We're Interested To See How Complii FinTech Solutions (ASX:CF1) Uses Its Cash Hoard To Grow

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Complii FinTech Solutions (ASX:CF1) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Complii FinTech Solutions

When Might Complii FinTech Solutions Run Out Of Money?

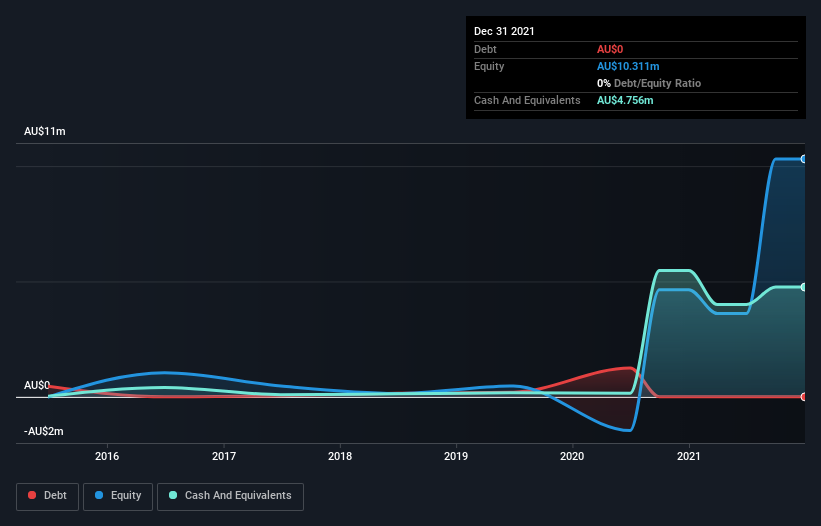

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2021, Complii FinTech Solutions had cash of AU$4.8m and no debt. Importantly, its cash burn was AU$1.3m over the trailing twelve months. Therefore, from December 2021 it had 3.6 years of cash runway. There's no doubt that this is a reassuringly long runway. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Complii FinTech Solutions Growing?

Some investors might find it troubling that Complii FinTech Solutions is actually increasing its cash burn, which is up 16% in the last year. On a more positive note, the operating revenue improved by 174% over the period, offering an indication that the expenditure may well be worthwhile. If revenue is maintained once spending on growth decreases, that could well pay off! We think it is growing rather well, upon reflection. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Complii FinTech Solutions To Raise More Cash For Growth?

We are certainly impressed with the progress Complii FinTech Solutions has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of AU$33m, Complii FinTech Solutions' AU$1.3m in cash burn equates to about 4.0% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Complii FinTech Solutions' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Complii FinTech Solutions' cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. While its increasing cash burn wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Complii FinTech Solutions (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CF1

Complii FinTech Solutions

Operates an integrated corporate and adviser management platform for the financial services sector in Australia, the Philippines, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives