Here's Why 8common Limited's (ASX:8CO) CEO Compensation Is The Least Of Shareholders Concerns

Key Insights

- 8common will host its Annual General Meeting on 2nd of November

- Total pay for CEO Andrew Bond includes AU$213.6k salary

- The overall pay is 50% below the industry average

- 8common's three-year loss to shareholders was 39% while its EPS was down 38% over the past three years

The performance at 8common Limited (ASX:8CO) has been rather lacklustre of late and shareholders may be wondering what CEO Andrew Bond is planning to do about this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 2nd of November. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

See our latest analysis for 8common

Comparing 8common Limited's CEO Compensation With The Industry

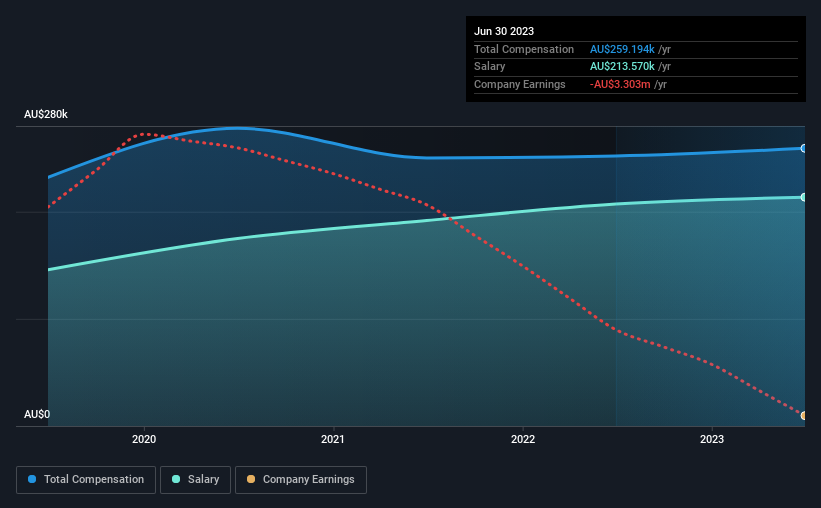

At the time of writing, our data shows that 8common Limited has a market capitalization of AU$16m, and reported total annual CEO compensation of AU$259k for the year to June 2023. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at AU$213.6k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Australian Software industry with market capitalizations under AU$315m, the reported median total CEO compensation was AU$519k. This suggests that Andrew Bond is paid below the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | AU$214k | AU$207k | 82% |

| Other | AU$46k | AU$45k | 18% |

| Total Compensation | AU$259k | AU$252k | 100% |

On an industry level, around 59% of total compensation represents salary and 41% is other remuneration. 8common pays out 82% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

8common Limited's Growth

8common Limited has reduced its earnings per share by 38% a year over the last three years. In the last year, its revenue is up 58%.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has 8common Limited Been A Good Investment?

Few 8common Limited shareholders would feel satisfied with the return of -39% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. The poor performance of the share price might have something to do with the lack of earnings growth. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for 8common (3 don't sit too well with us!) that you should be aware of before investing here.

Important note: 8common is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:8CO

8common

Engages in the expense management software business in Australia, Asia, North America, and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives