Janison Education Group Limited's (ASX:JAN) Shares Lagging The Industry But So Is The Business

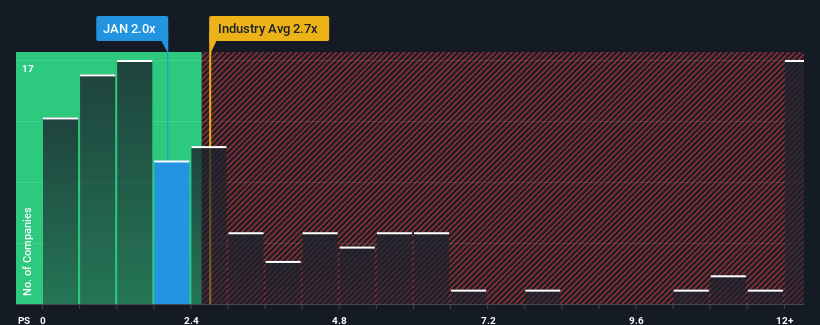

With a price-to-sales (or "P/S") ratio of 2x Janison Education Group Limited (ASX:JAN) may be sending bullish signals at the moment, given that almost half of all the Software companies in Australia have P/S ratios greater than 2.7x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Janison Education Group

What Does Janison Education Group's Recent Performance Look Like?

Janison Education Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Janison Education Group.How Is Janison Education Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Janison Education Group's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.9%. This was backed up an excellent period prior to see revenue up by 56% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 15% each year over the next three years. That's shaping up to be materially lower than the 20% each year growth forecast for the broader industry.

With this in consideration, its clear as to why Janison Education Group's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, our analysis of Janison Education Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Janison Education Group that we have uncovered.

If these risks are making you reconsider your opinion on Janison Education Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JAN

Janison Education Group

Engages in online assessment software, assessment products, and assessment services in Australia, New Zealand, Asia, and internationally.

Excellent balance sheet and good value.