Dubber Corporation Limited (ASX:DUB) insiders who acquired shares over the previous 12 months, can probably afford to ignore the recent 10% decline in the stock price. After accounting for the recent loss, the AU$930.3k worth of shares they purchased is now worth AU$1.78m, suggesting a good return on their investment.

Although we don't think shareholders should simply follow insider transactions, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Dubber

Dubber Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Peter Pawlowitsch for AU$585k worth of shares, at about AU$0.015 per share. We do like to see buying, but this purchase was made at well below the current price of AU$0.035. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

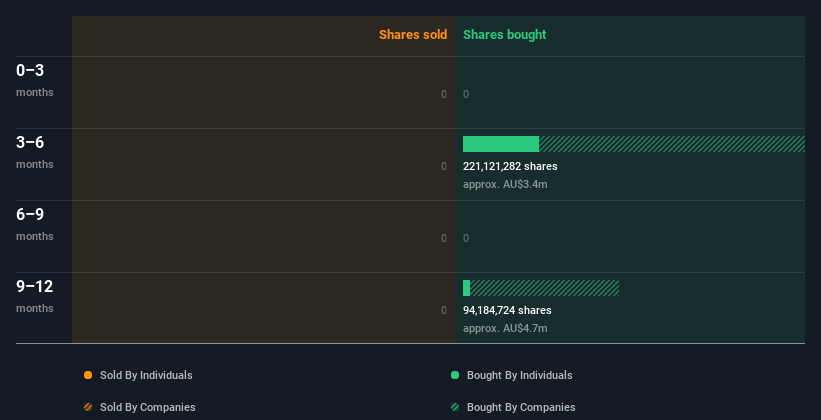

Dubber insiders may have bought shares in the last year, but they didn't sell any. Their average price was about AU$0.018. We don't deny that it is nice to see insiders buying stock in the company. However, we do note that they were buying at significantly lower prices than today's share price. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Dubber is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership Of Dubber

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Our data indicates that Dubber insiders own about AU$9.4m worth of shares (which is 10% of the company). Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

What Might The Insider Transactions At Dubber Tell Us?

It doesn't really mean much that no insider has traded Dubber shares in the last quarter. However, our analysis of transactions over the last year is heartening. We'd like to see bigger individual holdings. However, we don't see anything to make us think Dubber insiders are doubting the company. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Be aware that Dubber is showing 4 warning signs in our investment analysis, and 2 of those are a bit concerning...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DUB

Dubber

Provides unified call recording and conversation artificial intelligence services to the telecommunications industry in Australia, Europe, the United States, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion