How Much Are IXUP Limited (ASX:IXU) Insiders Spending On Buying Shares?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So we'll take a look at whether insiders have been buying or selling shares in IXUP Limited (ASX:IXU).

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But it is perfectly logical to keep tabs on what insiders are doing. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for IXUP

IXUP Insider Transactions Over The Last Year

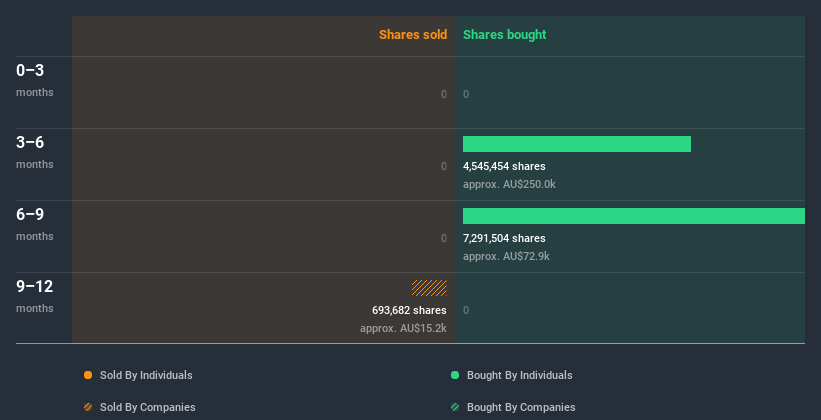

The Non- Executive Chairman Julian Babarczy made the biggest insider purchase in the last 12 months. That single transaction was for AU$250k worth of shares at a price of AU$0.055 each. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$0.13. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

In the last twelve months IXUP insiders were buying shares, but not selling. They paid about AU$0.027 on average. To my mind it is good that insiders have invested their own money in the company. But we must note that the investments were made at well below today's share price. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does IXUP Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Insiders own 12% of IXUP shares, worth about AU$11m, according to our data. However, it's possible that insiders might have an indirect interest through a more complex structure. We do generally prefer see higher levels of insider ownership.

So What Do The IXUP Insider Transactions Indicate?

There haven't been any insider transactions in the last three months -- that doesn't mean much. On a brighter note, the transactions over the last year are encouraging. Overall we don't see anything to make us think IXUP insiders are doubting the company, and they do own shares. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To help with this, we've discovered 4 warning signs (2 are a bit unpleasant!) that you ought to be aware of before buying any shares in IXUP.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading IXUP or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:DWG

DataWorks Group

Develops software products for gaming, sports marketing, and data analytics in Australia, the United Kingdom, and North America.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026