Nuix (ASX:NXL) Valuation in Focus Following CEO Transition and Strategic Leadership Changes

Reviewed by Simply Wall St

Nuix (ASX:NXL) is drawing attention after CEO Jonathan Rubinsztein announced plans to step down at the end of October, with John Ruthven stepping in as interim CEO. Leadership transitions such as this can prompt fresh scrutiny from investors who are curious about the company’s next strategic moves.

See our latest analysis for Nuix.

Nuix shares have been on a turbulent ride lately, with the latest leadership change drawing even more focus. Despite a brief uptick, the 1-day share price return of 0.41% has not offset steeper recent drops, like the 7-day return of -17.57%. For context, the company’s year-to-date share price is down 60.96%, but its three-year total shareholder return still shows a remarkable 328% gain. This reflects both risk and long-term potential as the business recalibrates.

If news like this has you thinking about fresh ideas for your investing watchlist, now’s a smart time to tap into discovery mode and check out fast growing stocks with high insider ownership.

All this sets the scene for a key question: is Nuix shaping up as an undervalued tech story with more to offer, or have markets already built future growth into its current share price?

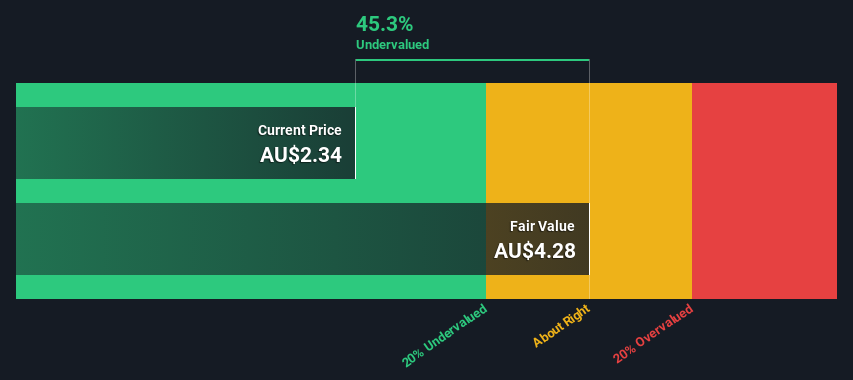

Most Popular Narrative: 30.4% Undervalued

At A$2.44, Nuix’s closing price sits well below the most popular narrative’s fair value of A$3.51. This gap has caught the market’s attention, especially as analysts update their growth outlook and pricing assumptions for the company.

The shift from perpetual licenses to recurring subscription models is poised to provide greater revenue stability and predictability, positively impacting earnings over time. Increased targeting of larger enterprise contracts with higher average deal sizes suggests potential for significant revenue increases and improved net margins through economies of scale.

Earnings growth, revenue upgrades, and a transformation in how Nuix wins and structures major contracts all factor in. Wonder what’s really driving this bold price target? Those headline growth rates and profit projections are underpinned by some surprisingly aggressive assumptions. The story isn't what you think.

Result: Fair Value of $3.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent legal costs and slower customer migrations to the new platform could challenge Nuix’s projected turnaround and hinder near-term profitability.

Find out about the key risks to this Nuix narrative.

Another View: What the SWS DCF Model Says

To challenge the price target narrative, we turn to our SWS DCF model for a different angle. The DCF result actually values Nuix at A$2.22 per share, which is below the current share price of A$2.44 and much lower than the A$3.51 consensus target. That is quite a gap, so which story do you trust with your money?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuix for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuix Narrative

If the story above doesn't match your perspective or you want to shape your own investment view, building your own narrative takes less than three minutes. Why not Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nuix.

Looking for More Investment Ideas?

Step up your search for the next big opportunity by trying these tailored stock ideas. Don’t let standout investments slip by while you wait for the perfect moment.

- Capture the gains from undervalued companies poised for a turnaround by checking out these 869 undervalued stocks based on cash flows that align with robust fundamentals and growth potential.

- Target big income potential as you pursue these 19 dividend stocks with yields > 3% with yields above 3%, perfect for boosting your portfolio’s stability and cash flow.

- Jump ahead of market shifts in artificial intelligence by scouting these 27 AI penny stocks driving innovation in automation, data analytics, and next-generation software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion