Amidst a mixed performance on the ASX, with gains led by the energy sector and a notable rise above the 7,800 points level, Australia's high growth tech stocks have captured significant attention as investors seek opportunities in an evolving market landscape. In such conditions, identifying promising tech companies often involves looking at those with innovative solutions and strong potential for scalability that align well with current economic trends.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Telix Pharmaceuticals | 20.02% | 34.25% | ★★★★★★ |

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.37% | 25.23% | ★★★★★★ |

| Wrkr | 57.01% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Pointerra | 50.42% | 159.12% | ★★★★★☆ |

| Echo IQ | 122.06% | 87.08% | ★★★★★★ |

| SiteMinder | 21.09% | 65.36% | ★★★★★★ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Life360, Inc. operates a technology platform that enables the location of people, pets, and things across North America, Europe, the Middle East, Africa, and other international regions with a market capitalization of approximately A$4.47 billion.

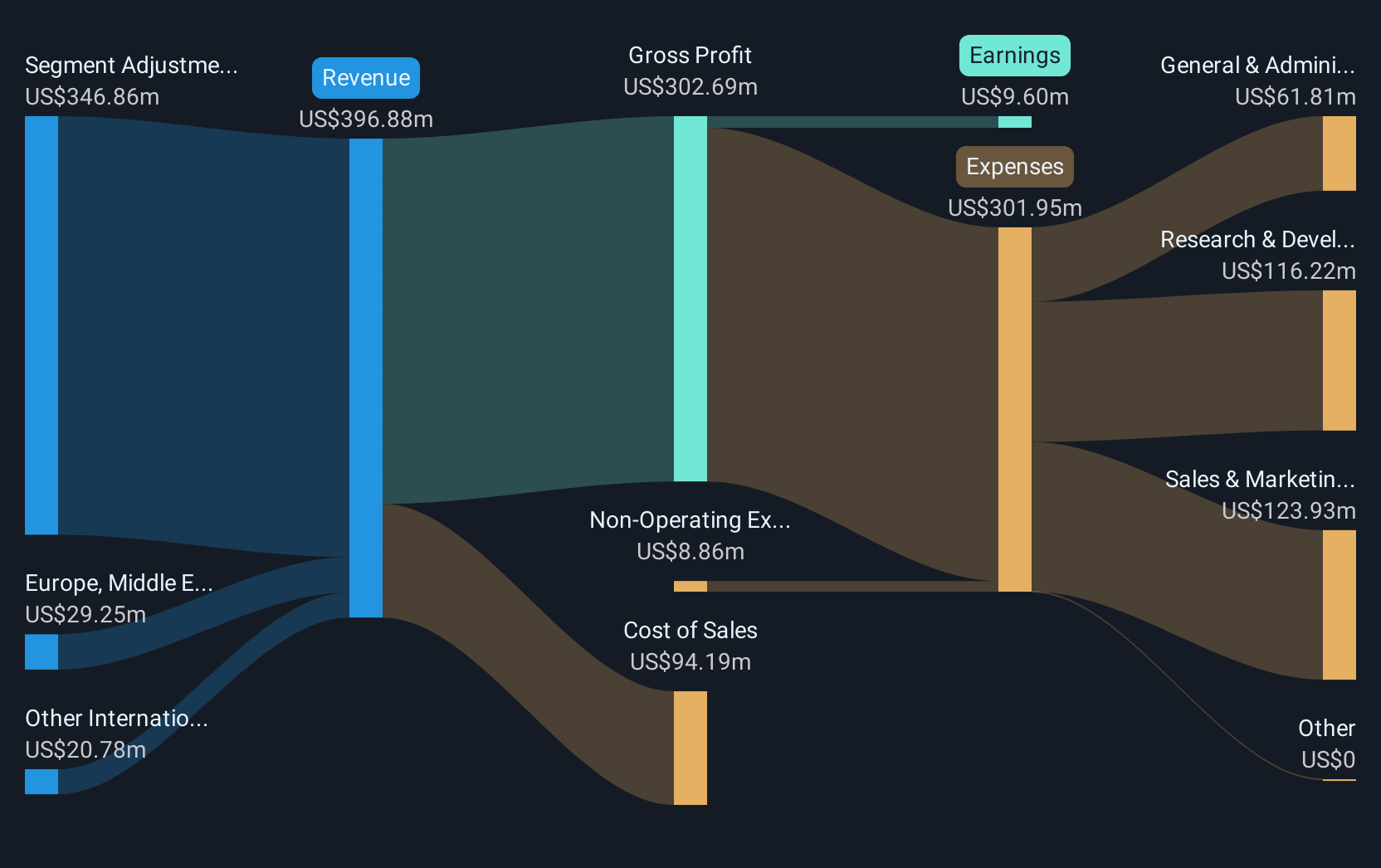

Operations: The company generates revenue primarily from its software and programming segment, amounting to $371.48 million. Its operations span across multiple regions, including North America, Europe, the Middle East, and Africa.

Amidst a dynamic tech landscape, Life360's recent strategic moves underscore its commitment to growth and security. With the appointment of Vari Bindra as CISO, previously with Amazon, the company aims to fortify its position as a trusted leader in family safety technology. This move complements their financial trajectory; Life360 reported a significant revenue increase to USD 115.53 million in Q4 2024 from USD 86.96 million the previous year and turned around from a net loss of USD 3.15 million to a net income of USD 8.5 million in the same period. Moreover, their inclusion in the S&P/ASX 100 Index highlights their expanding influence and market confidence amidst forecasts showing an expected annual profit growth of 43.54%. These developments not only enhance Life360's operational robustness but also align with broader industry trends towards enhanced digital security solutions and reliable growth metrics.

- Unlock comprehensive insights into our analysis of Life360 stock in this health report.

Assess Life360's past performance with our detailed historical performance reports.

Codan (ASX:CDA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Codan Limited develops technology solutions for various sectors including United Nations organizations, security and military groups, government departments, individuals, and small-scale miners with a market cap of A$2.69 billion.

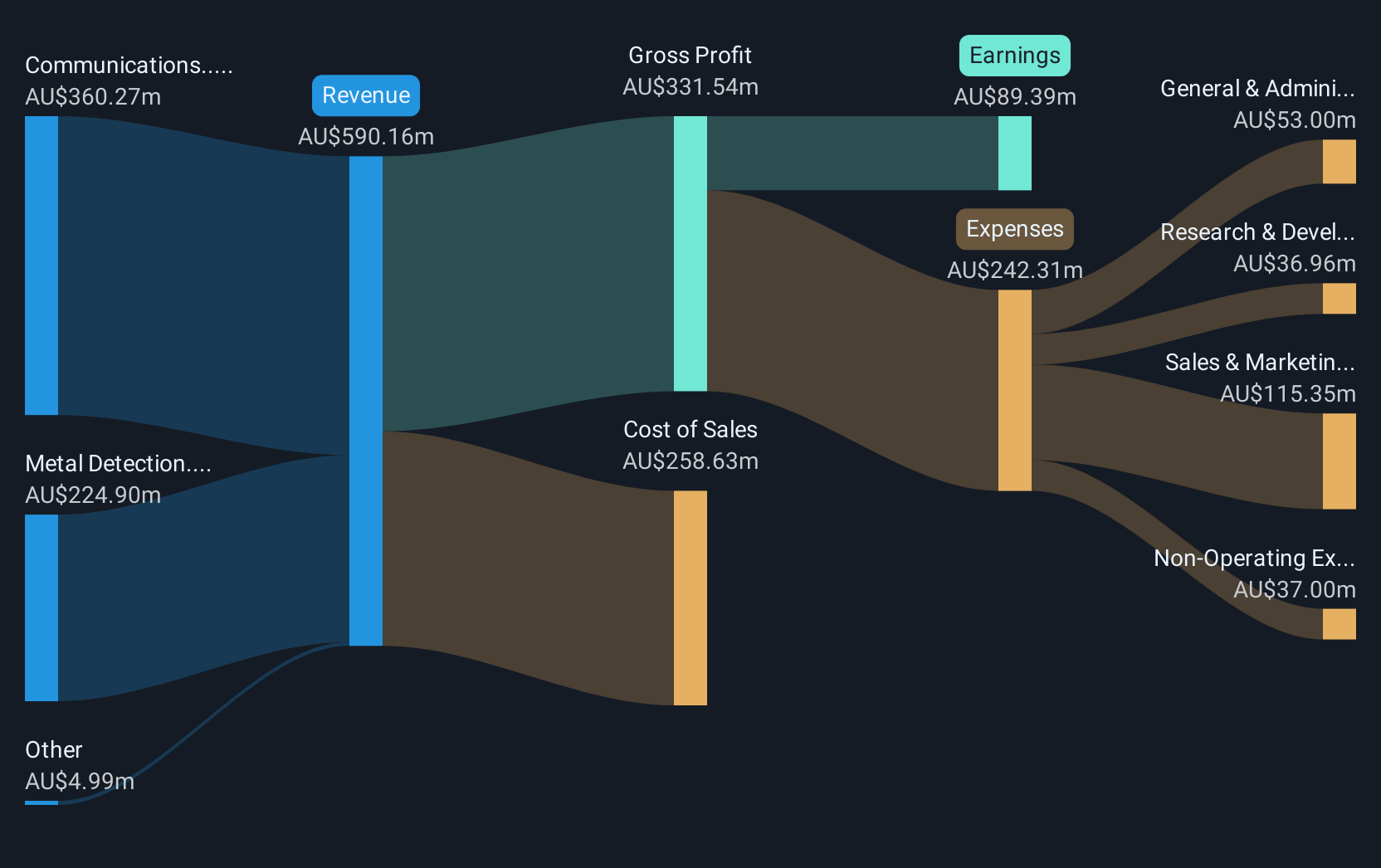

Operations: The company generates revenue primarily through its Communications and Metal Detection segments, contributing A$360.27 million and A$224.90 million, respectively.

Codan has demonstrated robust financial health, with its half-year sales climbing to AUD 305.62 million, marking a significant increase from AUD 265.92 million in the previous period. This growth is coupled with a net income rise to AUD 46.04 million from AUD 38.04 million, reflecting a strong earnings trajectory with an annualized growth rate of 15.8%. Furthermore, Codan's commitment to innovation is evident in its R&D investments, maintaining a strategic focus on developing cutting-edge technology solutions that cater to global market demands. These financial and operational strides not only highlight Codan’s resilience but also position it favorably within Australia's competitive tech landscape, suggesting promising prospects for continued expansion and impact in the industry.

- Delve into the full analysis health report here for a deeper understanding of Codan.

Examine Codan's past performance report to understand how it has performed in the past.

Dropsuite (ASX:DSE)

Simply Wall St Growth Rating: ★★★★☆☆

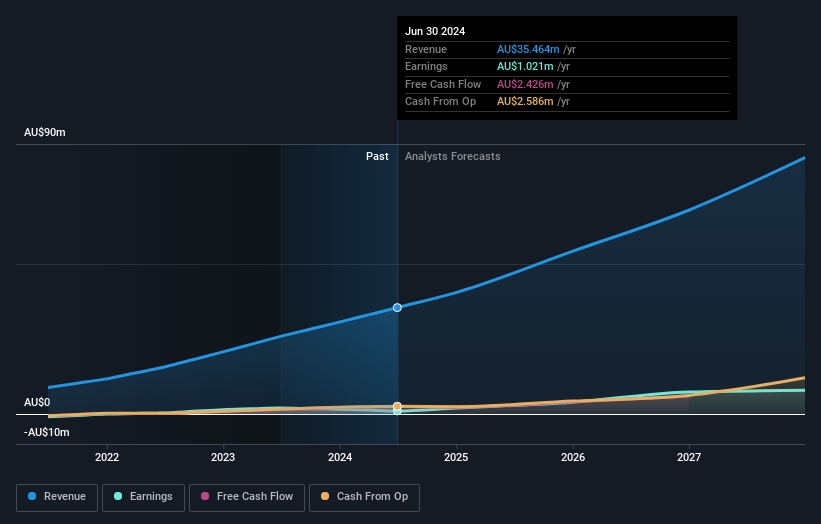

Overview: Dropsuite Limited offers cloud-based data backup and archiving solutions across various regions including Australia, Singapore, Europe, and the United States with a market capitalization of A$413.15 million.

Operations: Dropsuite Limited generates revenue primarily through the provision of backup services, amounting to A$41.17 million. The company focuses on delivering cloud-based solutions for data protection and archiving across multiple international markets.

Amidst a transformative acquisition by NinjaOne Australia, Dropsuite Limited showcased a notable revenue jump to AUD 41.15 million from AUD 30.63 million last year, reflecting an impressive annual growth of 19.3%. Despite this surge, net income dipped to AUD 0.829 million from AUD 1.58 million, indicating challenges in profitability even as the company expands its market footprint. The strategic move could potentially enhance Dropsuite's offerings and market position, leveraging NinjaOne's resources to possibly accelerate future growth trajectories and innovation in tech solutions within the competitive Australian landscape.

- Click here to discover the nuances of Dropsuite with our detailed analytical health report.

Gain insights into Dropsuite's historical performance by reviewing our past performance report.

Key Takeaways

- Delve into our full catalog of 47 ASX High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:360

Life360

Operates a technology platform to locate people, pets, and things in North America, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion