Increases to BrainChip Holdings Ltd's (ASX:BRN) CEO Compensation Might Cool off for now

Key Insights

- BrainChip Holdings' Annual General Meeting to take place on 21st of May

- Salary of US$456.8k is part of CEO Sean Hehir's total remuneration

- Total compensation is 243% above industry average

- Over the past three years, BrainChip Holdings' EPS grew by 3.0% and over the past three years, the total loss to shareholders 56%

Shareholders of BrainChip Holdings Ltd (ASX:BRN) will have been dismayed by the negative share price return over the last three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 21st of May. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for BrainChip Holdings

How Does Total Compensation For Sean Hehir Compare With Other Companies In The Industry?

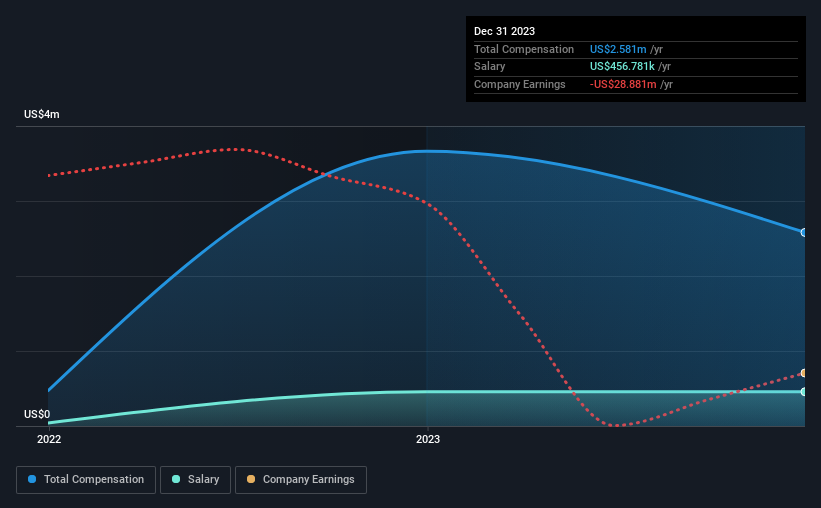

Our data indicates that BrainChip Holdings Ltd has a market capitalization of AU$483m, and total annual CEO compensation was reported as US$2.6m for the year to December 2023. Notably, that's a decrease of 30% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$457k.

For comparison, other companies in the Australian Software industry with market capitalizations ranging between AU$303m and AU$1.2b had a median total CEO compensation of US$752k. Hence, we can conclude that Sean Hehir is remunerated higher than the industry median. What's more, Sean Hehir holds AU$517k worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$457k | US$457k | 18% |

| Other | US$2.1m | US$3.2m | 82% |

| Total Compensation | US$2.6m | US$3.7m | 100% |

Talking in terms of the industry, salary represented approximately 57% of total compensation out of all the companies we analyzed, while other remuneration made up 43% of the pie. BrainChip Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

BrainChip Holdings Ltd's Growth

BrainChip Holdings Ltd has seen its earnings per share (EPS) increase by 3.0% a year over the past three years. Its revenue is down 95% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has BrainChip Holdings Ltd Been A Good Investment?

With a total shareholder return of -56% over three years, BrainChip Holdings Ltd shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 4 which shouldn't be ignored) in BrainChip Holdings we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if BrainChip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BRN

BrainChip Holdings

Develops software and hardware accelerated solutions for artificial intelligence and machine learning applications in North America, Oceania, Europe, the Middle East, and Asia.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026