A Sliding Share Price Has Us Looking At Energy One Limited's (ASX:EOL) P/E Ratio

To the annoyance of some shareholders, Energy One (ASX:EOL) shares are down a considerable 50% in the last month. The stock has been solid, longer term, gaining 17% in the last year.

All else being equal, a share price drop should make a stock more attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

Check out our latest analysis for Energy One

Does Energy One Have A Relatively High Or Low P/E For Its Industry?

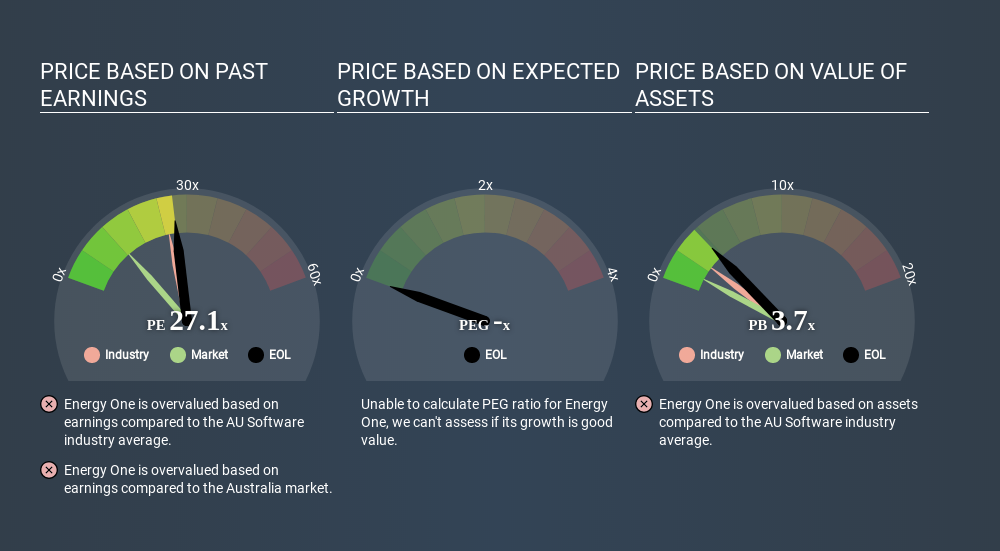

We can tell from its P/E ratio of 27.10 that there is some investor optimism about Energy One. As you can see below, Energy One has a higher P/E than the average company (25.1) in the software industry.

Energy One's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Energy One's earnings made like a rocket, taking off 56% last year. Even better, EPS is up 40% per year over three years. So we'd absolutely expect it to have a relatively high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. That means it doesn't take debt or cash into account. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Energy One's P/E?

Energy One has net debt worth 14% of its market capitalization. It would probably deserve a higher P/E ratio if it was net cash, since it would have more options for growth.

The Verdict On Energy One's P/E Ratio

Energy One has a P/E of 27.1. That's higher than the average in its market, which is 12.5. While the company does use modest debt, its recent earnings growth is superb. So on this analysis a high P/E ratio seems reasonable. Given Energy One's P/E ratio has declined from 54.2 to 27.1 in the last month, we know for sure that the market is significantly less confident about the business today, than it was back then. For those who don't like to trade against momentum, that could be a warning sign, but a contrarian investor might want to take a closer look.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Energy One. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:EOL

Energy One

Engages in the provision of software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

High growth potential with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)