- Australia

- /

- Metals and Mining

- /

- ASX:TKM

3 ASX Penny Stocks With Market Caps Under A$80M To Consider

Reviewed by Simply Wall St

The Australian market recently saw the ASX200 close down 0.28% at 8,330 points, marking a three-week low amid shifting economic indicators such as a surprise drop in unemployment to 3.9%. Despite these broader market fluctuations, penny stocks—though an outdated term—remain an intriguing investment area for those seeking growth opportunities in smaller or newer companies. With strong financial health, these stocks can offer both affordability and potential for long-term gains.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$65.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$324.01M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.80 | A$234.64M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.735 | A$94.87M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.58 | A$786.58M | ★★★★★☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.98M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$107.69M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,048 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Dusk Group (ASX:DSK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dusk Group Limited is an Australian retailer specializing in scented and unscented candles, home decor, home fragrances, and gift solutions, with a market cap of A$75.97 million.

Operations: The company generates revenue primarily through retail sales in the home fragrances and accessories segment, amounting to A$126.73 million.

Market Cap: A$75.97M

Dusk Group Limited, with a market cap of A$75.97 million, operates debt-free and has not diluted shareholders over the past year. The company’s short-term assets (A$39.7 million) comfortably cover both its short-term (A$25 million) and long-term liabilities (A$25.3 million). Despite high-quality earnings, recent performance has been challenging, with negative earnings growth of -63.3% over the past year and declining profit margins now at 3.4%, down from 8.5%. While trading below estimated fair value by 27.1%, Dusk's dividend yield of 5.33% is not well covered by earnings, raising sustainability concerns.

- Click here to discover the nuances of Dusk Group with our detailed analytical financial health report.

- Explore Dusk Group's analyst forecasts in our growth report.

Harmoney (ASX:HMY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Harmoney Corp Limited operates as an online provider of secured and unsecured personal loans in Australia and New Zealand, with a market cap of A$38.75 million.

Operations: Harmoney generates revenue through its financial services segment focused on consumer loans, amounting to A$35.42 million.

Market Cap: A$38.75M

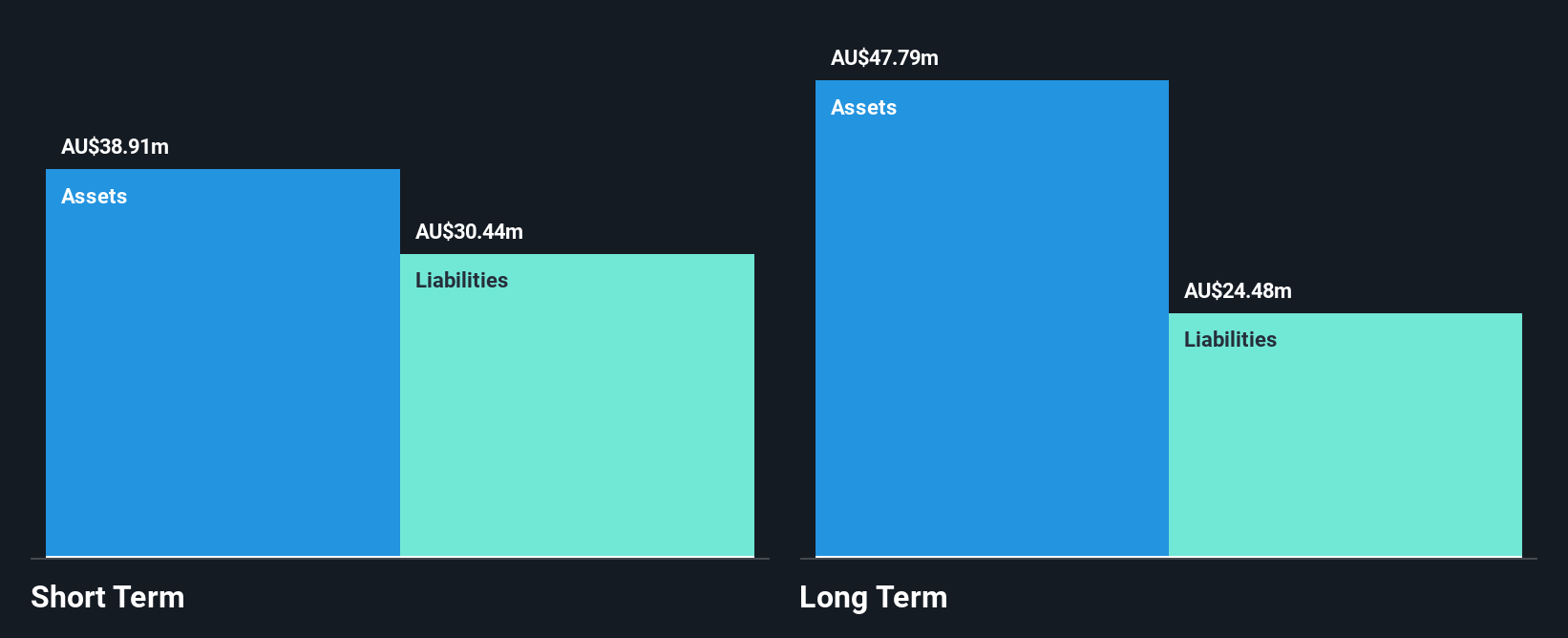

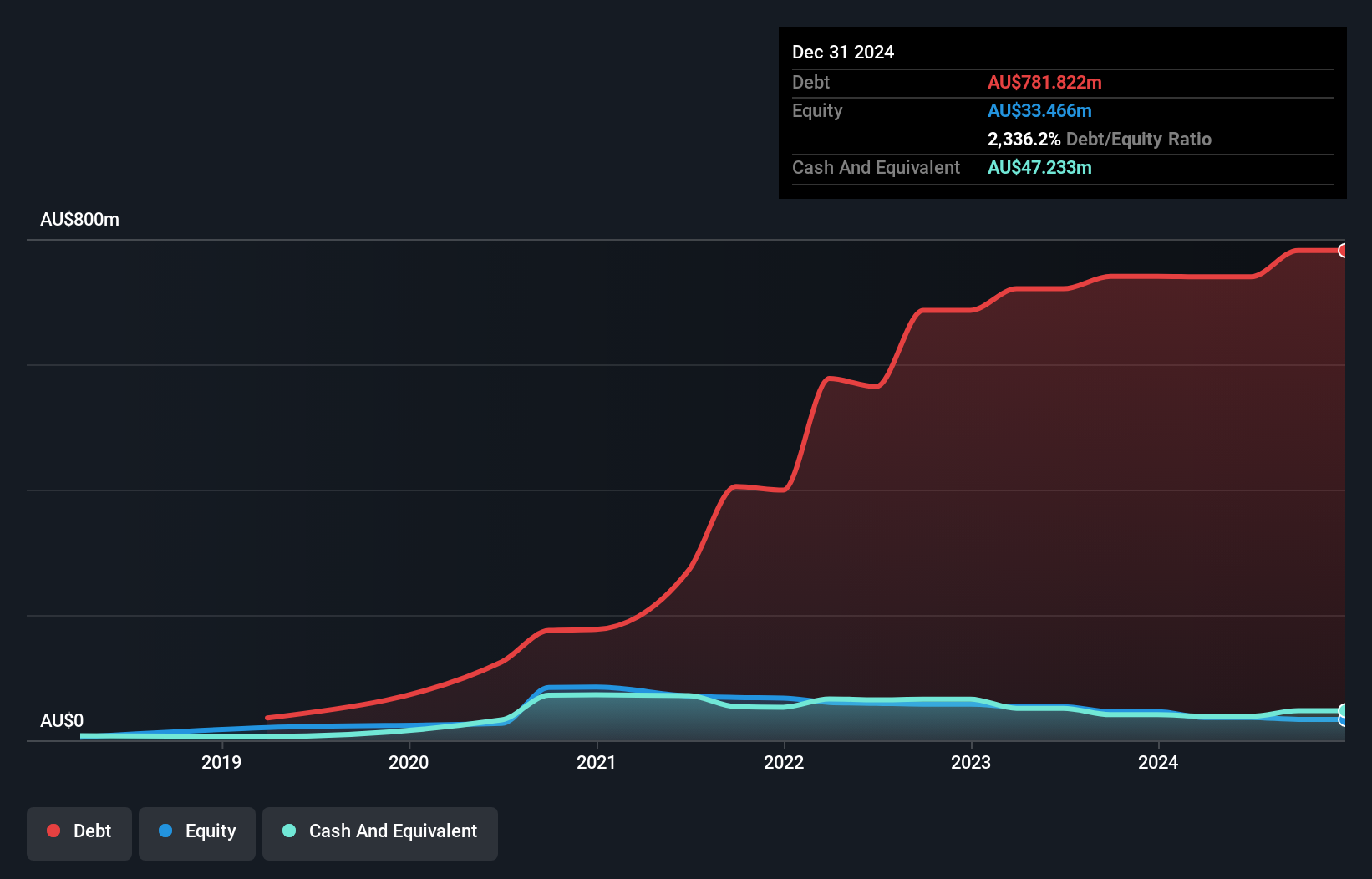

Harmoney Corp Limited, with a market cap of A$38.75 million, operates in the consumer finance sector and is currently unprofitable with a negative return on equity of -36.19%. Despite this, Harmoney maintains a strong cash position, having sufficient runway for over three years due to positive and growing free cash flow. The company's short-term assets (A$766.1M) comfortably cover both its short-term (A$5.6M) and long-term liabilities (A$742.0M). However, the high net debt to equity ratio of 1923.5% poses significant financial risk despite stable weekly volatility over the past year at 8%.

- Navigate through the intricacies of Harmoney with our comprehensive balance sheet health report here.

- Evaluate Harmoney's prospects by accessing our earnings growth report.

Trek Metals (ASX:TKM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Trek Metals Limited, with a market cap of A$13.52 million, is involved in the exploration and development of mineral properties in Australia.

Operations: Trek Metals Limited does not report any revenue segments.

Market Cap: A$13.52M

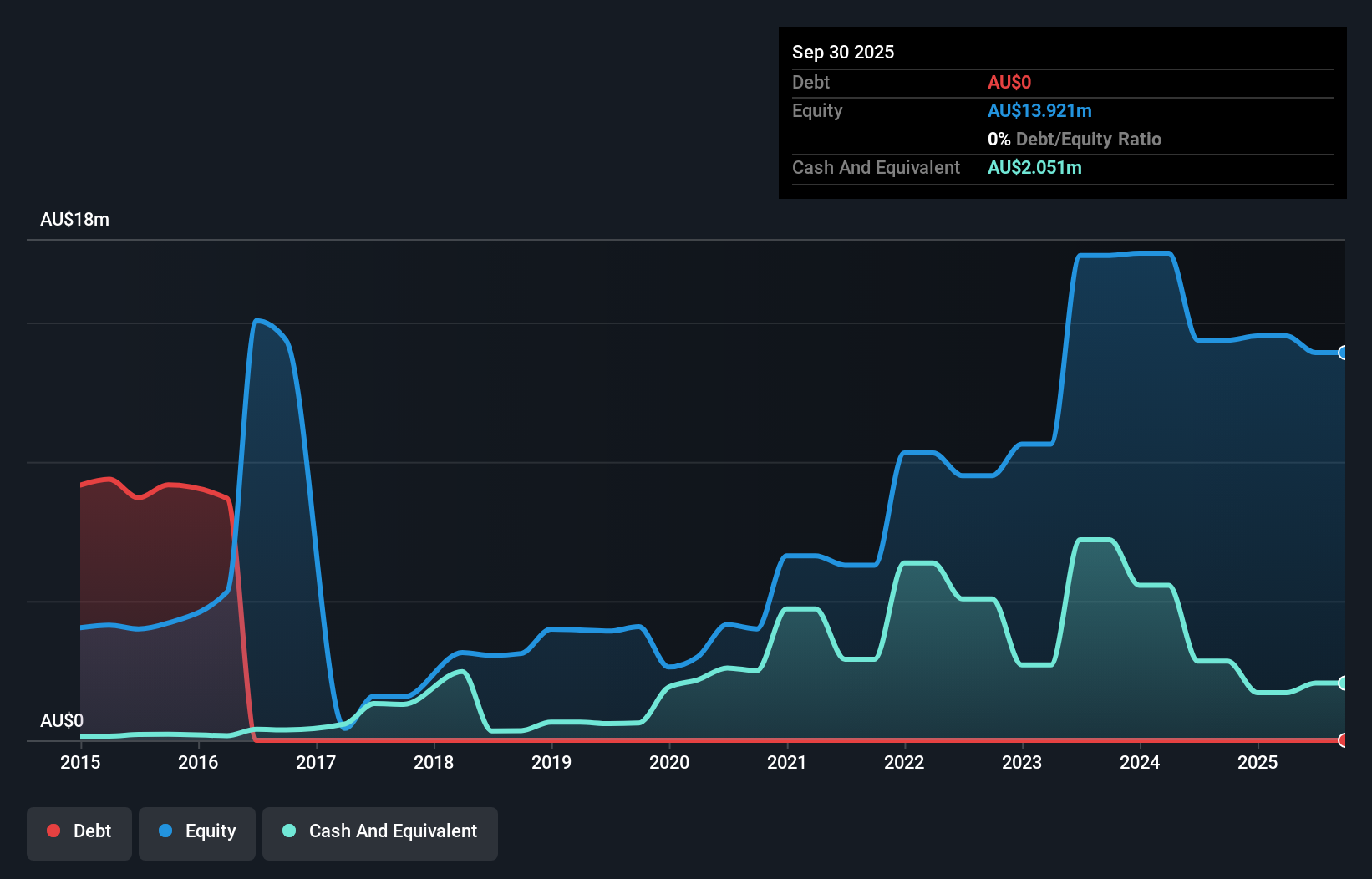

Trek Metals Limited, with a market cap of A$13.52 million, is pre-revenue and currently unprofitable, reporting a net loss of A$3.25 million for the half year ended September 2024. The company remains debt-free but faces financial constraints with less than a year of cash runway based on current free cash flow trends. Recent board changes include the resignation of Ms. Valerie Hodgins, which may impact strategic direction. Trek's short-term assets (A$3.1M) exceed its liabilities, providing some financial stability despite shareholder dilution over the past year and high share price volatility in recent months.

- Click to explore a detailed breakdown of our findings in Trek Metals' financial health report.

- Evaluate Trek Metals' historical performance by accessing our past performance report.

Where To Now?

- Unlock our comprehensive list of 1,048 ASX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Trek Metals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Trek Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TKM

Trek Metals

Engages in the exploration and development of mineral properties in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives