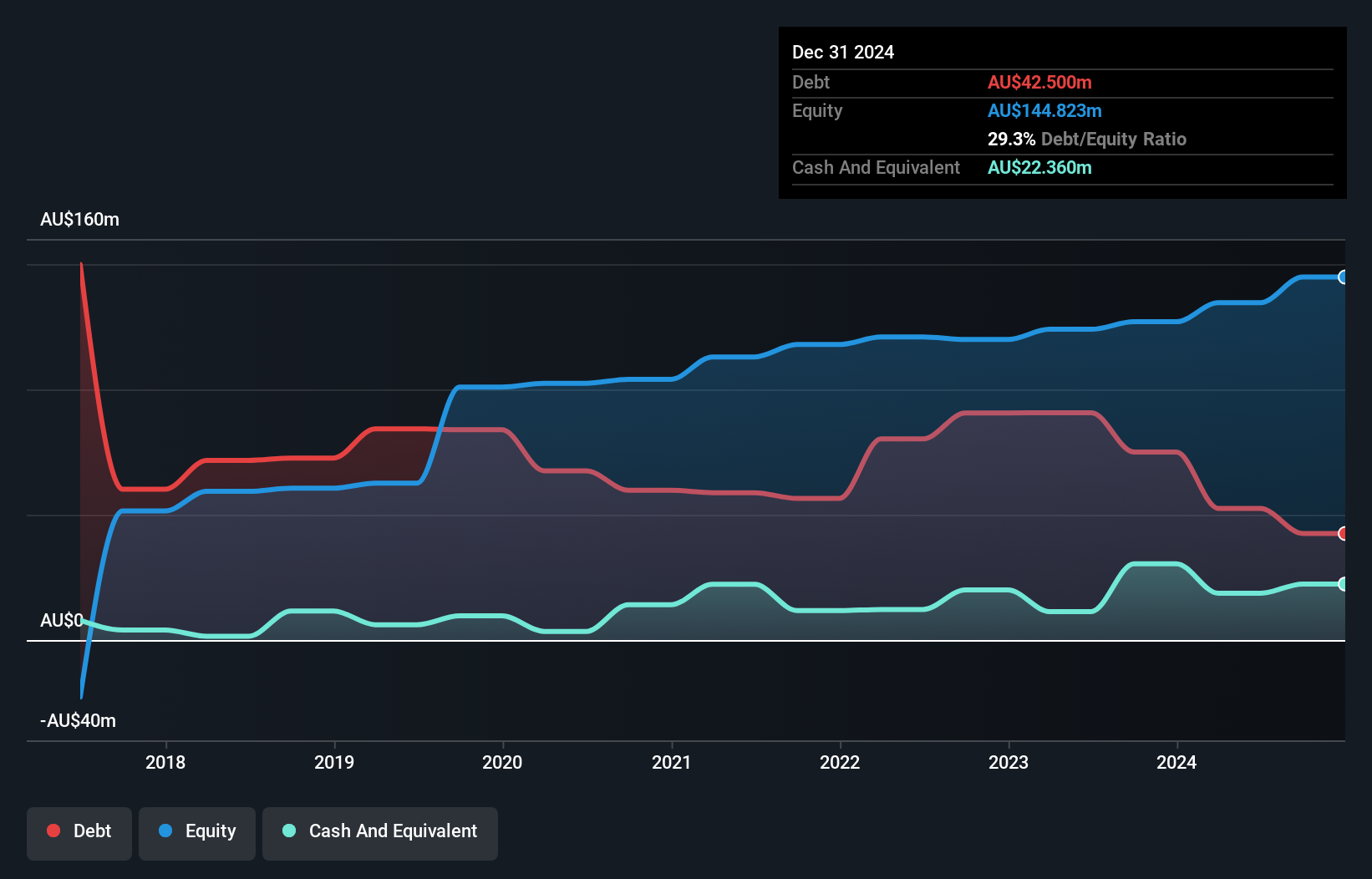

Wagners Holding, with a market cap of A$305.95 million, has seen impressive earnings growth of 229.2% over the past year, outpacing its 5-year average of 1.7%. The company's revenue is diversified across segments like Construction Materials and Project Services, contributing A$224.39 million and A$206.20 million respectively. Despite a satisfactory net debt to equity ratio of 25.1%, interest coverage by EBIT remains minimal at three times interest payments, indicating potential financial strain if not addressed further. Recent board changes include appointing Allan Brackin as an independent Non-Executive Director to strengthen governance and strategic oversight.

- Unlock comprehensive insights into our analysis of Wagners Holding stock in this financial health report.

- Review our growth performance report to gain insights into Wagners Holding's future.

Make It Happen

- Reveal the 1,032 hidden gems among our ASX Penny Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PPS

Praemium

Provides advisors and wealth management solutions by seamless digital platform experience in Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives