Amidst a challenging day for the ASX200, which is currently down by 1.1%, and all sectors seeing declines, investor focus might naturally shift towards more resilient investment opportunities. High insider ownership can be an indicator of confidence from those closest to the company, potentially making such stocks appealing in turbulent times like these.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 62.3% |

| DUG Technology (ASX:DUG) | 28.1% | 43.2% |

| SiteMinder (ASX:SDR) | 11.3% | 72.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Altium (ASX:ALU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Altium Limited is a company that specializes in developing and selling computer software for electronic product design, operating both in the United States and internationally, with a market capitalization of approximately A$8.96 billion.

Operations: The company generates revenue primarily through its cloud platform and design software segments, totaling approximately $60.36 million and $221.94 million respectively.

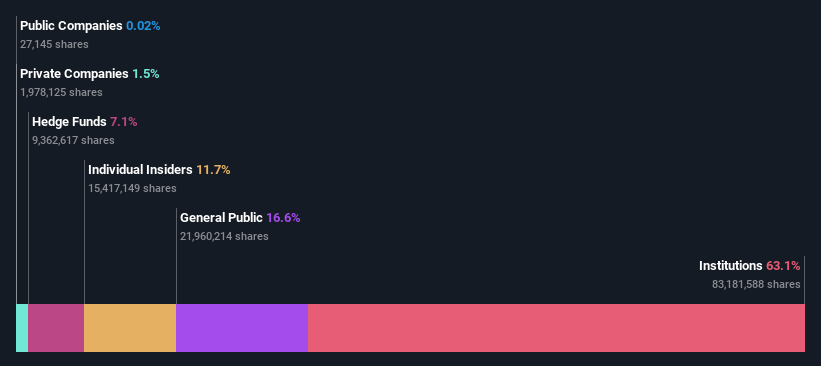

Insider Ownership: 11.7%

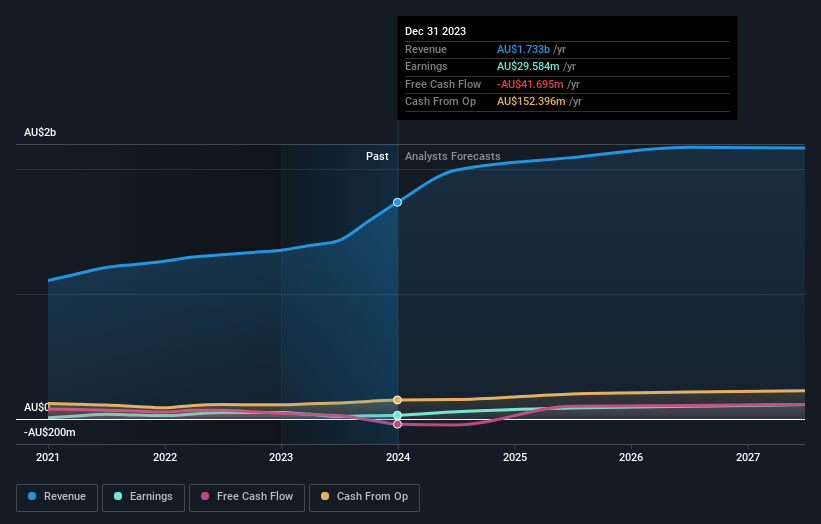

Altium, a company with high insider ownership, is poised for notable growth with earnings expected to increase by 21.15% annually. Despite slower revenue growth forecasts at 16% per year compared to other high-growth firms, Altium outpaces the broader Australian market's 5.4%. The firm also boasts a strong projected Return on Equity of 36.5%. Recent strategic moves include a distribution agreement through Phase Holographic Imaging and Kem-En-Tec Nordic to boost its presence in Nordic bioscience sectors.

- Click here to discover the nuances of Altium with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Altium's current price could be inflated.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited is involved in the development and supply of mining technology, with a market capitalization of approximately A$638.10 million.

Operations: The company generates revenue primarily through its mining services segment, totaling A$34.24 million.

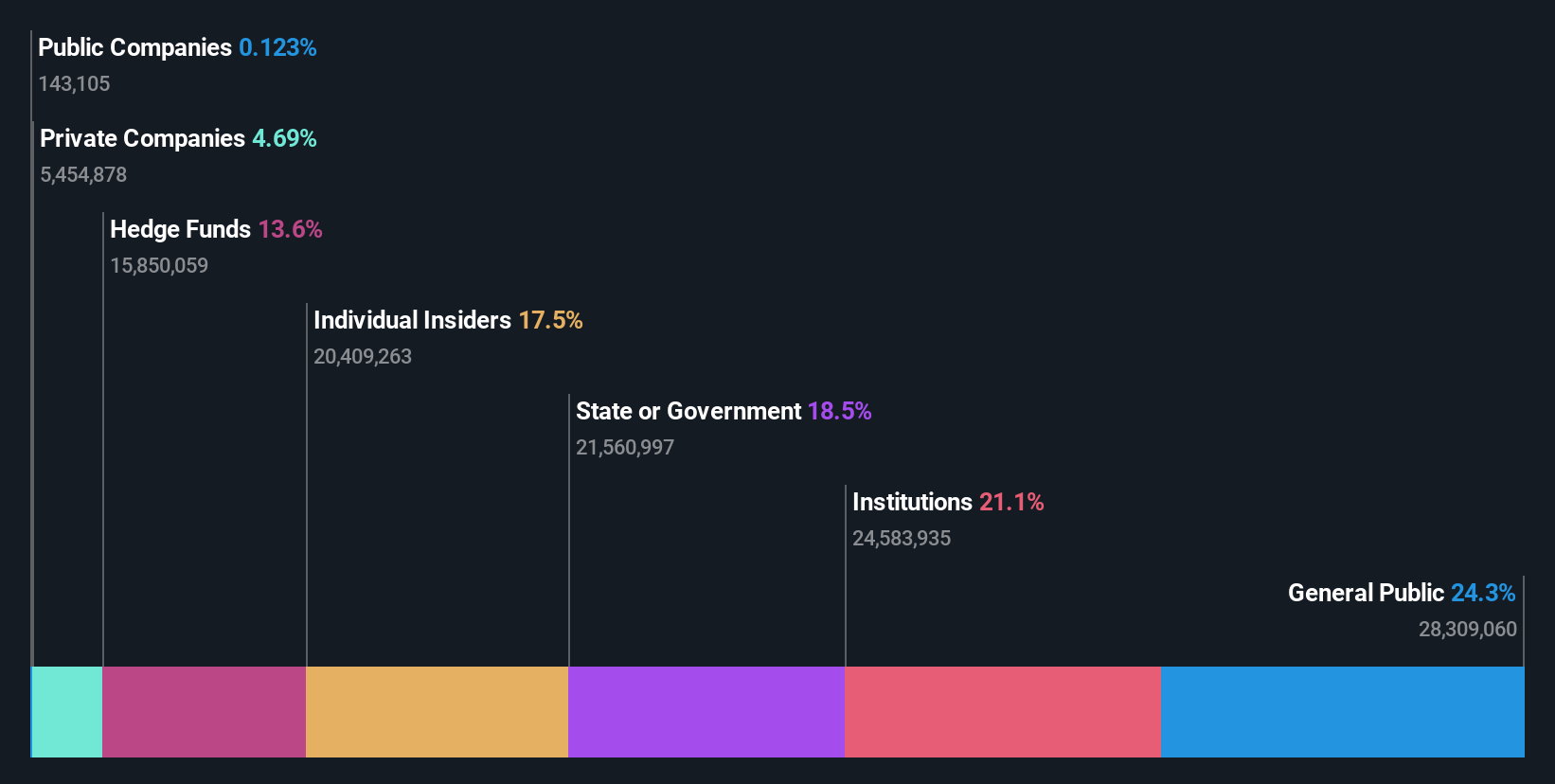

Insider Ownership: 21.3%

Chrysos, despite high insider ownership, presents a mixed growth outlook. The company is set to become profitable within three years with expected earnings growth of 63.48% annually. Revenue is also projected to increase significantly at 35.3% per year, outpacing the Australian market average of 5.4%. However, challenges include a low forecasted Return on Equity of 7.8% and recent shareholder dilution over the past year, which may concern investors looking for robust equity returns.

- Delve into the full analysis future growth report here for a deeper understanding of Chrysos.

- Our valuation report unveils the possibility Chrysos' shares may be trading at a premium.

Kelsian Group (ASX:KLS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kelsian Group Limited operates in providing land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.36 billion.

Operations: The company generates revenue through three primary segments: Australian Bus (A$934.76 million), International Bus (A$448.87 million), and Marine and Tourism (A$337.90 million).

Insider Ownership: 20.9%

Kelsian Group, with high insider ownership, is anticipated to have robust earnings growth of 25.84% annually, outperforming the Australian market's 13.7%. However, its revenue growth at 5.8% lags behind the desired 20% benchmark for high-growth companies. Recent substantial insider buying underscores confidence from within, despite a current trading value deemed 14.3% below its fair estimate and concerns over low profit margins and one-off financial impacts affecting quality of earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Kelsian Group.

- According our valuation report, there's an indication that Kelsian Group's share price might be on the expensive side.

Next Steps

- Embark on your investment journey to our 90 Fast Growing ASX Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALU

Altium

Develops and sells computer software for the design of electronic products in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives