- Australia

- /

- Consumer Finance

- /

- ASX:PLT

Aroa Biosurgery And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market recently experienced a downturn, with the ASX200 closing down 1.66% as investors took profits and reassessed their portfolios. Despite these fluctuations, there remains interest in exploring opportunities among smaller stocks that might offer growth potential. Often referred to as penny stocks—a term that may seem outdated—these investments can still present valuable opportunities for those seeking to uncover hidden value in companies with strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Aroa Biosurgery (ASX:ARX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aroa Biosurgery Limited develops, manufactures, and sells medical devices for wound and soft tissue repair using extracellular matrix technology in the United States and internationally, with a market cap of A$179.35 million.

Operations: The company generates revenue of NZ$69.07 million from its operations in developing, manufacturing, and selling products for soft tissue repair.

Market Cap: A$179.35M

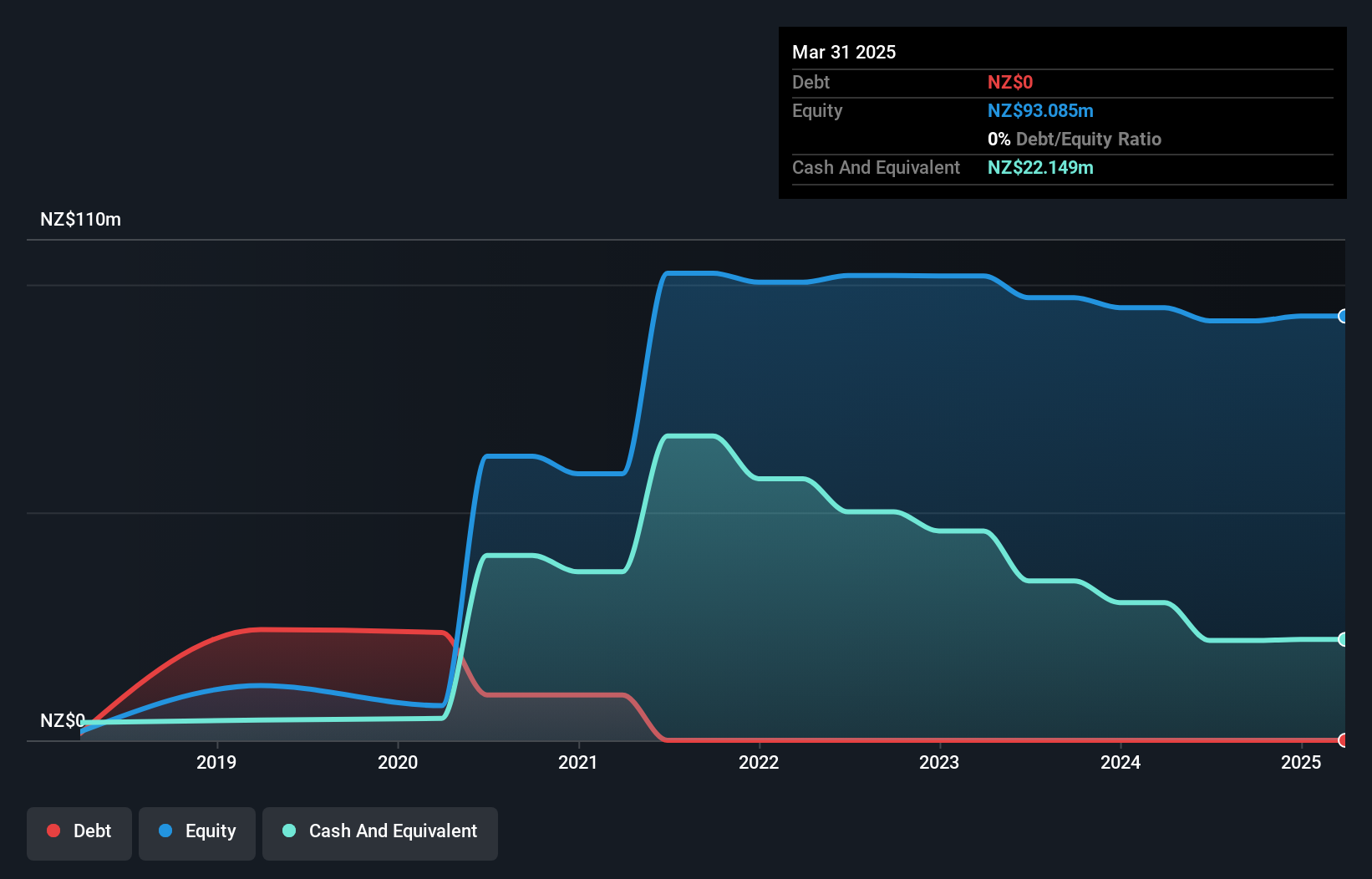

Aroa Biosurgery, with a market cap of A$179.35 million, is making strides in the medical device sector despite being unprofitable with a negative return on equity of -11.19%. The company has reduced its losses by 11.5% annually over the past five years and maintains a sufficient cash runway for more than a year based on current free cash flow. Trading at good value compared to peers, it remains debt-free and has not significantly diluted shareholders recently. Revenue guidance for fiscal 2025 is set between NZ$80 million and NZ$87 million, indicating potential growth prospects amid stable weekly volatility.

- Get an in-depth perspective on Aroa Biosurgery's performance by reading our balance sheet health report here.

- Assess Aroa Biosurgery's future earnings estimates with our detailed growth reports.

Plenti Group (ASX:PLT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Plenti Group Limited operates in the fintech lending and investment sector in Australia with a market capitalization of A$113.96 million.

Operations: The company generates revenue of A$71.94 million from its financial services offerings.

Market Cap: A$113.96M

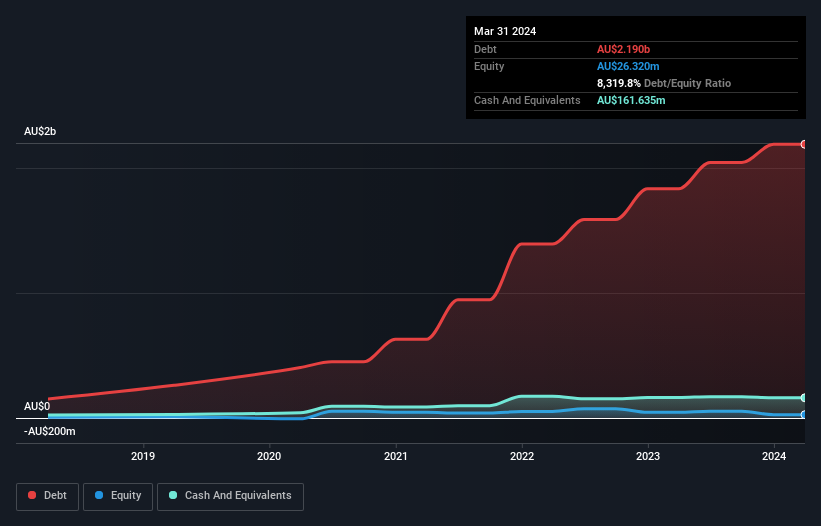

Plenti Group Limited, with a market cap of A$113.96 million, operates in the fintech sector and has recently advanced its strategic partnership with NAB by rolling out the 'NAB powered by Plenti' car and EV loan to NAB's personal banking customers. Despite being unprofitable with a negative return on equity of -55.88%, Plenti has a positive free cash flow, providing it with a cash runway for over three years. The company’s short-term assets significantly exceed its liabilities, although it carries high debt levels reflected in an elevated net debt to equity ratio of 7705.7%.

- Click to explore a detailed breakdown of our findings in Plenti Group's financial health report.

- Gain insights into Plenti Group's outlook and expected performance with our report on the company's earnings estimates.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$285.84 million, offers advisors and wealth management solutions through a seamless digital platform experience in Australia and internationally.

Operations: The company generates revenue of A$82.73 million from its Software & Programming segment.

Market Cap: A$285.84M

Praemium Limited, with a market cap of A$285.84 million, presents a mixed picture as a penny stock. Despite experiencing negative earnings growth of 42.3% over the past year and reduced net profit margins from 20.4% to 10.6%, it remains debt-free with strong liquidity; short-term assets of A$57.9 million exceed liabilities significantly. The company trades at good value compared to peers and is forecasted to grow earnings by 21.78% annually, though recent performance has been impacted by a one-off loss of A$3.9 million and management's relatively inexperienced tenure suggests potential for strategic shifts ahead.

- Dive into the specifics of Praemium here with our thorough balance sheet health report.

- Evaluate Praemium's prospects by accessing our earnings growth report.

Next Steps

- Navigate through the entire inventory of 1,027 ASX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLT

Plenti Group

Engages in the fintech lending and investment business in Australia.

Exceptional growth potential with excellent balance sheet.