- Australia

- /

- Metals and Mining

- /

- ASX:MRQ

3 ASX Penny Stocks With Market Caps Under A$20M To Consider

Reviewed by Simply Wall St

The Australian market recently closed on a positive note, with the ASX 200 gaining 0.29%, despite concerns about inflation remaining high according to the latest RBA minutes. In this context, penny stocks—though an outdated term—continue to attract attention for their potential value and growth opportunities, particularly in smaller or newer companies that may offer unique advantages. This article will explore three such penny stocks that stand out for their financial strength and potential long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,053 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Complii FinTech Solutions (ASX:CF1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Complii FinTech Solutions Ltd provides an integrated corporate and adviser management platform for the financial services sector in Australia and internationally, with a market cap of A$13.15 million.

Operations: The company's revenue segments include Complii with A$3.09 million, MIntegrity generating A$1.03 million, Primary Markets contributing A$2.09 million, Registry Direct at A$1.76 million, and Adviser Solutions Group bringing in A$0.19 million.

Market Cap: A$13.15M

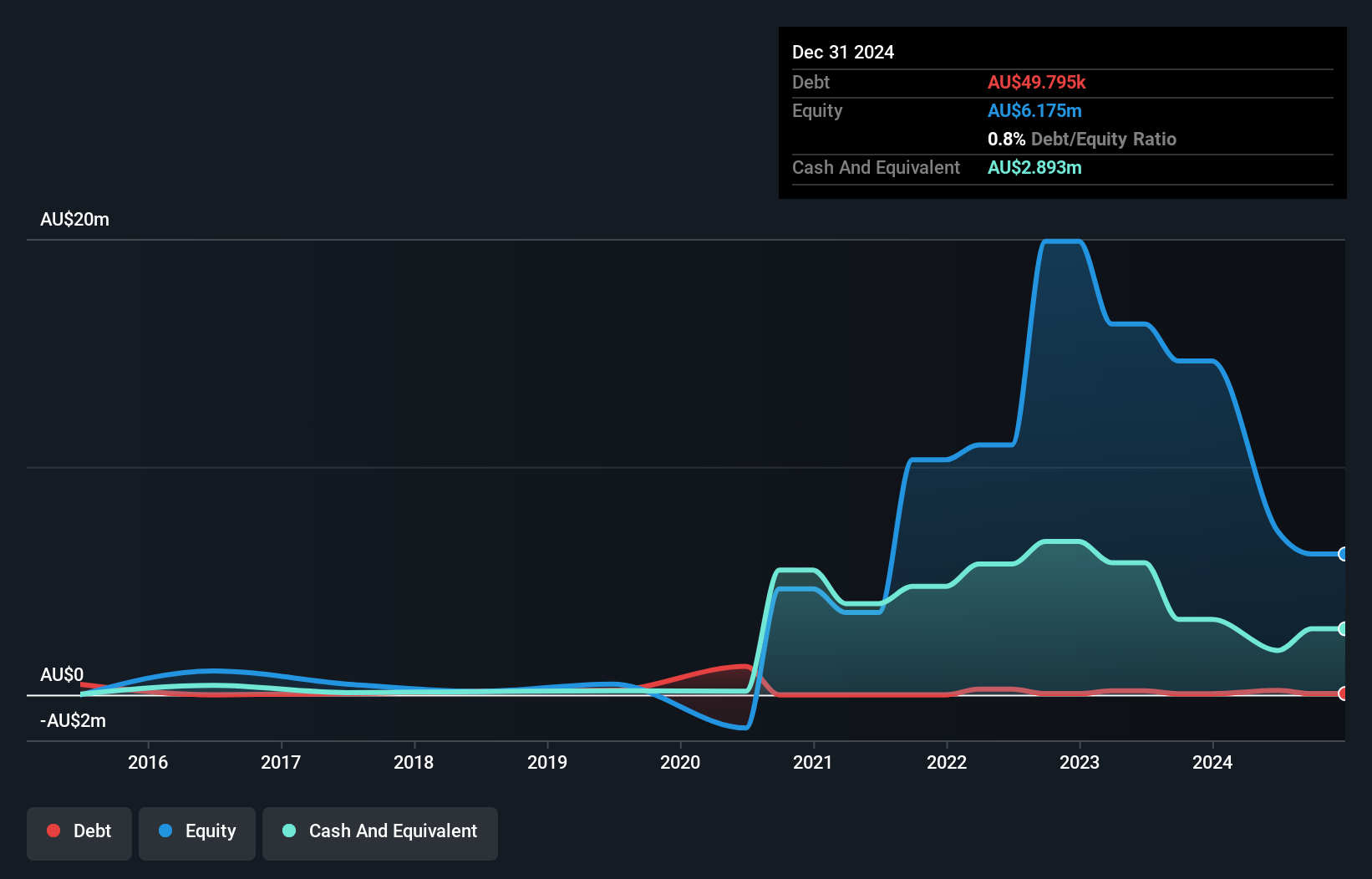

Complii FinTech Solutions, with a market cap of A$13.15 million, has shown significant volatility in its share price and remains unprofitable. Despite this, the company maintains a strong financial position, with short-term assets of A$10.4 million exceeding both its short-term liabilities and long-term liabilities. Complii's management team is experienced, but the company faces challenges with less than a year of cash runway if current cash flow trends persist. While revenue stands at A$7 million across various segments, profitability remains elusive as losses have increased over the past five years by 9.6% annually.

- Click here to discover the nuances of Complii FinTech Solutions with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Complii FinTech Solutions' track record.

MRG Metals (ASX:MRQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MRG Metals Ltd, with a market cap of A$10.85 million, explores and develops mineral projects in Mozambique, Zimbabwe, and Western Australia.

Operations: Currently, there are no reported revenue segments for MRG Metals Ltd.

Market Cap: A$10.85M

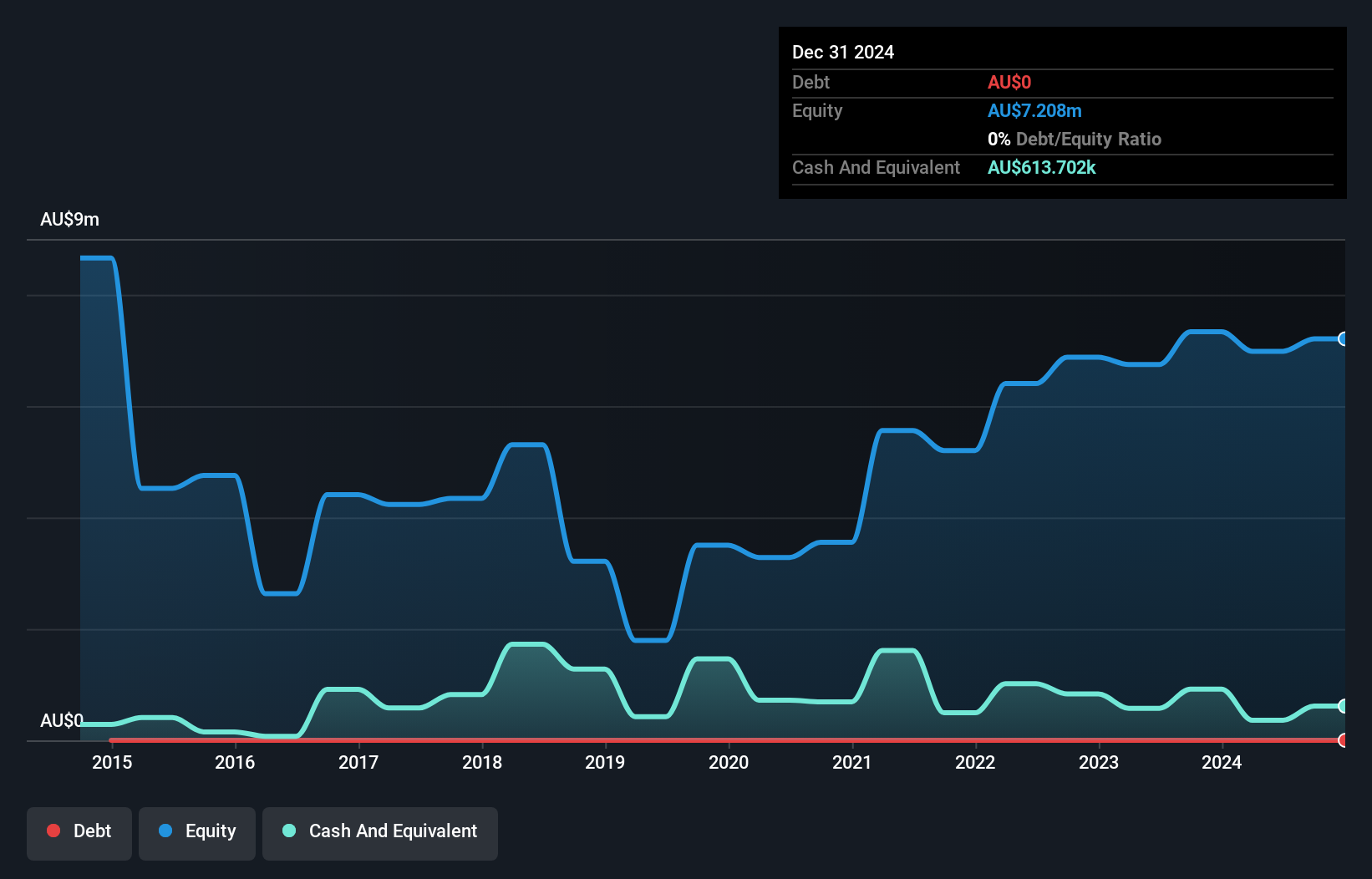

MRG Metals Ltd, with a market cap of A$10.85 million, is pre-revenue and faces significant challenges as highlighted by its auditor's doubts about its ability to continue as a going concern. Despite being debt-free and having short-term assets of A$762.6K exceeding short-term liabilities of A$223.5K, the company remains unprofitable with a net loss reported for the past fiscal year. The share price has been highly volatile, and shareholders experienced dilution over the past year with shares outstanding increasing by 9.7%. MRG Metals has raised additional capital but currently has only a short cash runway available.

- Click here and access our complete financial health analysis report to understand the dynamics of MRG Metals.

- Learn about MRG Metals' historical performance here.

Triton Minerals (ASX:TON)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Triton Minerals Limited focuses on the exploration, evaluation, and development of graphite projects in Mozambique with a market cap of A$14.12 million.

Operations: Triton Minerals Limited has not reported specific revenue segments.

Market Cap: A$14.12M

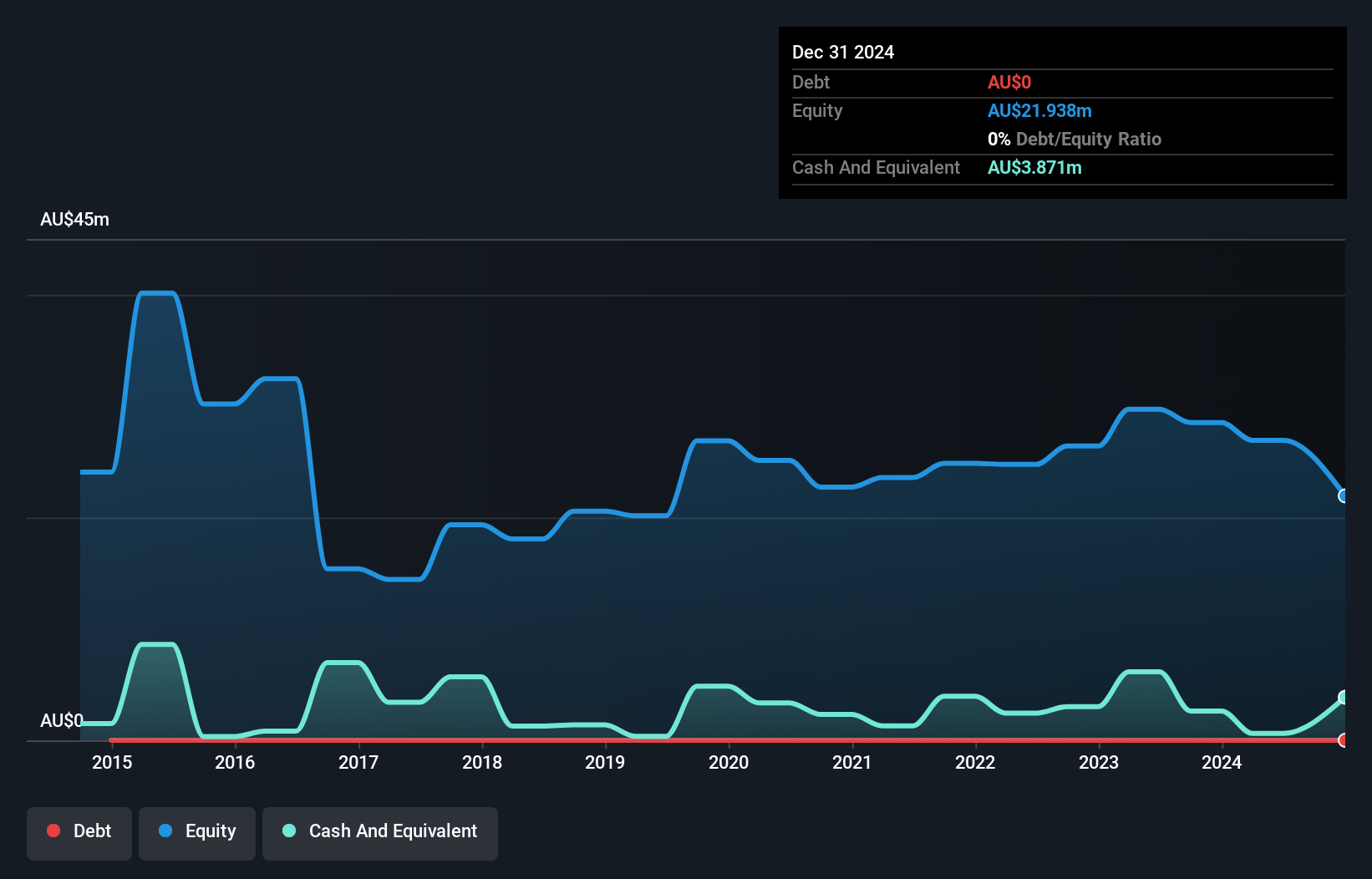

Triton Minerals Limited, with a market cap of A$14.12 million, is pre-revenue and currently unprofitable. The company has no debt and its short-term assets of A$25.4 million comfortably cover both its short-term liabilities (A$1.2 million) and long-term liabilities (A$297.3K). Despite this, Triton faces challenges with less than a year of cash runway based on current free cash flow trends. Recent executive changes include the appointment of Ruizhe Hu as company secretary; Hu brings over 15 years in financial accounting experience to the role while continuing as CFO amidst ongoing strategic developments in Mozambique graphite projects.

- Jump into the full analysis health report here for a deeper understanding of Triton Minerals.

- Gain insights into Triton Minerals' past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1,053 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MRQ

MRG Metals

Explores and develops mineral projects in Mozambique, Zimbabwe, and Western Australia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion