- Australia

- /

- Hospitality

- /

- ASX:CTD

ASX Growth Stars With High Insider Confidence

Reviewed by Simply Wall St

As the ASX 200 grapples with geopolitical tensions and fluctuating oil prices, the Energy sector emerges as a standout performer amid broader market volatility. In such uncertain times, stocks with high insider ownership can signal strong confidence in a company's future prospects, making them appealing to investors seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Brightstar Resources (ASX:BTR) | 11.6% | 106.7% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Adveritas (ASX:AV1) | 19.9% | 88.8% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

Let's uncover some gems from our specialized screener.

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market capitalization of A$1.15 billion.

Operations: The company's revenue segments include Business (A$102.99 million), Wholesale (A$143.55 million), Residential (A$628.51 million), and Enterprise and Government (A$93.51 million).

Insider Ownership: 11.2%

Earnings Growth Forecast: 29.3% p.a.

Aussie Broadband is poised for growth with forecasted revenue and earnings set to outpace the broader Australian market. Despite recent insider selling, the company remains undervalued relative to its estimated fair value. Recent board additions, including Sarah Adam-Gedge and Graeme Barclay, bring substantial industry expertise that may support strategic objectives like mergers and acquisitions aimed at enhancing shareholder value. The company's commitment to balancing organic growth with M&A aligns with its goal of maximizing shareholder returns.

- Navigate through the intricacies of Aussie Broadband with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Aussie Broadband's shares may be trading at a discount.

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company offering technologies to optimize performance, prevent injuries, and manage return-to-play for athletes across various regions, with a market cap of A$1.56 billion.

Operations: The company's revenue segments include Tactics & Coaching at $36.66 million and Performance & Health at $63.47 million.

Insider Ownership: 14.4%

Earnings Growth Forecast: 94.9% p.a.

Catapult Group International is positioned for growth, with revenue expected to increase at 14.2% annually, surpassing the broader Australian market. Recent earnings showed improved financial performance with sales rising to US$116.53 million and a reduced net loss of US$8.81 million. Despite insider selling in the past quarter, the company has seen substantial insider buying over three months prior. The launch of Vector 8 enhances its product suite, potentially boosting future profitability and operational efficiency in sports analytics technology.

- Delve into the full analysis future growth report here for a deeper understanding of Catapult Group International.

- The valuation report we've compiled suggests that Catapult Group International's current price could be inflated.

Corporate Travel Management (ASX:CTD)

Simply Wall St Growth Rating: ★★★★☆☆

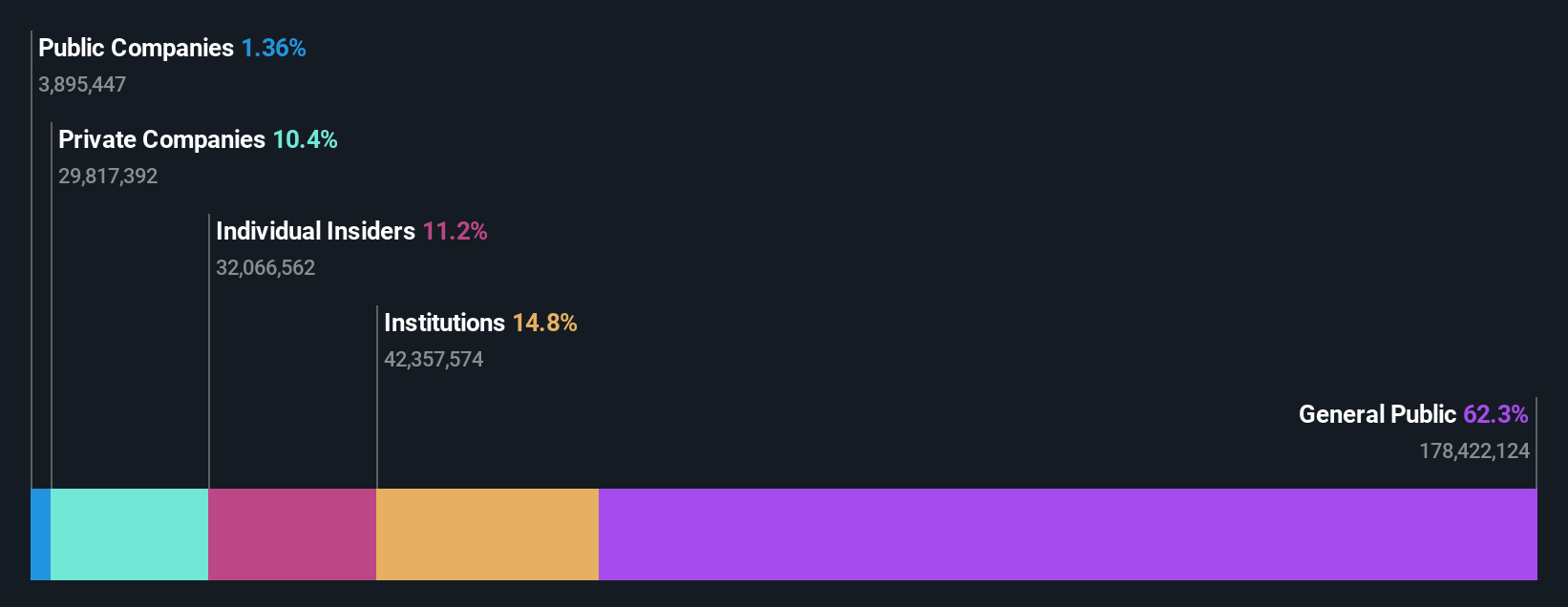

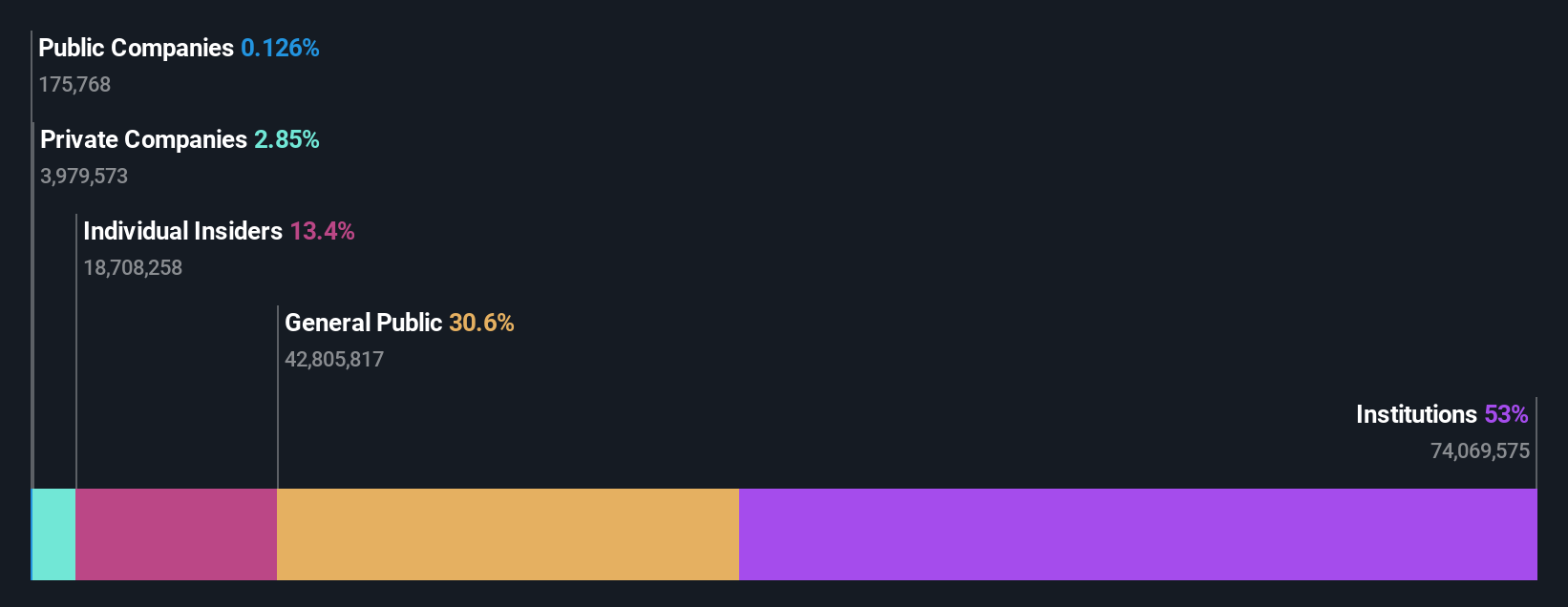

Overview: Corporate Travel Management Limited is a travel management solutions company that oversees the procurement and delivery of travel services across Australia, New Zealand, North America, Asia, and Europe with a market cap of A$1.77 billion.

Operations: The company's revenue segments include Travel Services in Asia (A$60.96 million), Europe (A$126.20 million), North America (A$319.90 million), and Australia and New Zealand (A$181.43 million).

Insider Ownership: 13.4%

Earnings Growth Forecast: 21.4% p.a.

Corporate Travel Management is poised for growth with earnings projected to expand significantly at 21.4% annually, outpacing the Australian market. Revenue is set to grow faster than the market average, though profit margins have decreased from last year. Despite recent executive changes, with Jo Sully taking over as CEO for Australia & New Zealand, her extensive experience and focus on innovation could enhance operational efficiency and client retention in the corporate travel sector.

- Take a closer look at Corporate Travel Management's potential here in our earnings growth report.

- The analysis detailed in our Corporate Travel Management valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 95 companies by clicking here.

- Contemplating Other Strategies? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTD

Corporate Travel Management

A travel management solutions company, manages the procurement and delivery of travel services in Australia and New Zealand, North America, Asia, and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives