Nuix Limited's (ASX:NXL) 29% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Unfortunately for some shareholders, the Nuix Limited (ASX:NXL) share price has dived 29% in the last thirty days, prolonging recent pain. Still, a bad month hasn't completely ruined the past year with the stock gaining 61%, which is great even in a bull market.

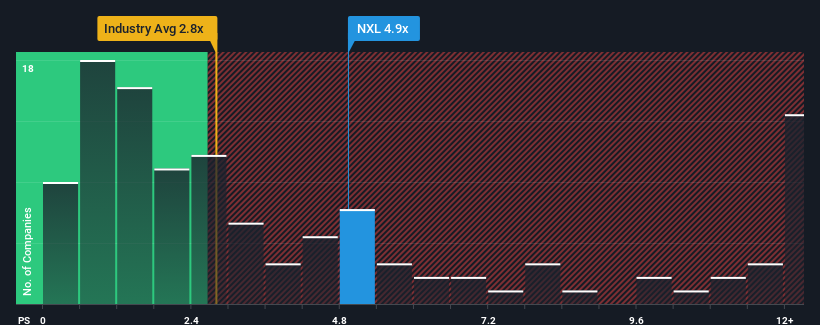

Although its price has dipped substantially, given around half the companies in Australia's Software industry have price-to-sales ratios (or "P/S") below 2.7x, you may still consider Nuix as a stock to avoid entirely with its 4.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Nuix

How Has Nuix Performed Recently?

Nuix's revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Nuix will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Nuix?

In order to justify its P/S ratio, Nuix would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. The latest three year period has also seen an excellent 30% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 18% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is noticeably more attractive.

In light of this, it's alarming that Nuix's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Nuix's P/S Mean For Investors?

A significant share price dive has done very little to deflate Nuix's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that Nuix currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Nuix with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026