Why Investors Shouldn't Be Surprised By Integrated Research Limited's (ASX:IRI) Low P/S

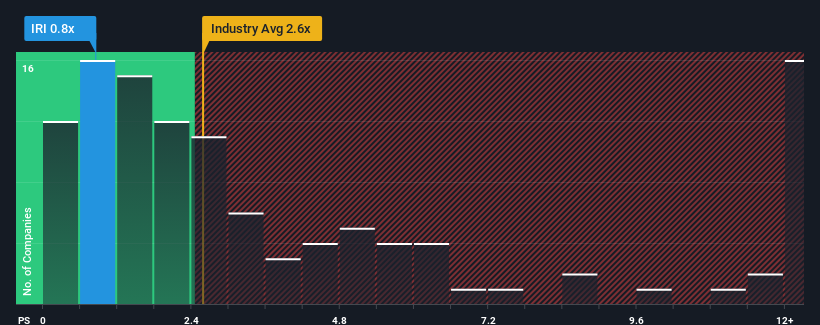

Integrated Research Limited's (ASX:IRI) price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Software industry in Australia, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Integrated Research

What Does Integrated Research's P/S Mean For Shareholders?

Recent times haven't been great for Integrated Research as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Integrated Research will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Integrated Research's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.7%. However, this wasn't enough as the latest three year period has seen an unpleasant 21% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 4.3% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

In light of this, it's understandable that Integrated Research's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Integrated Research's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Integrated Research's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - Integrated Research has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IRI

Integrated Research

Designs, develops, implements, and sells software for business-critical computing, unified communication, and payment networks.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives