As the Australian market grapples with geopolitical tensions impacting sectors like Industrials and IT, investors are navigating a landscape where energy stocks have emerged as temporary winners amidst broader sell-offs. In this environment, identifying high growth tech stocks requires careful consideration of their resilience to external shocks and potential for innovation-driven expansion.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gratifii | 42.14% | 113.99% | ★★★★★★ |

| Pro Medicus | 22.19% | 23.49% | ★★★★★★ |

| WiseTech Global | 20.15% | 25.52% | ★★★★★★ |

| Wrkr | 56.40% | 116.83% | ★★★★★★ |

| AVA Risk Group | 29.15% | 108.15% | ★★★★★★ |

| Echo IQ | 61.50% | 65.86% | ★★★★★★ |

| BlinkLab | 65.54% | 64.35% | ★★★★★★ |

| Immutep | 70.42% | 42.39% | ★★★★★☆ |

| Adveritas | 52.34% | 88.83% | ★★★★★★ |

| SiteMinder | 19.89% | 69.58% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Audinate Group (ASX:AD8)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions both in Australia and internationally, with a market capitalization of A$585.21 million.

Operations: Audinate Group Limited generates revenue primarily from its Contract Electronics Manufacturing Services, amounting to A$73.60 million. The company focuses on digital AV networking solutions across various markets globally.

Amidst a challenging backdrop, Audinate Group has demonstrated resilience with a projected annual revenue growth of 16.2%, outpacing the Australian market average of 5.6%. Despite experiencing a significant earnings contraction last year, the company's future looks promising with an anticipated earnings growth rate of 50.3% annually, far exceeding the broader market forecast of 11.6%. This rebound is underscored by strategic board changes aimed at bolstering governance and strategy, positioning Audinate for continued innovation and market penetration in high-tech sectors. The firm's commitment to R&D remains robust, crucial for sustaining its competitive edge and driving future growth in an ever-evolving tech landscape.

- Navigate through the intricacies of Audinate Group with our comprehensive health report here.

Explore historical data to track Audinate Group's performance over time in our Past section.

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to enhance performance, prevent injuries, and evaluate return-to-play for athletes and teams globally, with a market cap of A$1.56 billion.

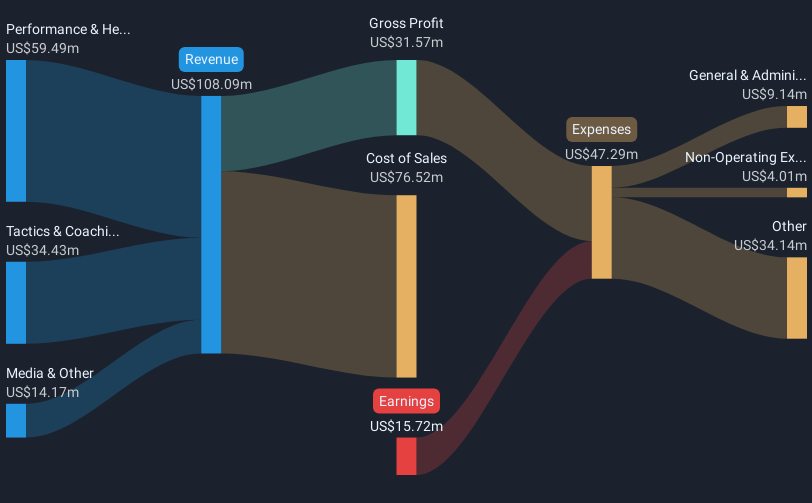

Operations: Catapult Group International Ltd generates revenue primarily through its Performance & Health segment, which accounts for $63.47 million, followed by Tactics & Coaching at $36.66 million. The company provides solutions across Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas to optimize athlete performance and reduce injury risks.

Catapult Group International, amid recent strategic developments including its M&A calls and the launch of Vector 8, shows promising signs of growth. The company reported a significant reduction in net loss to USD 8.81 million from USD 16.7 million year-on-year, with sales climbing to USD 116.53 million. This performance is underpinned by robust R&D efforts that are critical for maintaining its competitive edge in sports technology—evident from its latest innovations like Vector 8 which offers advanced real-time athlete monitoring capabilities. With expected revenue growth at an annual rate of 14.2% and forecasted earnings growth surging by nearly 95%, Catapult is poised for a turnaround, reflecting its potential resilience and adaptability in the high-tech sector despite current unprofitability.

- Get an in-depth perspective on Catapult Group International's performance by reading our health report here.

Learn about Catapult Group International's historical performance.

FINEOS Corporation Holdings (ASX:FCL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa with a market cap of A$761.66 million.

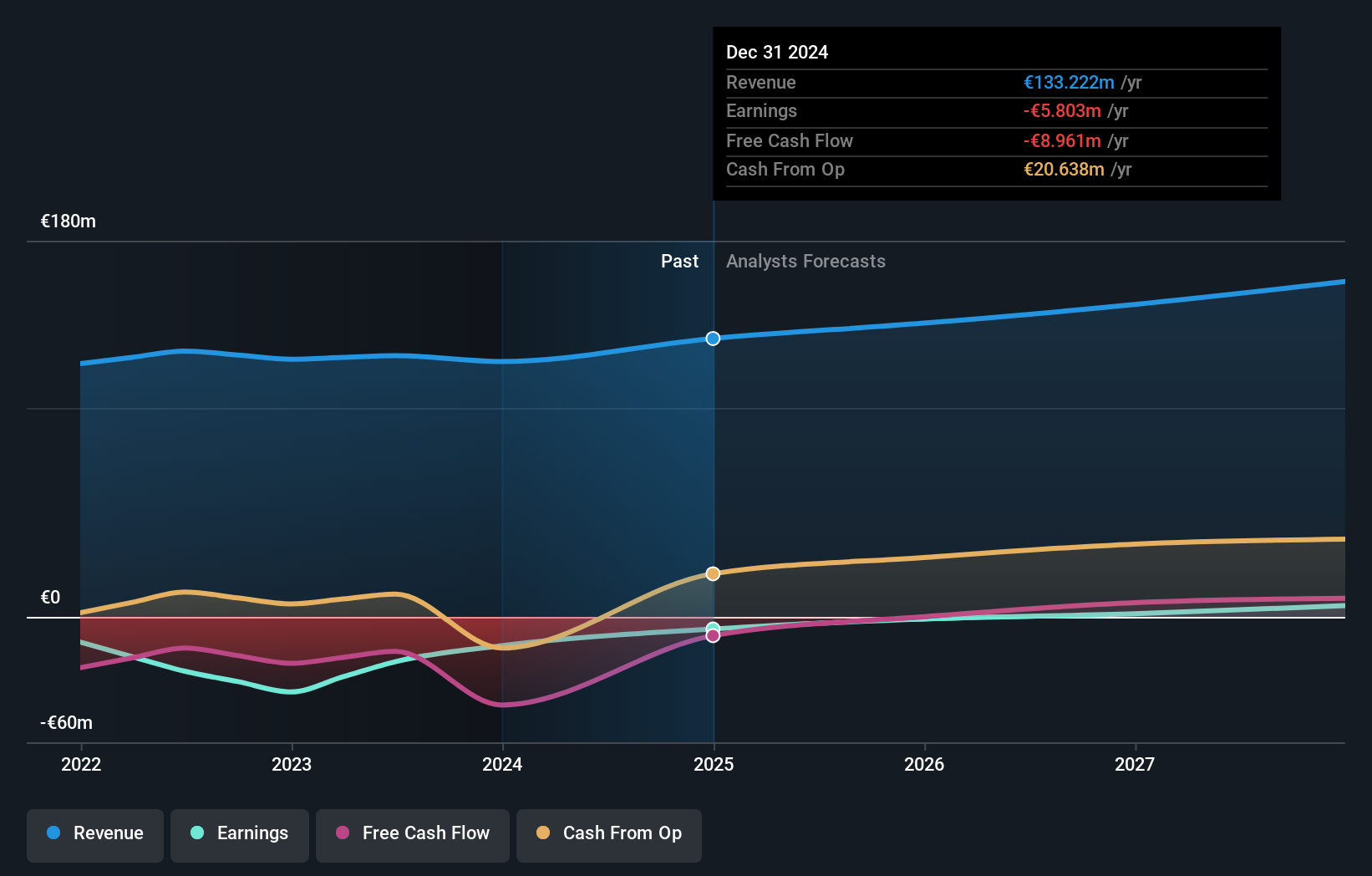

Operations: FINEOS Corporation Holdings focuses on enterprise software solutions for claims and policy management, targeting life, accident, and health insurers along with employee benefits providers. The company generates revenue primarily from its Software & Programming segment, amounting to €133.22 million.

FINEOS Corporation Holdings has demonstrated a commitment to innovation and client service, as evidenced by its recent partnership with Nationale-Nederlanden to launch a Personal Injury Portal. This platform, powered by FINEOS Claims APIs, highlights the company's ability to enhance operational efficiency and customer interaction through technology. Despite recent executive changes, FINEOS continues to expand its technological footprint in the insurance sector. The company's strategic focus is further illustrated by its collaboration with Wellthy to integrate care management services into insurance platforms, addressing comprehensive caregiving needs and improving member experience efficiently. These initiatives are part of FINEOS's broader strategy to leverage its robust platform capabilities in driving future growth within the tech-driven insurance market.

Seize The Opportunity

- Investigate our full lineup of 47 ASX High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAT

Catapult Sports

A sports science and analytics company, development and supply of technologies that improve the performance of athletes and sports teams in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives