Megaport and DartPoints Partnership Could Be a Game Changer for Megaport (ASX:MP1)

Reviewed by Simply Wall St

- Earlier this month, Megaport and DartPoints announced a partnership to bring Megaport's cloud connectivity platform to DartPoints' Greenville Data Center, marking Megaport’s first presence in South Carolina and opening access to over 975 data centers and 380-plus cloud onramps across the region.

- This collaboration allows regional enterprises to provision private cloud connections with reduced latency and lower bandwidth costs, positioning Greenville as a key Southeast hub for hybrid cloud and AI workloads.

- We'll explore how Megaport's entry into the Southeast US through DartPoints could strengthen its network expansion and long-term growth prospects.

Megaport Investment Narrative Recap

To be a Megaport shareholder, you need to believe in the company's ability to scale its global network profitably and consistently attract enterprise customers in a competitive cloud connectivity market. The DartPoints partnership expands Megaport’s US footprint, which could support growth targets, but does not appear to materially change the key short-term catalyst, successful execution of rapid network expansions, or address the ongoing risks of elevated operational expenditure and heightened competition.

Among recent announcements, the integration of Megaport’s services onto Connectbase’s platform aligns closely with the DartPoints partnership, as both streamline access to cloud connectivity and simplify how enterprises link to data centers. Together, these relationships reinforce Megaport’s focus on reducing complexity and cost for customers while continuing to broaden its market reach and product distribution, directly supporting its revenue growth catalyst.

However, while expansion brings opportunity, investors should be aware that increasing operational costs and competitive risks could ...

Read the full narrative on Megaport (it's free!)

Megaport's projections call for A$310.1 million in revenue and A$42.3 million in earnings by 2028. This is based on a 14.4% annual revenue growth rate and a A$36.3 million increase in earnings from the current A$6.0 million.

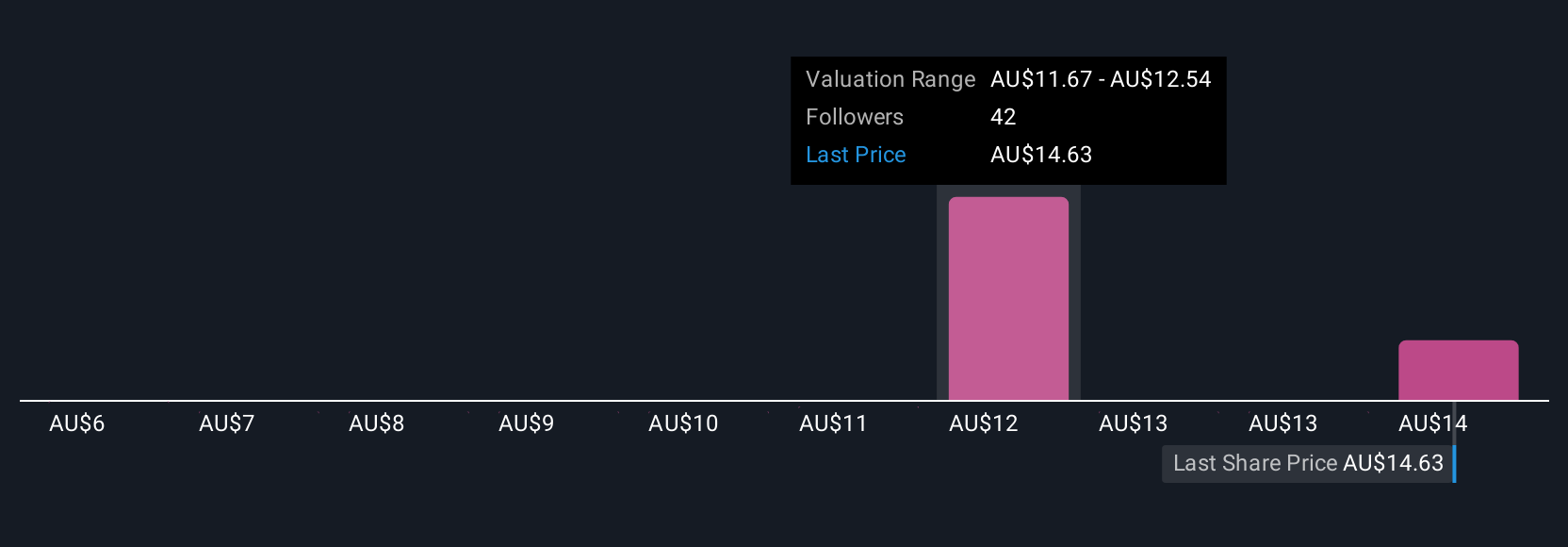

Uncover how Megaport's forecasts yield a A$12.07 fair value, a 18% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided four fair value estimates for Megaport stock, ranging from A$6.40 to A$15.27 per share. With execution on network expansion as a major catalyst, these perspectives highlight how investor expectations for the company’s growth can vary substantially.

Build Your Own Megaport Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Megaport research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Megaport research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Megaport's overall financial health at a glance.

No Opportunity In Megaport?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MP1

Megaport

Provides on-demand interconnection and internet exchange services to the enterprises and service providers in Australia, New Zealand, Hong Kong, Singapore, Japan, North America, Italy, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives