We Ran A Stock Scan For Earnings Growth And Etherstack (ASX:ESK) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Etherstack (ASX:ESK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Etherstack with the means to add long-term value to shareholders.

See our latest analysis for Etherstack

Etherstack's Improving Profits

Over the last three years, Etherstack has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Etherstack's EPS soared from US$0.011 to US$0.017, over the last year. That's a impressive gain of 50%.

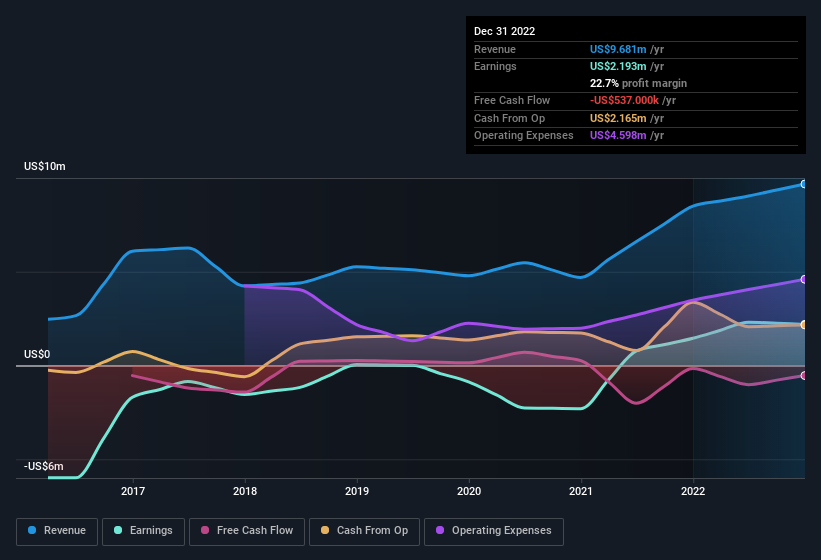

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Etherstack achieved similar EBIT margins to last year, revenue grew by a solid 14% to US$9.7m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Etherstack is no giant, with a market capitalisation of AU$63m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Etherstack Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Etherstack shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that Non-Executive Chairman Peter Francis Stephens bought US$36k worth of shares at an average price of around US$0.40. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Etherstack.

On top of the insider buying, we can also see that Etherstack insiders own a large chunk of the company. To be exact, company insiders hold 71% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about US$45m riding on the stock, at current prices. So there's plenty there to keep them focused!

Should You Add Etherstack To Your Watchlist?

For growth investors, Etherstack's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. So it's fair to say that this stock may well deserve a spot on your watchlist. You still need to take note of risks, for example - Etherstack has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Etherstack, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Etherstack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ESK

Etherstack

A wireless technology company, engages in the development, manufacture, licensing, and sale of mission critical radio technologies to equipment manufacturers and network operators in the United Kingdom, the United States, Japan, and Australia.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Investment Case: Sotkamo Silver (SOSI)

The "AI Fear" Arbitrage Opportunity

From $5M to $2B: Why the 2024 Crash Was the Best Buying Opportunity in Consumer Stocks

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.