The Etherstack (ASX:ESK) Share Price Has Gained 297%, So Why Not Pay It Some Attention?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right business to buy shares in, you can make more than you can lose. Take, for example Etherstack plc (ASX:ESK). Its share price is already up an impressive 297% in the last twelve months. Looking back further, the stock price is 217% higher than it was three years ago.

View our latest analysis for Etherstack

Etherstack wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Etherstack saw its revenue grow by 7.4%. That's not great considering the company is losing money. In contrast, the share price took off during the year, gaining 297%. We're happy that investors have made money, though we wonder if the increase will be sustained. We're not so sure that revenue growth is driving the market optimism about the stock.

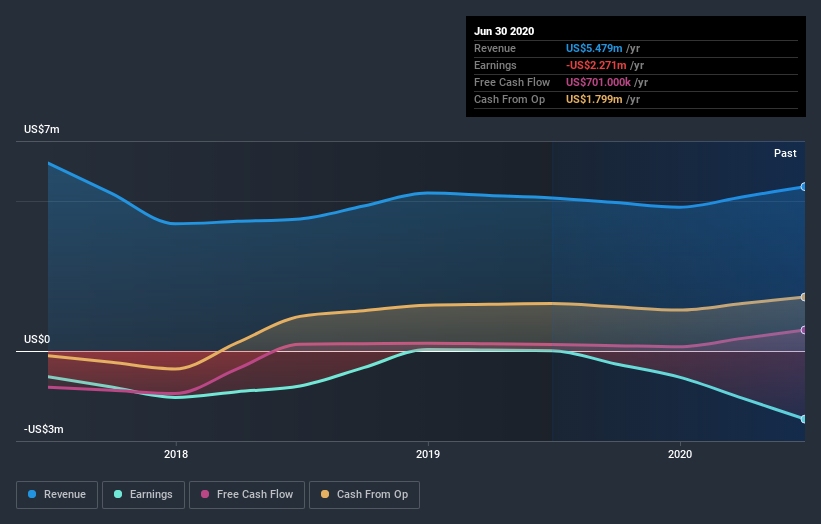

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Etherstack stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Etherstack shareholders have received a total shareholder return of 297% over one year. That's better than the annualised return of 39% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Etherstack has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

When trading Etherstack or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Etherstack might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ESK

Etherstack

A wireless technology company, engages in the development, manufacture, licensing, and sale of mission critical radio technologies to equipment manufacturers and network operators in the United Kingdom, the United States, Japan, and Australia.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Phase 3 HALEO results have a high probability of Success

Mader Group (ASX: MAD): Strong Growth, Strong Returns — But at a Price

Netflix - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion