- Australia

- /

- Metals and Mining

- /

- ASX:RND

ASX Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Australian shares are modestly up this morning, with the ASX 200 futures indicating a slight gain as investors await the Reserve Bank of Australia's decision on interest rates. Amidst these developments, penny stocks continue to capture investor interest due to their potential for significant growth. Although the term "penny stocks" may seem outdated, these smaller or less-established companies can offer substantial value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.97 | A$92.93M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$300.77M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.24 | A$346.95M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$3.02 | A$250.39M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.08 | A$67.25M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.55 | A$108.01M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.09 | A$340.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.84 | A$101.78M | ★★★★★★ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Catapult Group International (ASX:CAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to optimize athlete performance, prevent injuries, and enhance return to play across various regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas; it has a market cap of A$1.04 billion.

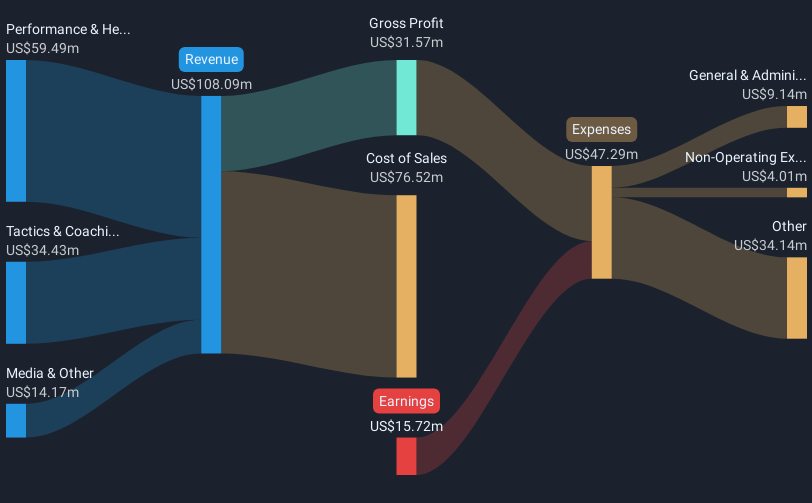

Operations: Catapult Group International's revenue is derived from three main segments: Performance & Health ($59.49 million), Tactics & Coaching ($34.43 million), and Media & Other ($14.17 million).

Market Cap: A$1.04B

Catapult Group International, a sports science and analytics company, faces challenges as it remains unprofitable with a negative return on equity of -19.58%. Despite this, the company maintains a stable cash runway exceeding three years due to positive free cash flow. Its revenue is expected to grow by 14.61% annually, driven by its Performance & Health segment generating A$59.49 million. Although short-term liabilities surpass short-term assets (A$30.5M vs A$71.7M), long-term liabilities are covered by assets, and there's no significant shareholder dilution recently observed. The experienced board and management team provide stability amid these financial hurdles.

- Dive into the specifics of Catapult Group International here with our thorough balance sheet health report.

- Gain insights into Catapult Group International's future direction by reviewing our growth report.

Rand Mining (ASX:RND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rand Mining Limited is an Australian company focused on the exploration, development, and production of mineral properties with a market cap of A$103.51 million.

Operations: The company generates revenue of A$34.76 million from its operations in metals and mining, specifically focusing on gold and other precious metals.

Market Cap: A$103.51M

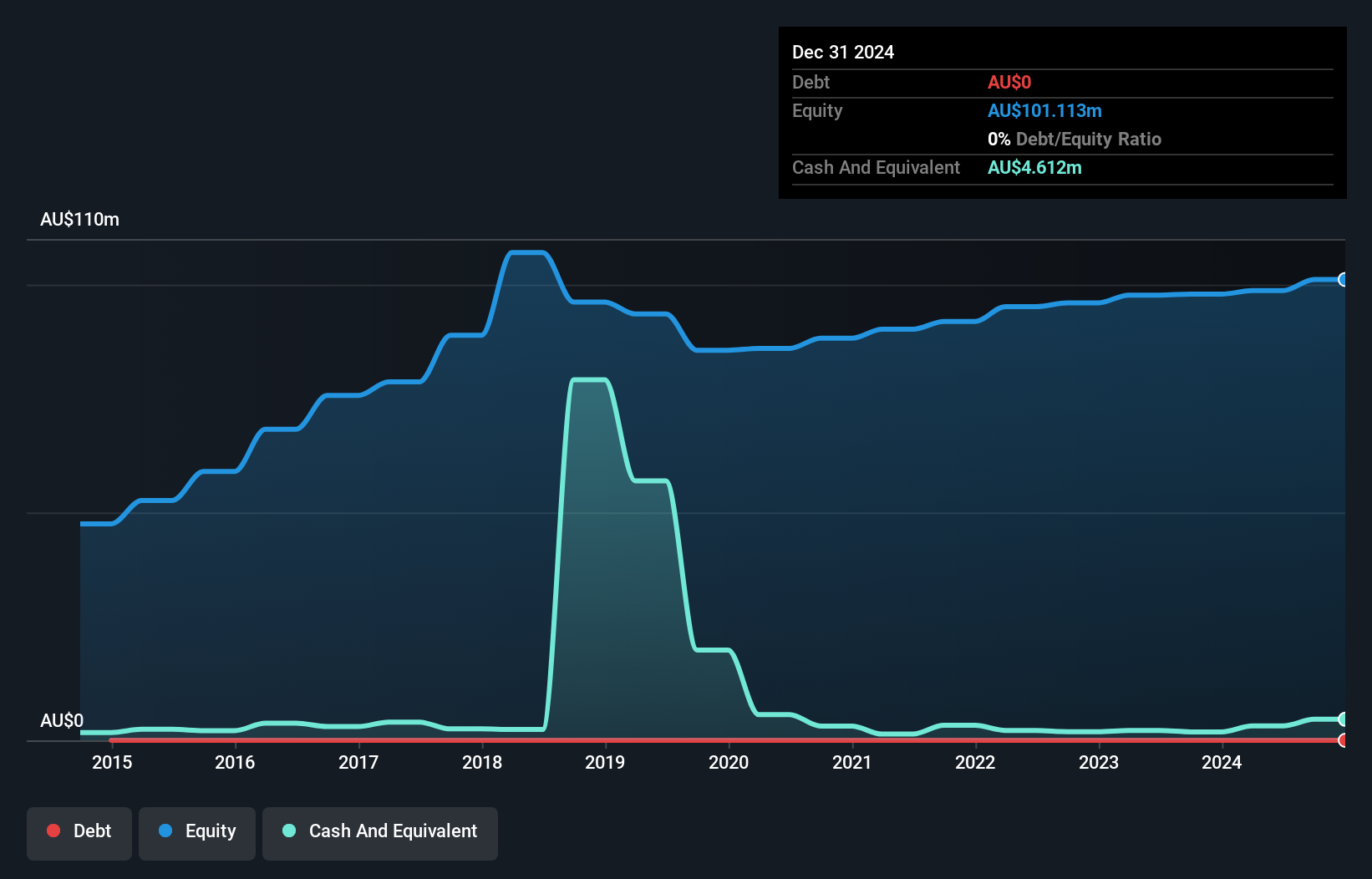

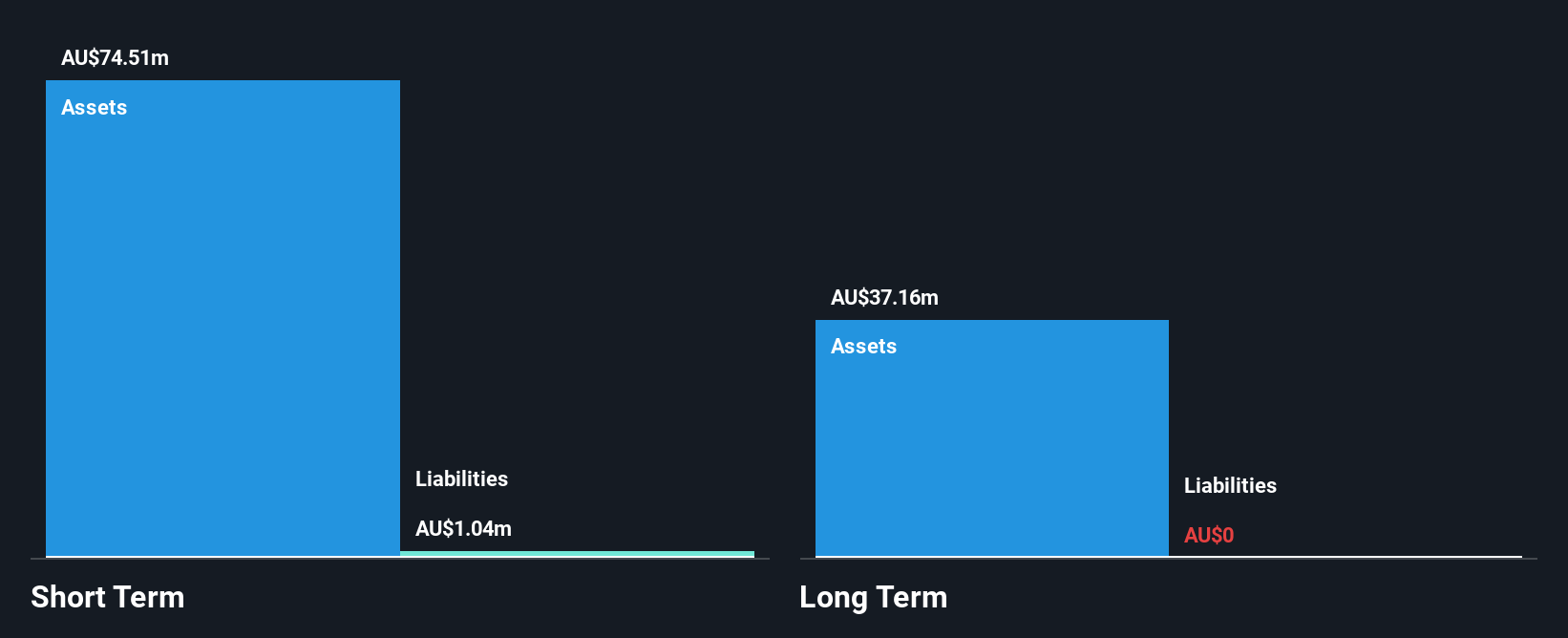

Rand Mining Limited, with a market cap of A$103.51 million and generating A$34.76 million in revenue, operates without debt and has stable weekly volatility at 8%. Its short-term assets (A$81.2M) comfortably cover both short-term (A$3.4M) and long-term liabilities (A$2.2M). Despite a seasoned management team averaging 22.1 years of tenure, the company has seen an annual earnings decline of 18.2% over five years, with recent negative growth hindering industry comparisons. Trading significantly below estimated fair value and undiluted shareholder equity offer potential appeal amidst declining net profit margins from last year’s 27.3% to the current 19.2%.

- Click here to discover the nuances of Rand Mining with our detailed analytical financial health report.

- Examine Rand Mining's past performance report to understand how it has performed in prior years.

Thorney Technologies (ASX:TEK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thorney Technologies Ltd, with a market cap of A$51.53 million, invests in technology-related companies.

Operations: Thorney Technologies Ltd's revenue segment primarily consists of investments, which reported a negative revenue of -A$11.70 million.

Market Cap: A$51.53M

Thorney Technologies Ltd, with a market cap of A$51.53 million, focuses on technology investments and is currently pre-revenue, reporting negative revenue of -A$11.70 million. Despite being unprofitable with increasing losses over the past five years, the company benefits from a stable weekly volatility at 6% and no debt obligations. Its short-term assets (A$70.1M) significantly exceed its short-term liabilities (A$1.3M), ensuring financial stability for more than three years based on current cash flow trends. The experienced board of directors averages 8.2 years in tenure, providing seasoned oversight without recent shareholder dilution concerns.

- Unlock comprehensive insights into our analysis of Thorney Technologies stock in this financial health report.

- Assess Thorney Technologies' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Investigate our full lineup of 1,032 ASX Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RND

Rand Mining

Engages in the exploration, development, and production of mineral properties in Australia.

Flawless balance sheet and fair value.

Market Insights

Community Narratives