As the Australian market navigates a complex landscape marked by fluctuating iron ore prices and economic indicators pointing to persistent deflation in China, investors are keenly observing the tech sector for potential high-growth opportunities. In this environment, identifying promising tech stocks involves assessing their ability to innovate and adapt amidst broader market shifts, such as those influenced by commodity trends and central bank decisions.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pro Medicus | 20.19% | 22.27% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| WiseTech Global | 20.26% | 22.91% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 51.57% | 52.67% | ★★★★★★ |

| Echo IQ | 49.20% | 51.35% | ★★★★★★ |

| Wrkr | 55.92% | 116.30% | ★★★★★★ |

| Immutep | 70.44% | 43.18% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 18.78% | 55.55% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★☆☆

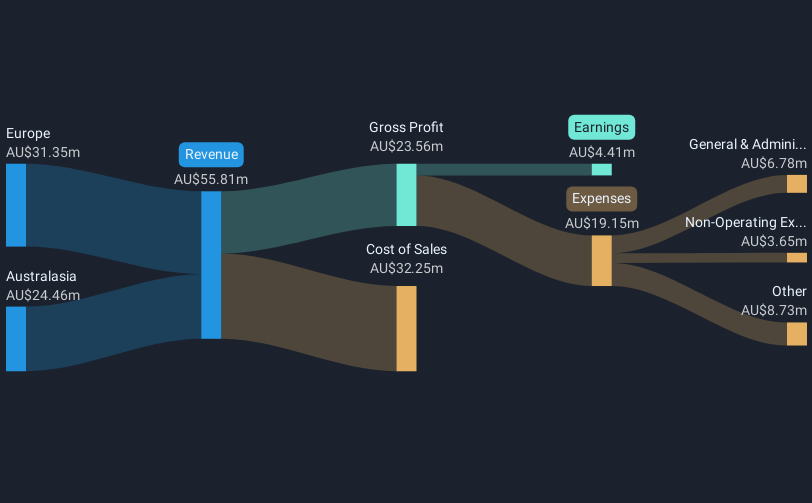

Overview: Energy One Limited offers software solutions, outsourced operations, and advisory services for wholesale energy and carbon trading markets in Australasia and Europe, with a market cap of A$418.57 million.

Operations: The company generates revenue primarily from its energy software industry, amounting to A$55.81 million.

Energy One, a player in the high-growth tech sector in Australia, has demonstrated remarkable financial performance with earnings surging by 273.3% over the past year, significantly outpacing the software industry's growth of 5.6%. This growth trajectory is supported by a robust forecast that expects earnings to expand at an annual rate of 42%, well above the Australian market average of 10.9%. Despite facing challenges like significant insider selling in recent months, Energy One continues to innovate and invest heavily in R&D, maintaining its competitive edge within the tech landscape. The company's commitment to technological advancement is evident from its R&D expenses which are strategically reinvested to fuel future innovations and market expansion. With revenue projected to increase at a yearly rate of 14.9%, surpassing the national average of 5.5%, Energy One is poised for sustained growth albeit at a pace slower than some might anticipate for high-growth sectors.

- Click here to discover the nuances of Energy One with our detailed analytical health report.

Evaluate Energy One's historical performance by accessing our past performance report.

Infomedia (ASX:IFM)

Simply Wall St Growth Rating: ★★★★☆☆

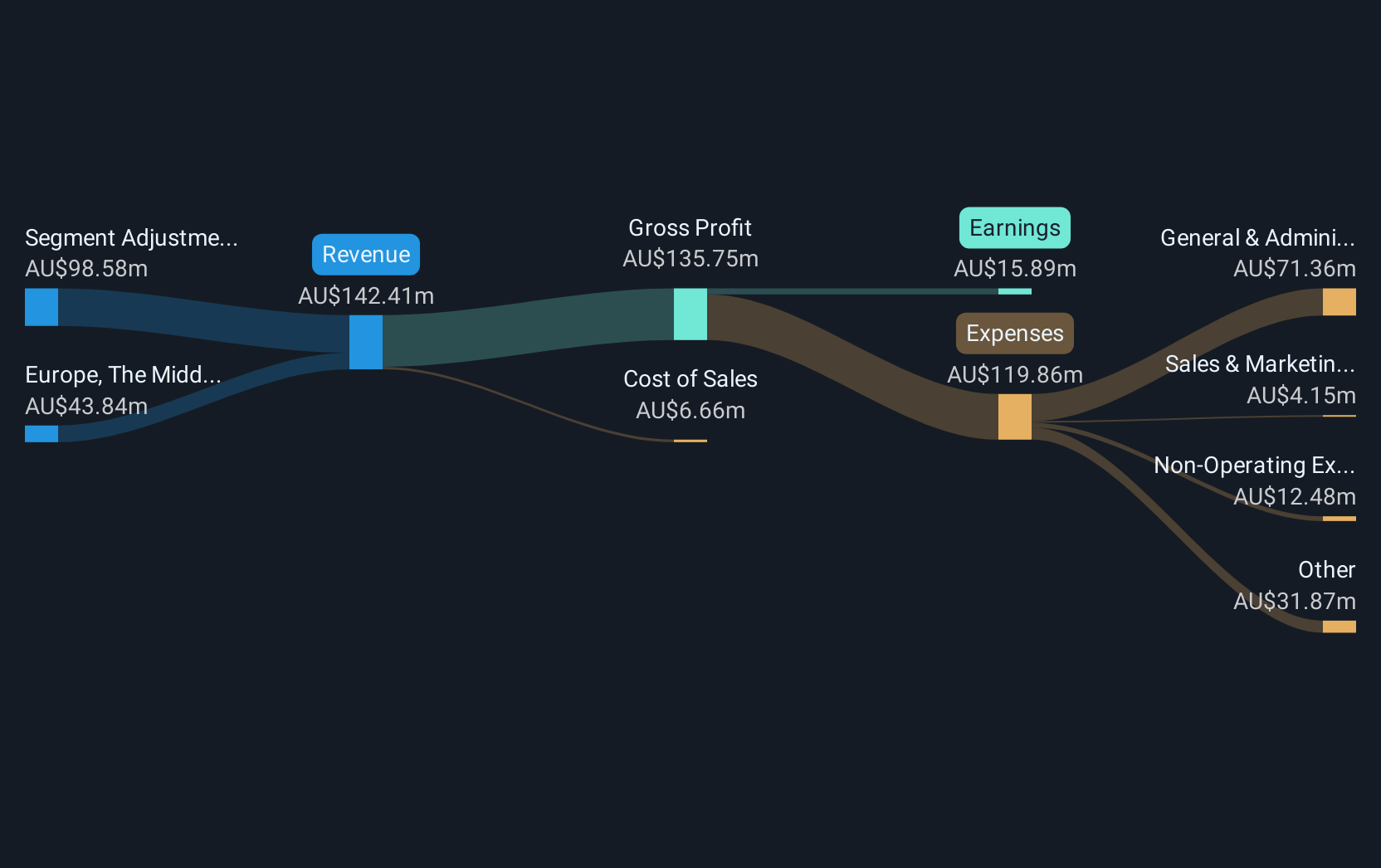

Overview: Infomedia Ltd is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$471.74 million.

Operations: Infomedia generates revenue primarily from its publishing segment, specifically in periodicals, amounting to A$142.41 million. The company focuses on providing technology solutions like electronic parts catalogues and service quoting software for the automotive sector globally.

Infomedia has shown resilience and adaptability in the tech sector, with a notable 61.3% earnings growth over the past year, outperforming the software industry's average of 5.6%. This growth is underpinned by robust forecasts predicting annual earnings to increase by 19.9%, significantly above Australia's market average of 10.9%. Despite recent executive changes, Infomedia maintains strong fundamentals; its R&D focus is evident with substantial investments aimed at fostering innovation and securing competitive advantages in rapidly evolving tech landscapes. The company's strategic emphasis on R&D not only fuels technological advancements but also aligns well with industry shifts towards more sustainable and efficient business models, ensuring it remains at the forefront of market trends.

- Navigate through the intricacies of Infomedia with our comprehensive health report here.

Review our historical performance report to gain insights into Infomedia's's past performance.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

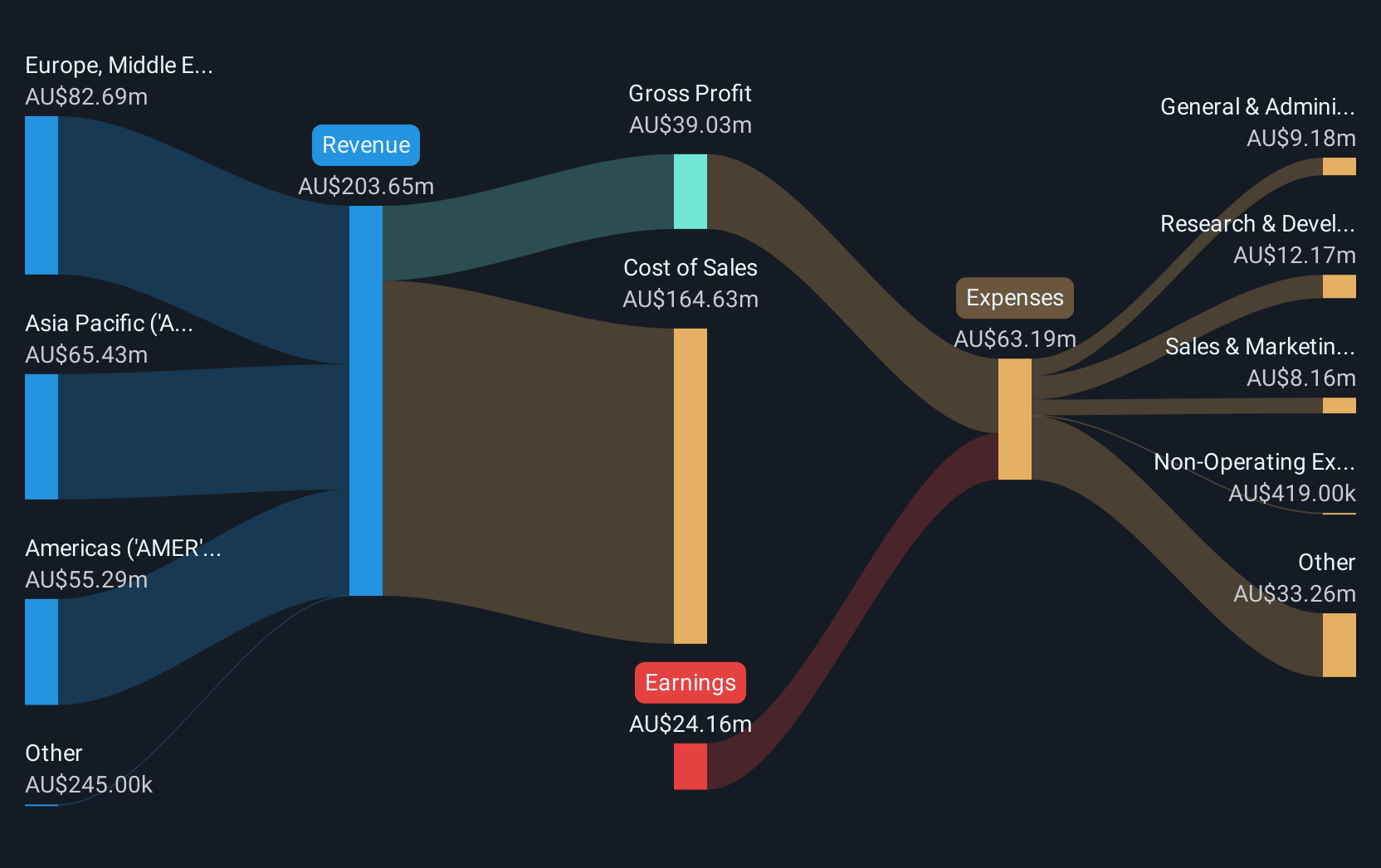

Overview: SiteMinder Limited is an Australian company that develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers globally, with a market cap of A$1.24 billion.

Operations: SiteMinder generates revenue primarily through its software and programming segment, which accounted for A$203.65 million. The company focuses on providing online guest acquisition platforms and commerce solutions to accommodation providers both in Australia and internationally.

SiteMinder, amidst a dynamic shift in the software industry towards SaaS models, has demonstrated robust performance with an 18.8% annual revenue growth and an impressive 55.6% surge in earnings per year. This growth trajectory is complemented by substantial R&D investments, which have significantly shaped its market position and innovation capabilities. Recently, SiteMinder announced a change in company secretary, underscoring ongoing strategic adjustments within its leadership team to better navigate future challenges and opportunities in the tech landscape. These developments reflect SiteMinder's proactive approach to both governance and technological advancement, setting a solid foundation for sustained growth amid evolving industry demands.

- Click here and access our complete health analysis report to understand the dynamics of SiteMinder.

Assess SiteMinder's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 46 ASX High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EOL

Energy One

Engages in the provision of software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

High growth potential with solid track record.

Market Insights

Community Narratives