- Australia

- /

- Specialized REITs

- /

- ASX:NSR

ASX Stocks Estimated To Be Undervalued In September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 1.7%, driven by gains of 4.5% in one sector, and is up 12% over the last 12 months. In this context of strong performance and anticipated earnings growth of 12% per annum over the next few years, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.30 | A$8.20 | 47.5% |

| Duratec (ASX:DUR) | A$1.40 | A$2.60 | 46.2% |

| Genesis Minerals (ASX:GMD) | A$2.10 | A$4.00 | 47.5% |

| Charter Hall Group (ASX:CHC) | A$16.05 | A$29.32 | 45.3% |

| Megaport (ASX:MP1) | A$7.45 | A$13.57 | 45.1% |

| Little Green Pharma (ASX:LGP) | A$0.085 | A$0.17 | 49.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.375 | A$0.72 | 47.9% |

| Ai-Media Technologies (ASX:AIM) | A$0.74 | A$1.42 | 47.8% |

| Superloop (ASX:SLC) | A$1.765 | A$3.31 | 46.7% |

Here we highlight a subset of our preferred stocks from the screener.

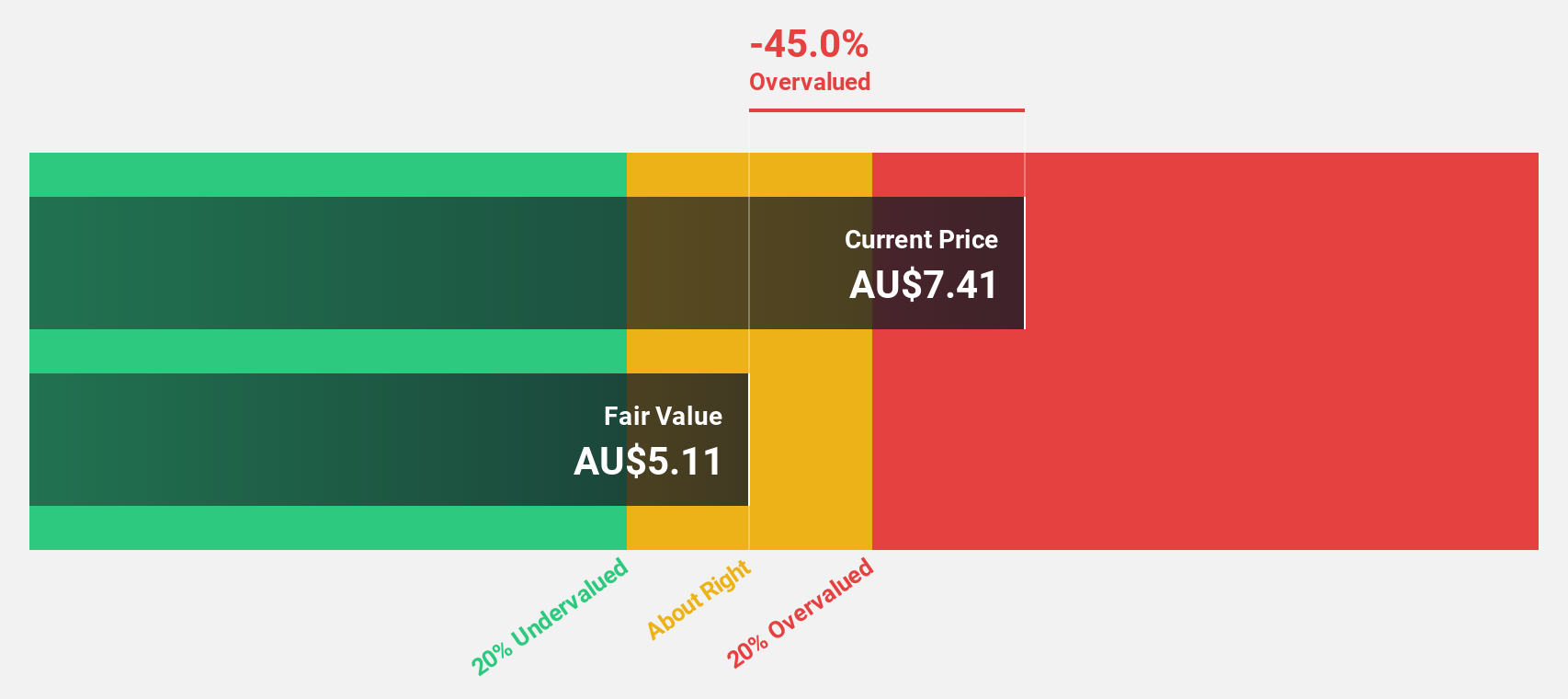

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform to locate people, pets, and things across North America, Europe, the Middle East, Africa, and internationally with a market cap of A$3.76 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounted to $328.68 million.

Estimated Discount To Fair Value: 41.1%

Life360, trading at A$16.87, is significantly undervalued based on its discounted cash flow analysis with an estimated fair value of A$28.62. Despite recent insider selling and shareholder dilution, the company is expected to become profitable within three years and has a forecasted revenue growth rate of 15.7% per year, outpacing the Australian market average. Recent product innovations like the new Tile Bluetooth trackers could enhance revenue streams further and align with Life360's vision for family safety and connectivity.

- Upon reviewing our latest growth report, Life360's projected financial performance appears quite optimistic.

- Take a closer look at Life360's balance sheet health here in our report.

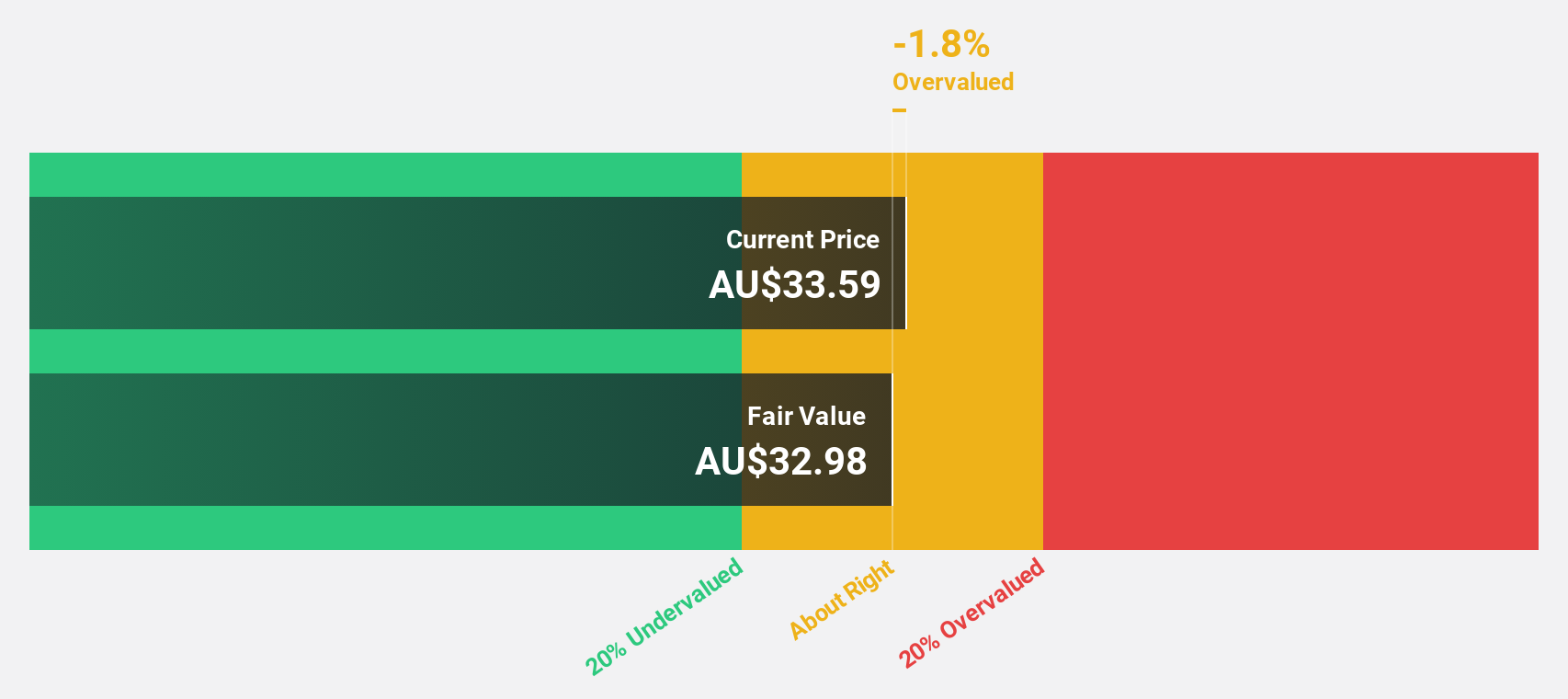

Data#3 (ASX:DTL)

Overview: Data#3 Limited provides IT solutions and services across Australia, Fiji, and the Pacific Islands with a market cap of A$1.18 billion.

Operations: Revenue from the Value-Added IT Reseller and IT Solutions Provider segment amounts to A$805.75 million.

Estimated Discount To Fair Value: 43.8%

Data#3, trading at A$7.62, is undervalued with a fair value estimate of A$13.56 and trades 43.8% below this estimate. Despite slower earnings growth (11%) compared to the market (12.3%), its revenue is expected to grow significantly at 34.1% annually, outpacing the market's 5.3%. Recent financials show net income rose from A$37 million to A$43 million year-over-year, although dividends remain poorly covered by earnings or free cash flows.

- Our expertly prepared growth report on Data#3 implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Data#3.

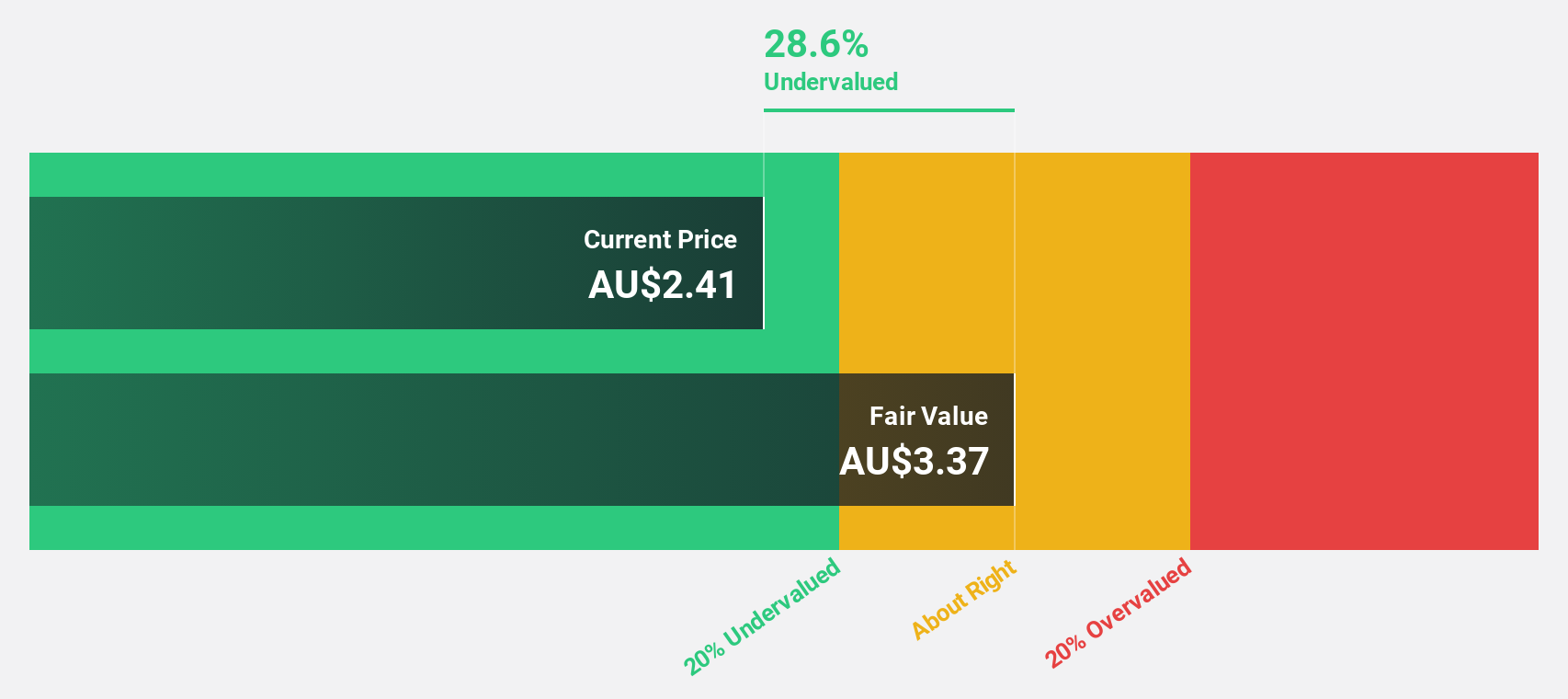

National Storage REIT (ASX:NSR)

Overview: National Storage REIT (ASX:NSR) is the largest self-storage provider in Australia and New Zealand, operating over 225 centres and serving more than 90,000 residential and commercial customers, with a market cap of A$3.40 billion.

Operations: The company's revenue primarily comes from the operation and management of storage centres, generating A$354.69 million.

Estimated Discount To Fair Value: 38.4%

National Storage REIT is trading at A$2.46, significantly below its estimated fair value of A$3.99, suggesting it may be undervalued based on cash flows. The company reported full-year revenue of A$355.37 million, up from A$330.04 million the previous year, though net income fell to A$28.93 million from A$37.3 million. Forecasts indicate earnings growth at 21.2% annually and revenue growth at 8.2%, outpacing market averages but with a low return on equity projected (4.6%).

- The analysis detailed in our National Storage REIT growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of National Storage REIT.

Seize The Opportunity

- Dive into all 40 of the Undervalued ASX Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Storage REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NSR

National Storage REIT

National Storage is the largest self-storage provider in Australia and New Zealand, with over 225 centres providing tailored storage solutions to over 90,000 residential and commercial customers.

Established dividend payer with reasonable growth potential.