High Growth Tech Stocks In Australia Featuring 3 Dynamic Picks

Reviewed by Simply Wall St

The Australian market recently experienced a boost following a policy reversal by Trump, granting a 90-day reprieve on China tariffs, which positively impacted the ASX. In this dynamic environment, identifying high growth tech stocks that can capitalize on shifting global policies and investor sentiment is crucial for those looking to navigate the evolving landscape of Australia's tech sector.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.14% | 25.01% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Immutep | 54.51% | 42.38% | ★★★★★☆ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| SiteMinder | 19.87% | 69.57% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our ASX High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★☆☆

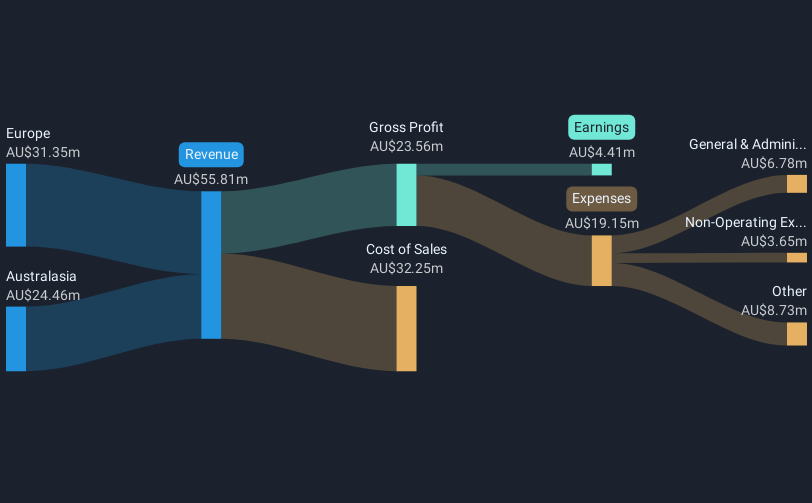

Overview: Energy One Limited offers software solutions, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets across Australasia and Europe with a market cap of A$422.96 million.

Operations: The company generates revenue primarily from its Energy Software Industry segment, amounting to A$55.81 million.

Energy One has demonstrated robust growth, notably outpacing the software industry with a 273.3% earnings surge over the past year, compared to the industry's average of 4.9%. This performance is underscored by its recent inclusion in the S&P/ASX All Ordinaries Index and a significant turnaround in financials—posting AUD 28.82 million in revenue and converting a previous loss into an AUD 2.46 million net income for the last half-year. The company's forward-looking indicators are equally promising, with earnings expected to grow by 42% annually, significantly above Australia's market average growth rate of 11.7%. Despite these strong prospects, it’s important to note that EOL’s forecasted return on equity is modest at 15.5%, suggesting potential challenges in sustaining high profitability relative to shareholder equity.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★☆☆

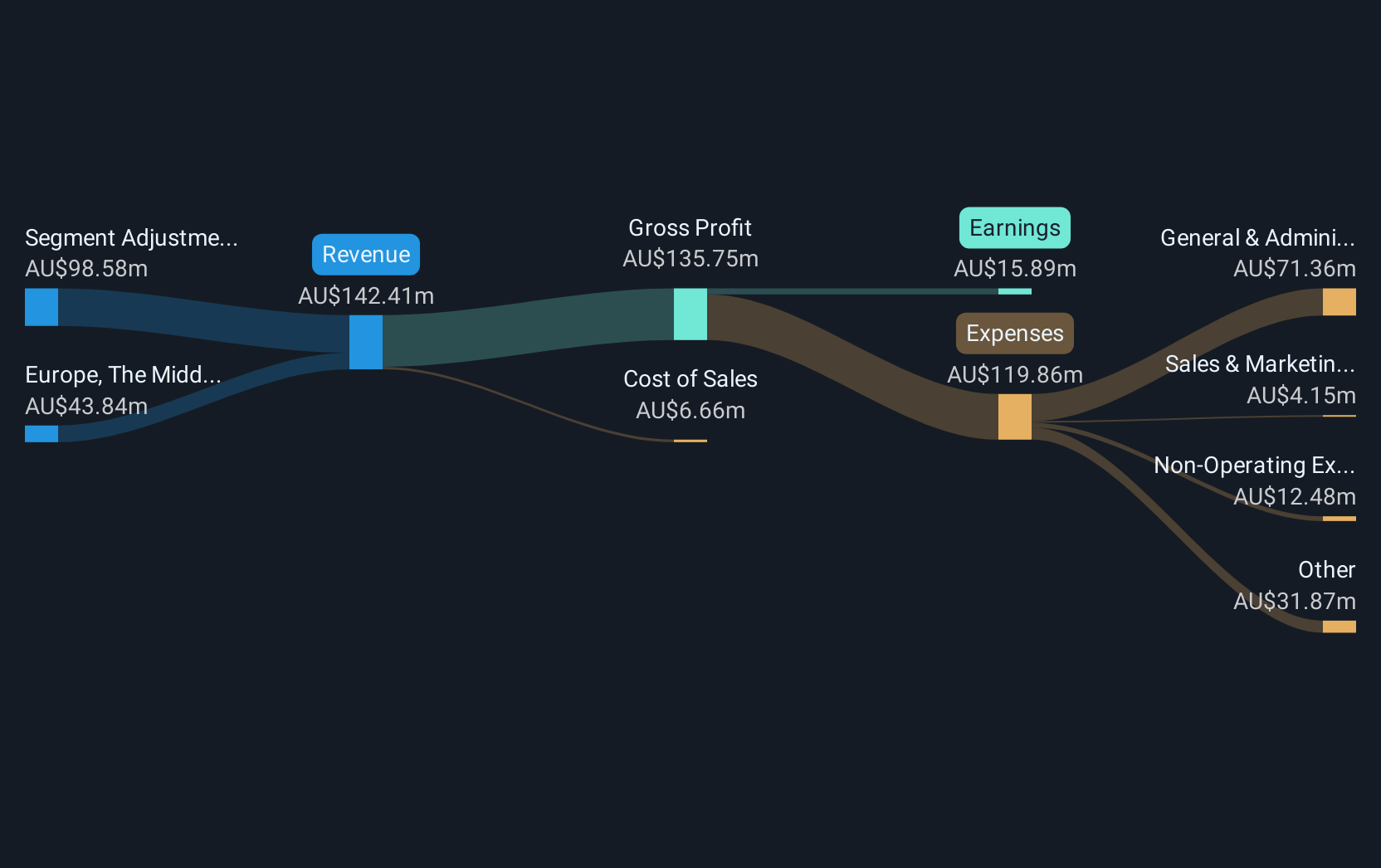

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$486.83 million.

Operations: Infomedia Ltd generates revenue primarily from its publishing segment, specifically in periodicals, amounting to A$142.41 million.

Infomedia, navigating a dynamic tech landscape, has recently intensified its R&D efforts with an investment surge, signaling a robust commitment to innovation. In the last financial year, R&D expenses climbed to AUD 15.3 million from AUD 12.7 million, representing a significant portion of revenue at 21%. This strategic focus is evident as Infomedia's earnings soared by 61.3% over the past year, outstripping the software industry's average growth of 4.9%. Alongside this growth trajectory, the company implemented a share repurchase program aimed at buying back up to 5% of its issued capital by early March next year; this move underscores management’s confidence in sustaining momentum amidst evolving market demands and technological advancements.

- Take a closer look at Infomedia's potential here in our health report.

Evaluate Infomedia's historical performance by accessing our past performance report.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

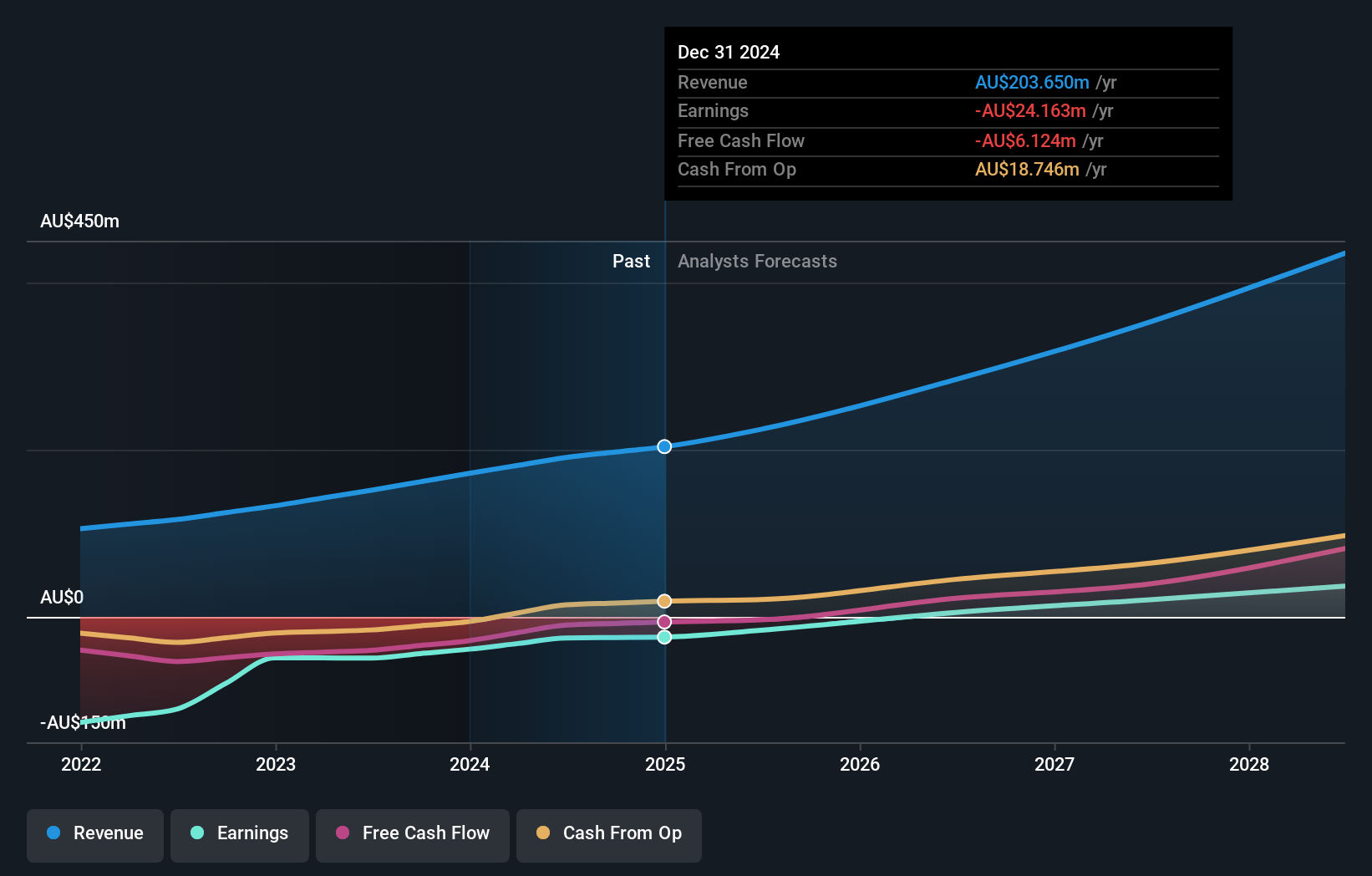

Overview: SiteMinder Limited provides an online guest acquisition platform and commerce solutions for accommodation providers globally, with a market cap of approximately A$1.18 billion.

Operations: SiteMinder generates revenue primarily from its software and programming segment, totaling A$203.65 million. The company's focus is on developing and marketing solutions that enhance guest acquisition for accommodation providers both in Australia and internationally.

SiteMinder, amidst a challenging landscape, has demonstrated resilience with its recent financial performance. For the half-year ending December 2024, revenue rose to AUD 104.45 million from AUD 91.72 million in the previous period, marking an annualized increase of approximately 13.9%. However, the company still faces hurdles as evidenced by a consistent net loss of AUD 13.89 million. Despite these challenges, SiteMinder's commitment to growth is evident in its R&D investments which are crucial for innovation and maintaining competitiveness in the fast-evolving tech sector. This strategic focus on development could be pivotal for future profitability and market position enhancement.

- Click to explore a detailed breakdown of our findings in SiteMinder's health report.

Explore historical data to track SiteMinder's performance over time in our Past section.

Taking Advantage

- Delve into our full catalog of 48 ASX High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDR

SiteMinder

Develops, markets, and sells online guest acquisition platform and commerce solutions for accommodation providers in Australia and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives