Envirosuite (ASX:EVS shareholders incur further losses as stock declines 16% this week, taking three-year losses to 58%

Investing in stocks inevitably means buying into some companies that perform poorly. But long term Envirosuite Limited (ASX:EVS) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 58% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 45% lower in that time. Even worse, it's down 26% in about a month, which isn't fun at all.

Since Envirosuite has shed AU$16m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Envirosuite

Envirosuite wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Envirosuite saw its revenue grow by 18% per year, compound. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 17% per year. The market must have had really high expectations to be disappointed with this progress. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

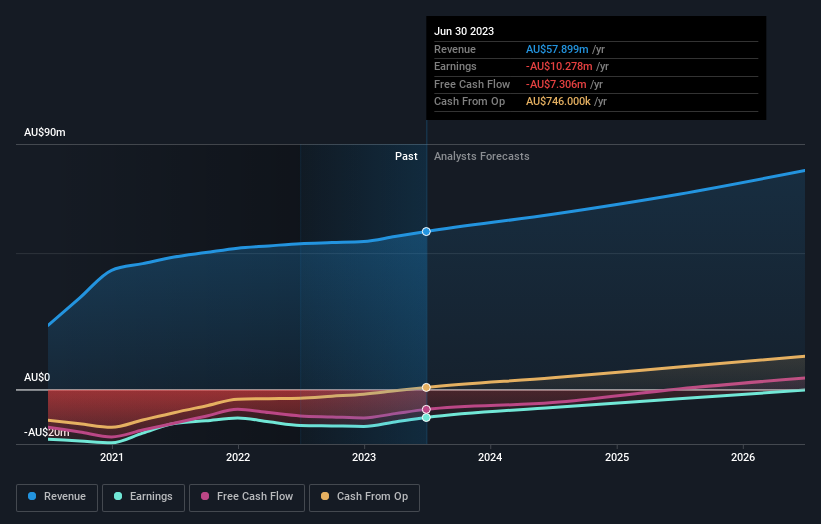

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Envirosuite in this interactive graph of future profit estimates.

A Different Perspective

Envirosuite shareholders are down 45% for the year, but the market itself is up 6.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Envirosuite better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Envirosuite .

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Envirosuite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVS

Envirosuite

Develops and sells environmental management technology solutions.

Undervalued with adequate balance sheet.