Dropsuite (ASX:DSE) shareholders are still up 718% over 5 years despite pulling back 13% in the past week

The Dropsuite Limited (ASX:DSE) share price has had a bad week, falling 13%. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 718% in that time. Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the long term performance has been good but there's been a recent pullback of 13%, let's check if the fundamentals match the share price.

Check out our latest analysis for Dropsuite

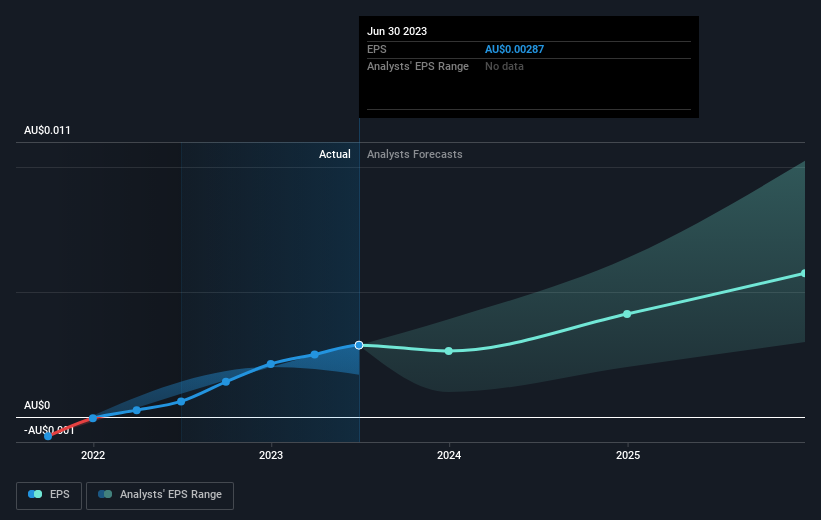

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Dropsuite became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Dropsuite has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Dropsuite's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Dropsuite shareholders have received a total shareholder return of 29% over the last year. However, that falls short of the 52% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Dropsuite that you should be aware of before investing here.

But note: Dropsuite may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:DSE

Flawless balance sheet with reasonable growth potential.