We Take A Look At Why CV Check Ltd's (ASX:CV1) CEO Compensation Is Well Earned

It would be hard to discount the role that CEO Rod Sherwood has played in delivering the impressive results at CV Check Ltd (ASX:CV1) recently. Coming up to the next AGM on 31 March 2021, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for CV Check

Comparing CV Check Ltd's CEO Compensation With the industry

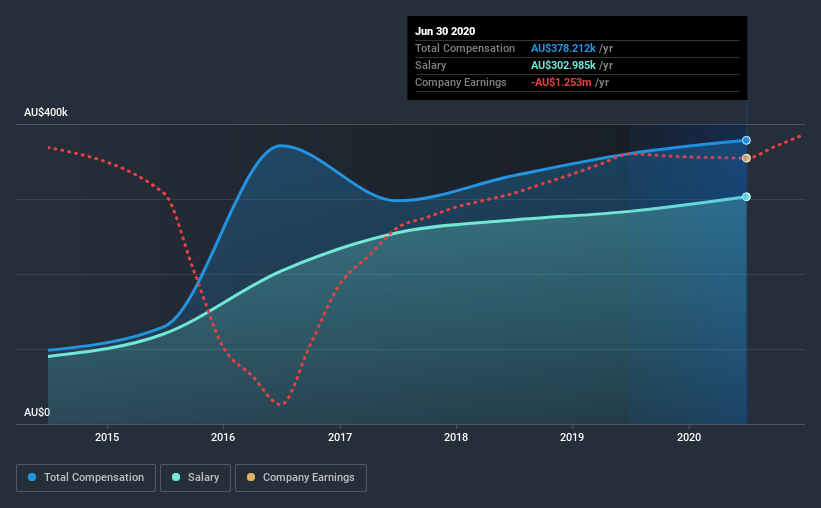

At the time of writing, our data shows that CV Check Ltd has a market capitalization of AU$53m, and reported total annual CEO compensation of AU$378k for the year to June 2020. That's just a smallish increase of 4.9% on last year. We note that the salary portion, which stands at AU$303.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$261m, reported a median total CEO compensation of AU$410k. So it looks like CV Check compensates Rod Sherwood in line with the median for the industry. What's more, Rod Sherwood holds AU$2.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$303k | AU$284k | 80% |

| Other | AU$75k | AU$77k | 20% |

| Total Compensation | AU$378k | AU$361k | 100% |

On an industry level, roughly 46% of total compensation represents salary and 54% is other remuneration. CV Check is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at CV Check Ltd's Growth Numbers

CV Check Ltd has seen its earnings per share (EPS) increase by 53% a year over the past three years. Its revenue is down 1.3% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has CV Check Ltd Been A Good Investment?

Boasting a total shareholder return of 96% over three years, CV Check Ltd has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 3 warning signs for CV Check that investors should be aware of in a dynamic business environment.

Important note: CV Check is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade CV Check, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinatico might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:KYP

Kinatico

Provides screening, verification, and SaaS-based workforce management and compliance technology systems in Australia and New Zealand.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion