Megaport (ASX:MP1) adds AU$207m to market cap in the past 7 days, though investors from three years ago are still down 62%

This week we saw the Megaport Limited (ASX:MP1) share price climb by 18%. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 62% in that period. So it's good to see it climbing back up. After all, could be that the fall was overdone.

While the stock has risen 18% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Megaport

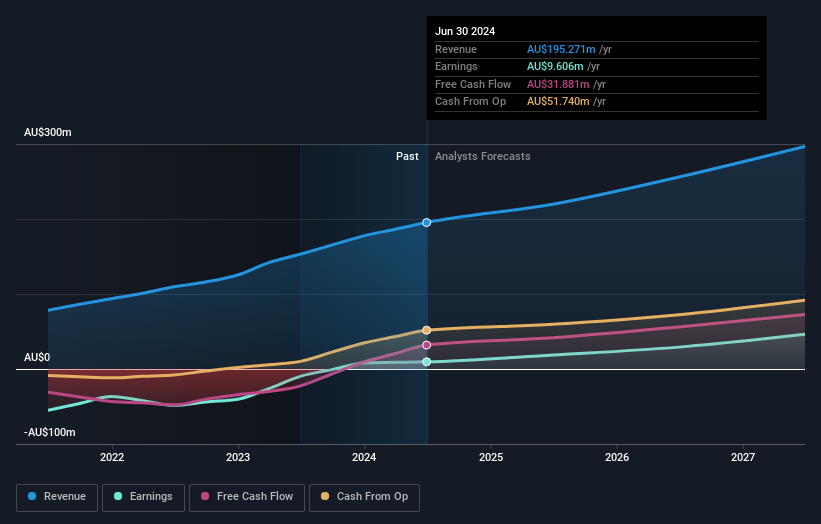

Given that Megaport only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Megaport grew revenue at 30% per year. That's well above most other pre-profit companies. In contrast, the share price is down 17% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Megaport is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Megaport will earn in the future (free analyst consensus estimates)

A Different Perspective

Megaport shareholders are down 21% for the year, but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before spending more time on Megaport it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives