ASX Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As the Australian market anticipates a modest rise today, buoyed by a calmer Wall Street and steady iron ore exports to China, investors are keenly observing how these macroeconomic factors might influence growth stocks on the ASX. In this context, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them an intriguing option for those looking to navigate current market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Brightstar Resources (ASX:BTR) | 11.6% | 98.8% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.4% | 108.2% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| BETR Entertainment (ASX:BBT) | 32% | 121.8% |

We'll examine a selection from our screener results.

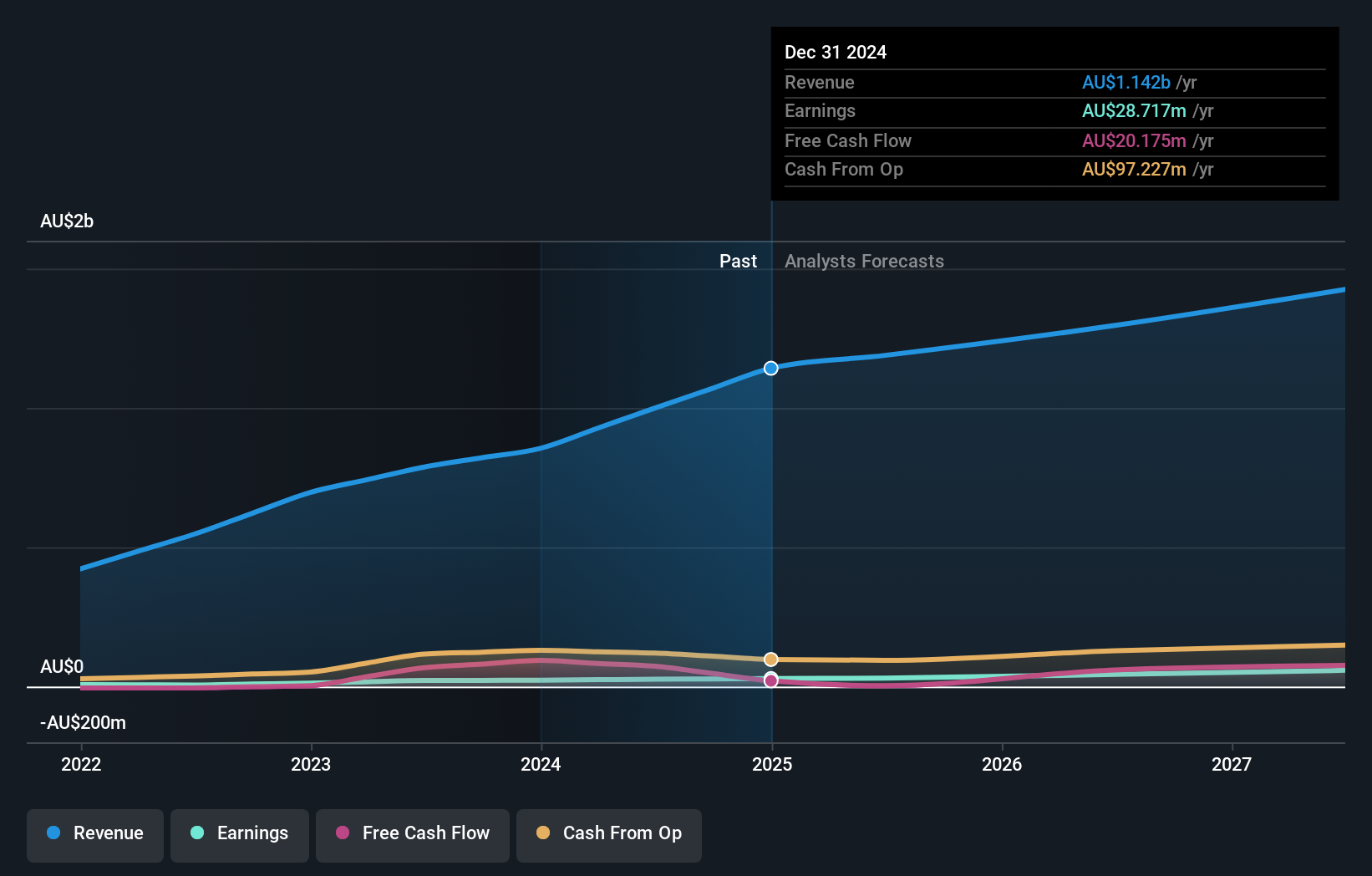

Aussie Broadband (ASX:ABB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia, with a market cap of A$1.15 billion.

Operations: The company's revenue is derived from several segments, including Business (A$102.99 million), Wholesale (A$143.55 million), Residential (A$628.51 million), and Enterprise and Government (A$93.51 million).

Insider Ownership: 11.3%

Earnings Growth Forecast: 25.2% p.a.

Aussie Broadband's growth trajectory is bolstered by significant insider ownership, with more shares bought than sold recently. The company is actively pursuing M&A opportunities to enhance shareholder value and expand its capabilities. Despite a forecasted low return on equity of 12.9%, earnings are expected to grow significantly at 25.2% annually, outpacing the broader Australian market. Recent board appointments bring extensive industry experience, supporting strategic growth initiatives in telecommunications infrastructure.

- Click to explore a detailed breakdown of our findings in Aussie Broadband's earnings growth report.

- In light of our recent valuation report, it seems possible that Aussie Broadband is trading behind its estimated value.

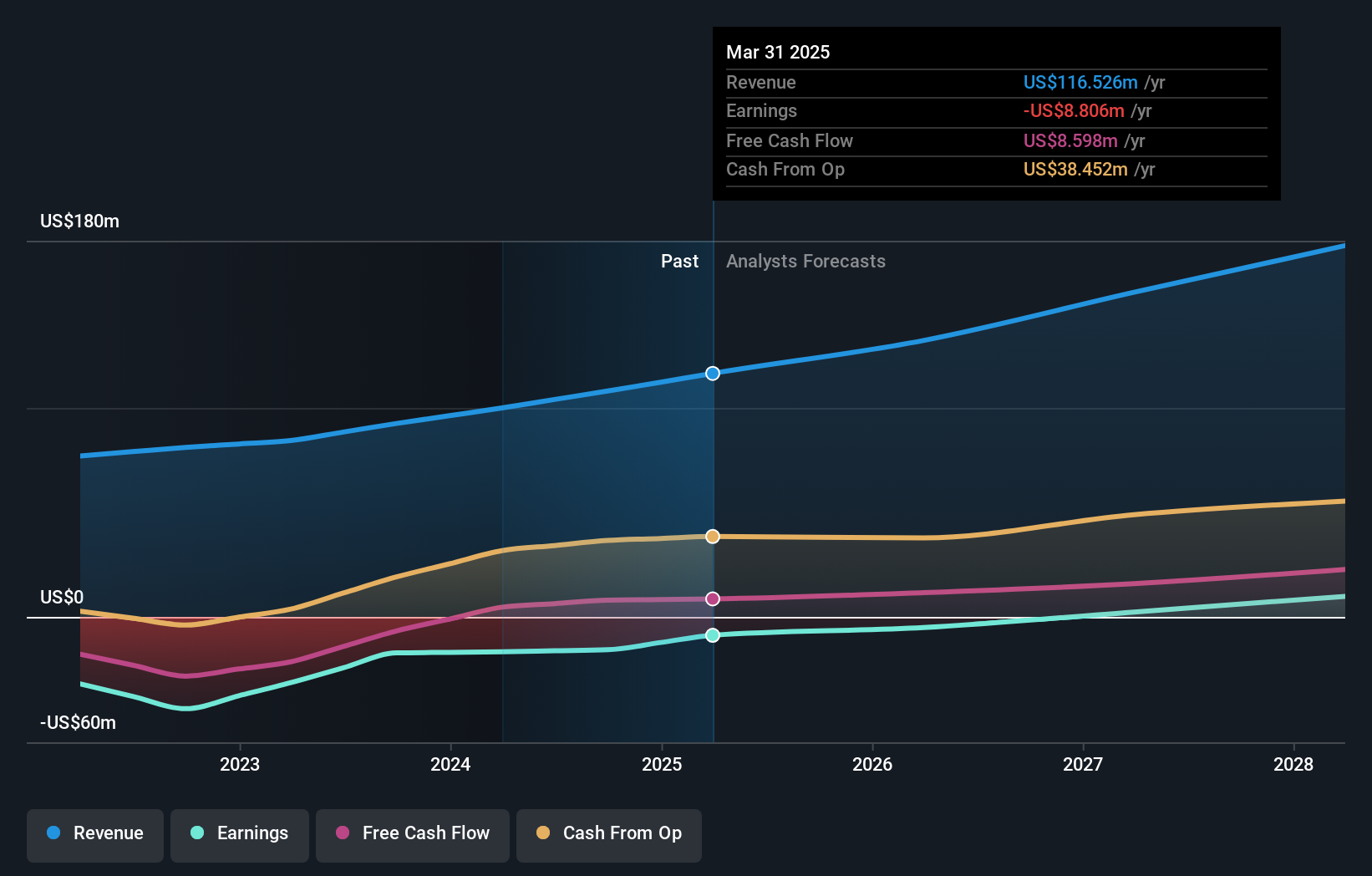

Catapult Group International (ASX:CAT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Catapult Group International Ltd, with a market cap of A$1.40 billion, is a sports science and analytics company offering technologies to enhance performance and manage athlete health across various regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Operations: The company's revenue is primarily derived from its Performance & Health segment at $63.47 million, followed by Tactics & Coaching at $36.66 million, and Media & Other at $16.40 million.

Insider Ownership: 16%

Earnings Growth Forecast: 95.7% p.a.

Catapult Group International's growth prospects are supported by its innovative product offerings, such as the recently launched Vector 8, which enhances athlete performance monitoring. Despite a net loss of US$8.81 million for the year ending March 2025, this marks an improvement from the previous year's loss. Revenue is forecast to grow at 14.1% annually, outpacing the broader Australian market's growth rate. The company is expected to achieve profitability within three years, driven by strategic advancements and market expansion efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Catapult Group International.

- The valuation report we've compiled suggests that Catapult Group International's current price could be inflated.

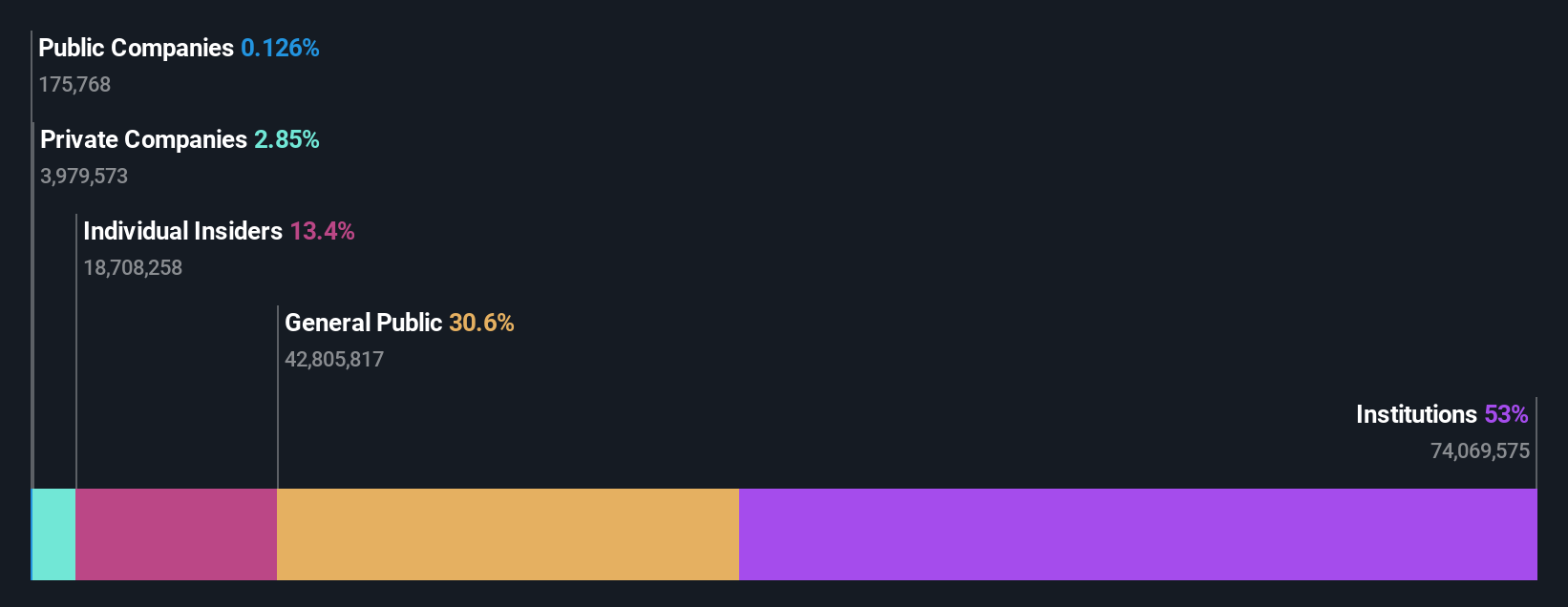

Corporate Travel Management (ASX:CTD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corporate Travel Management Limited is a travel management solutions company that oversees the procurement and delivery of travel services across Australia and New Zealand, North America, Asia, and Europe, with a market cap of A$1.80 billion.

Operations: The company's revenue comes from travel services across various regions, with A$60.96 million from Asia, A$126.20 million from Europe, A$319.90 million from North America, and A$181.43 million from Australia and New Zealand.

Insider Ownership: 13.4%

Earnings Growth Forecast: 21.4% p.a.

Corporate Travel Management is poised for growth, with earnings expected to increase by 21.4% annually, surpassing the Australian market's average. Despite a decline in profit margins from 15.3% to 9.2%, the company's revenue is projected to grow at 6.7% per year, outpacing the broader market's rate of 5.6%. The recent appointment of Jo Sully as CEO for Australia & New Zealand may enhance operational efficiency and client retention through her extensive industry experience and innovation expertise.

- Navigate through the intricacies of Corporate Travel Management with our comprehensive analyst estimates report here.

- The analysis detailed in our Corporate Travel Management valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Discover the full array of 98 Fast Growing ASX Companies With High Insider Ownership right here.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ABB

Aussie Broadband

Provides telecommunications and technology services in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives