ASX Growth Companies With High Insider Ownership For April 2025

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 closing up 0.36% at 7,997 points, driven by gains in the Energy, IT, and Discretionary sectors despite a slight dip in Materials. In this environment of sectoral growth and strategic acquisitions, identifying growth companies with high insider ownership can be particularly appealing as it often signals confidence from those closest to the business's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Fenix Resources (ASX:FEX) | 21.1% | 47.8% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 16% | 108.2% |

| Echo IQ (ASX:EIQ) | 19.8% | 87.1% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Plenti Group (ASX:PLT) | 12.7% | 85% |

| Image Resources (ASX:IMA) | 16.1% | 127.3% |

| BETR Entertainment (ASX:BBT) | 38.6% | 77.5% |

Underneath we present a selection of stocks filtered out by our screen.

Energy One (ASX:EOL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energy One Limited offers software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in Australasia and Europe, with a market cap of A$397.90 million.

Operations: The company's revenue is primarily derived from its Energy Software Industry segment, totaling A$55.81 million.

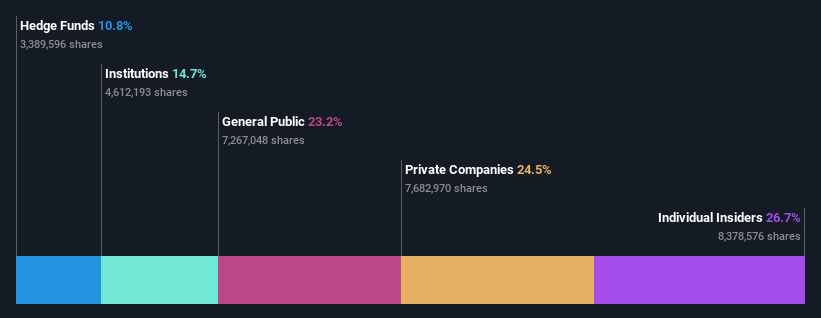

Insider Ownership: 26.7%

Earnings Growth Forecast: 42% p.a.

Energy One has been added to the S&P/ASX All Ordinaries Index, highlighting its market presence. The company reported a net income of A$2.46 million for the half year ended December 2024, reversing a prior loss. Revenue and earnings are forecast to grow significantly faster than the Australian market, though insider activity shows substantial selling recently. Despite this, Energy One's growth trajectory remains strong with expected annual profit growth of 42%.

- Navigate through the intricacies of Energy One with our comprehensive analyst estimates report here.

- The analysis detailed in our Energy One valuation report hints at an inflated share price compared to its estimated value.

MA Financial Group (ASX:MAF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MA Financial Group Limited, with a market cap of A$1.03 billion, offers a range of financial services in Australia through its subsidiaries.

Operations: MA Financial Group's revenue is primarily derived from Asset Management (A$189.65 million), Lending & Technology (A$60.82 million), and Corporate Advisory and Equities (CA&E) (A$55.72 million), with a smaller contribution from Corporate Services (A$0.42 million).

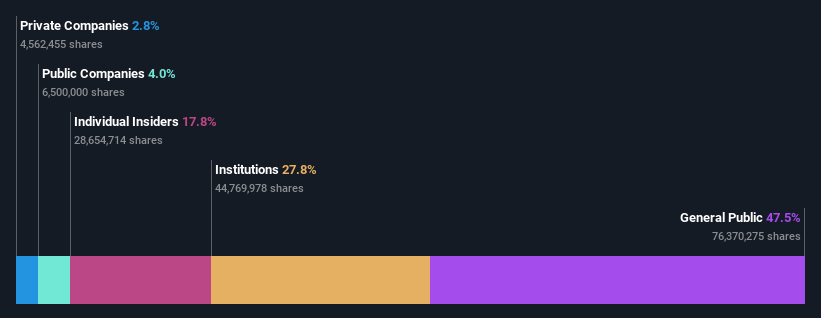

Insider Ownership: 17.8%

Earnings Growth Forecast: 30.7% p.a.

MA Financial Group is poised for strong earnings growth, with forecasts indicating a 30.7% annual increase, outpacing the broader Australian market. Recent earnings showed a rise to A$41.79 million from A$28.52 million year-on-year, although revenue is expected to decline significantly over three years. The company's return on equity is projected to be robust at 21.4%. Despite limited recent insider trading activity and a dividend not fully covered by free cash flow, strategic board appointments bolster governance.

- Click here to discover the nuances of MA Financial Group with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that MA Financial Group is trading beyond its estimated value.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$9.46 billion.

Operations: The company's revenue segments include Software at A$347.35 million, Corporate at A$87.02 million, and Consulting at A$72.17 million.

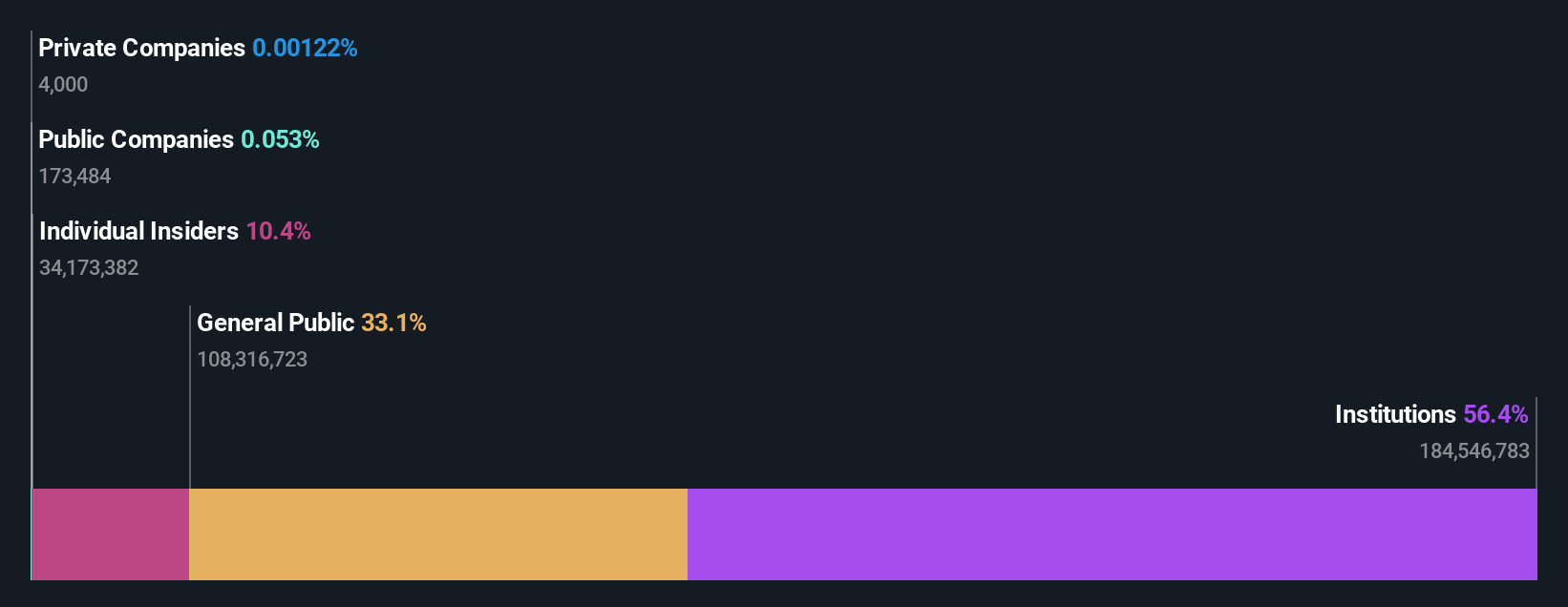

Insider Ownership: 10.4%

Earnings Growth Forecast: 15.6% p.a.

Technology One's earnings are poised to grow at 15.65% annually, surpassing the Australian market's 11.7% forecast, though not significantly high. Revenue growth is expected at 12.1%, outpacing the broader market but below 20%. Recent insider buying activity was more than selling but not substantial in volume. The company's addition to the FTSE All-World Index and changes in governance, including a director's retirement, highlight its evolving strategic position amidst steady financial performance.

- Delve into the full analysis future growth report here for a deeper understanding of Technology One.

- Our valuation report unveils the possibility Technology One's shares may be trading at a premium.

Make It Happen

- Unlock our comprehensive list of 95 Fast Growing ASX Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Technology One, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives