- Australia

- /

- Metals and Mining

- /

- ASX:WAF

ASX Penny Stocks Spotlight Bannerman Energy And 2 More

Reviewed by Simply Wall St

The Australian market recently faced pressure from a stable US core inflation rate and mixed Chinese data, which dampened local investor sentiment. In such fluctuating conditions, penny stocks—typically representing smaller or newer companies—can offer intriguing opportunities for investors seeking growth at lower price points. While the term "penny stock" may seem outdated, these stocks continue to present potential for significant returns when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.375 | A$107.47M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.59 | A$112.49M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.05 | A$470.25M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.31 | A$2.63B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.77 | A$468M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.58 | A$867.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Bannerman Energy (ASX:BMN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bannerman Energy Ltd is involved in the exploration and development of uranium properties in Africa, with a market cap of A$538.48 million.

Operations: Bannerman Energy Ltd does not report any revenue segments.

Market Cap: A$538.48M

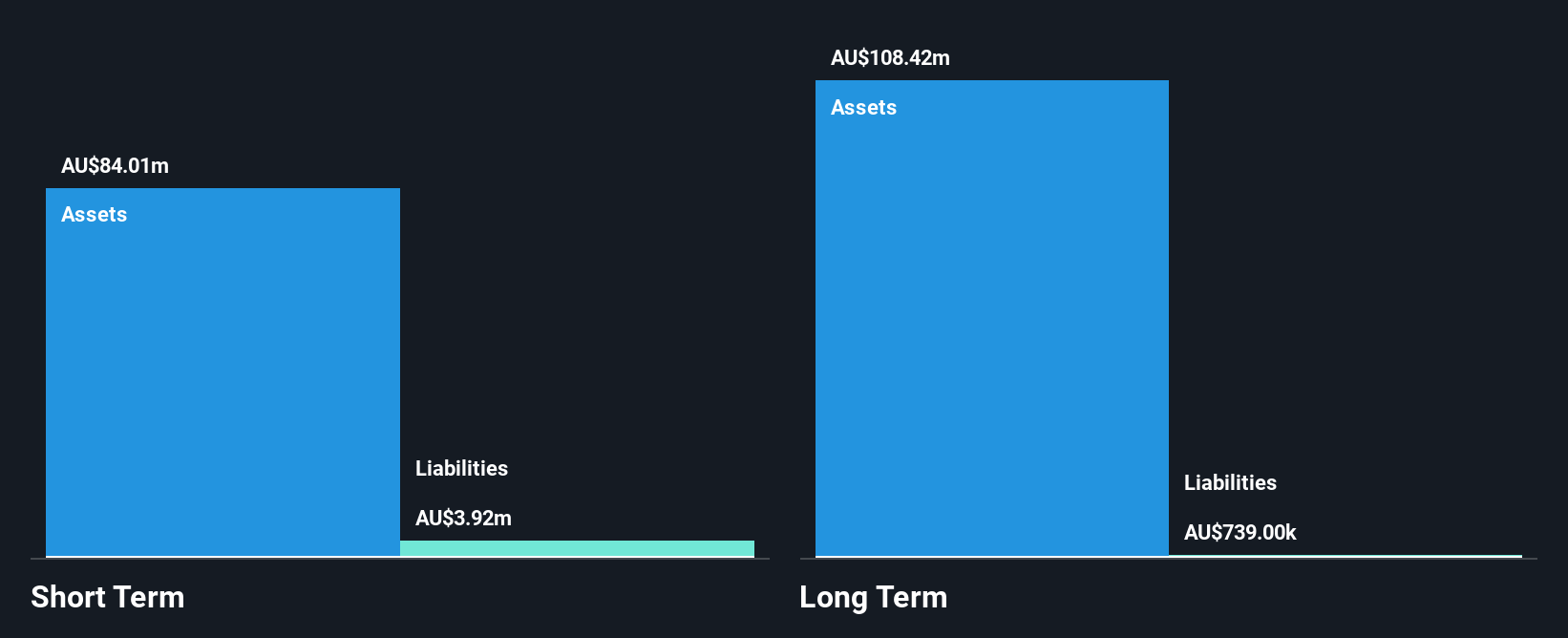

Bannerman Energy Ltd, with a market cap of A$538.48 million, is pre-revenue and has been focusing on uranium exploration in Africa. Recently, the company completed a follow-on equity offering raising A$85 million, which may help extend its cash runway beyond the current nine-month estimate based on free cash flow projections. The appointment of Danny Goeman as Independent Chair of its Product Offtake Committee brings valuable marketing expertise to the team. Bannerman remains debt-free with short-term assets significantly exceeding liabilities; however, it is currently unprofitable with negative return on equity and increasing losses over five years at 32.1% annually.

- Take a closer look at Bannerman Energy's potential here in our financial health report.

- Gain insights into Bannerman Energy's outlook and expected performance with our report on the company's earnings estimates.

BrainChip Holdings (ASX:BRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BrainChip Holdings Ltd develops software and hardware accelerated solutions for artificial intelligence and machine learning applications across multiple regions, with a market cap of A$425.41 million.

Operations: The company generates revenue primarily from the technological development of designs, amounting to $0.40 million.

Market Cap: A$425.41M

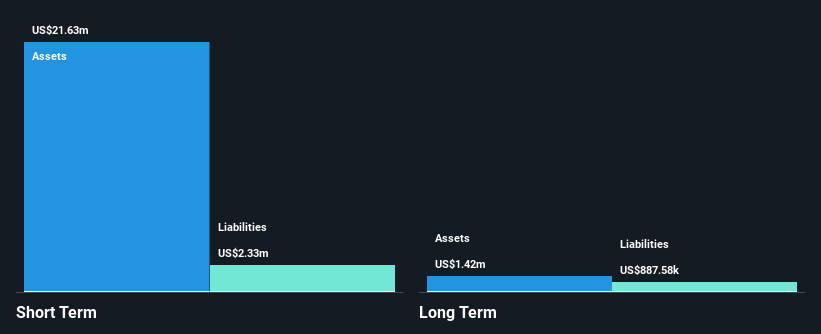

BrainChip Holdings Ltd, with a market cap of A$425.41 million, is pre-revenue, generating less than US$1 million annually. The company has formed strategic alliances to enhance its AI capabilities, notably collaborating with HaiLa Technologies to develop ultra-efficient IoT solutions. Despite its innovative partnerships and technology-driven prospects in AI and machine learning applications, BrainChip remains unprofitable and earnings are forecasted to decline over the next three years. However, it maintains a solid financial position with short-term assets exceeding liabilities and no debt on its balance sheet. The management team is relatively new but supported by an experienced board.

- Get an in-depth perspective on BrainChip Holdings' performance by reading our balance sheet health report here.

- Understand BrainChip Holdings' earnings outlook by examining our growth report.

West African Resources (ASX:WAF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: West African Resources Limited is involved in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa with a market cap of A$2.63 billion.

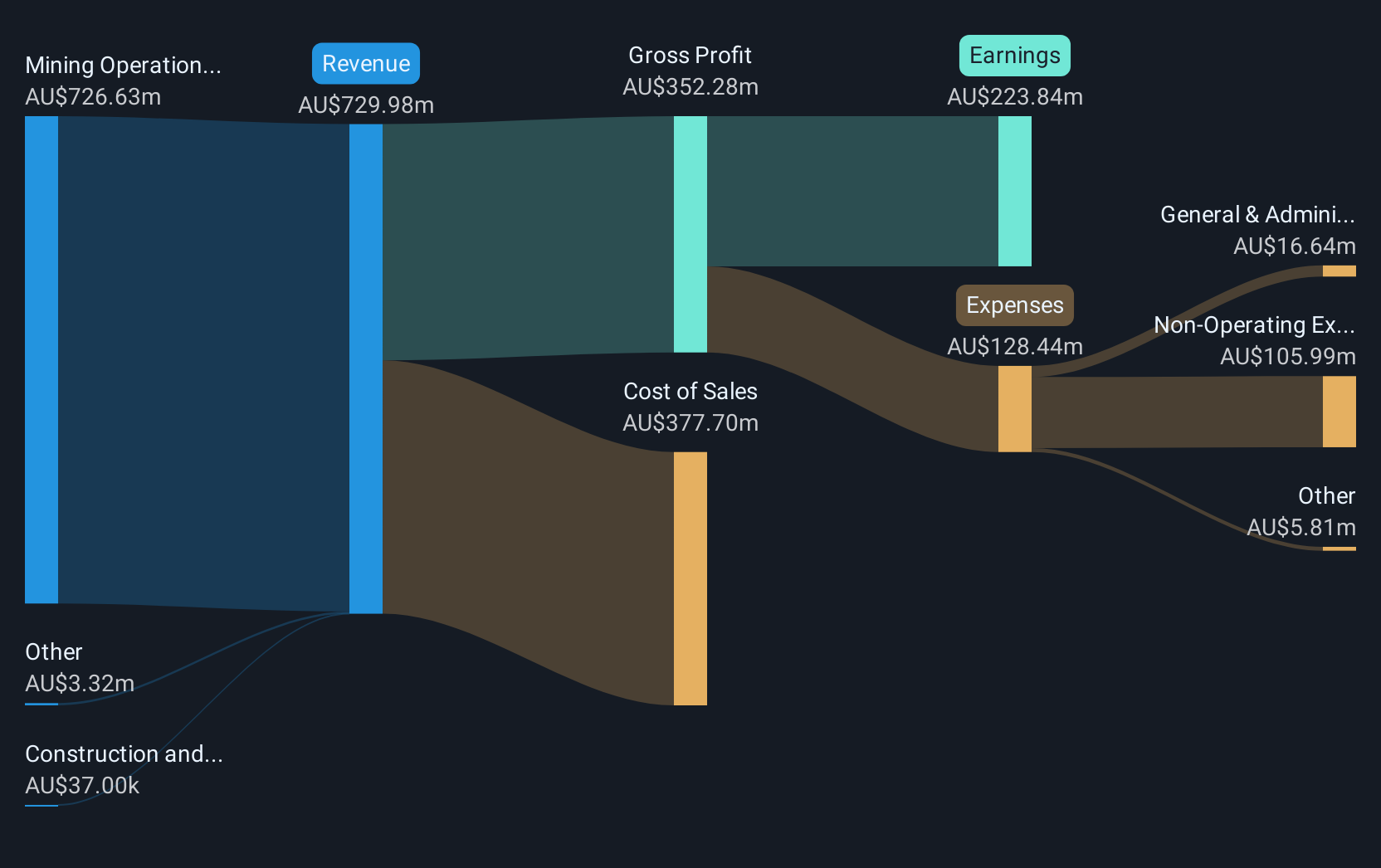

Operations: The company generates revenue primarily from its mining operations, amounting to A$726.63 million, with a minor contribution of A$0.037 million from construction and exploration activities.

Market Cap: A$2.63B

West African Resources, with a market cap of A$2.63 billion, stands out for its robust financial health and growth trajectory. The company has transitioned to profitability over the past five years, with earnings growing annually by 24%, and an impressive 52.4% increase in the past year alone, outpacing industry averages. Its debt management is commendable; the net debt to equity ratio is a satisfactory 1.1%, and interest payments are well covered by EBIT at 119 times coverage. Trading significantly below estimated fair value suggests potential upside, while analysts predict further stock price appreciation by 66.7%.

- Dive into the specifics of West African Resources here with our thorough balance sheet health report.

- Examine West African Resources' earnings growth report to understand how analysts expect it to perform.

Next Steps

- Investigate our full lineup of 458 ASX Penny Stocks right here.

- Ready To Venture Into Other Investment Styles? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West African Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WAF

West African Resources

Engages in the mining, mineral processing, acquisition, exploration, and project development of gold projects in West Africa.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives