- Australia

- /

- Diversified Financial

- /

- ASX:FTC

We Think That There Are Issues Underlying FinTech Chain's (ASX:FTC) Earnings

FinTech Chain Limited (ASX:FTC) announced strong profits, but the stock was stagnant. Our analysis suggests that shareholders have noticed something concerning in the numbers.

See our latest analysis for FinTech Chain

A Closer Look At FinTech Chain's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

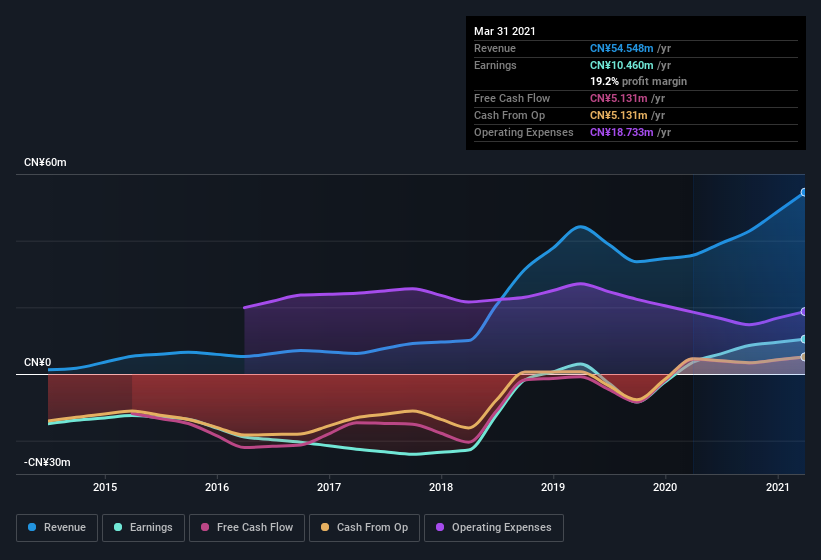

FinTech Chain has an accrual ratio of 0.61 for the year to March 2021. Ergo, its free cash flow is significantly weaker than its profit. Statistically speaking, that's a real negative for future earnings. In fact, it had free cash flow of CN¥5.1m in the last year, which was a lot less than its statutory profit of CN¥10.5m. We note, however, that FinTech Chain grew its free cash flow over the last year. One positive for FinTech Chain shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. As a result, some shareholders may be looking for stronger cash conversion in the current year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of FinTech Chain.

Our Take On FinTech Chain's Profit Performance

As we have made quite clear, we're a bit worried that FinTech Chain didn't back up the last year's profit with free cashflow. For this reason, we think that FinTech Chain's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To help with this, we've discovered 5 warning signs (2 can't be ignored!) that you ought to be aware of before buying any shares in FinTech Chain.

This note has only looked at a single factor that sheds light on the nature of FinTech Chain's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade FinTech Chain, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:FTC

FinTech Chain

An investment holding company, provides system development and information technology services in Mainland China.

Slight and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion