- Australia

- /

- Metals and Mining

- /

- ASX:LTR

3 ASX Growth Stocks With Up To 16% Insider Ownership

Reviewed by Simply Wall St

The ASX200 has recently hit a new record high, buoyed by significant gains in the mining sector and strong performances across ten out of eleven sectors. In this thriving market environment, growth companies with substantial insider ownership can offer unique insights into potential future performance.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 81.1% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Liontown Resources (ASX:LTR)

Simply Wall St Growth Rating: ★★★★★★

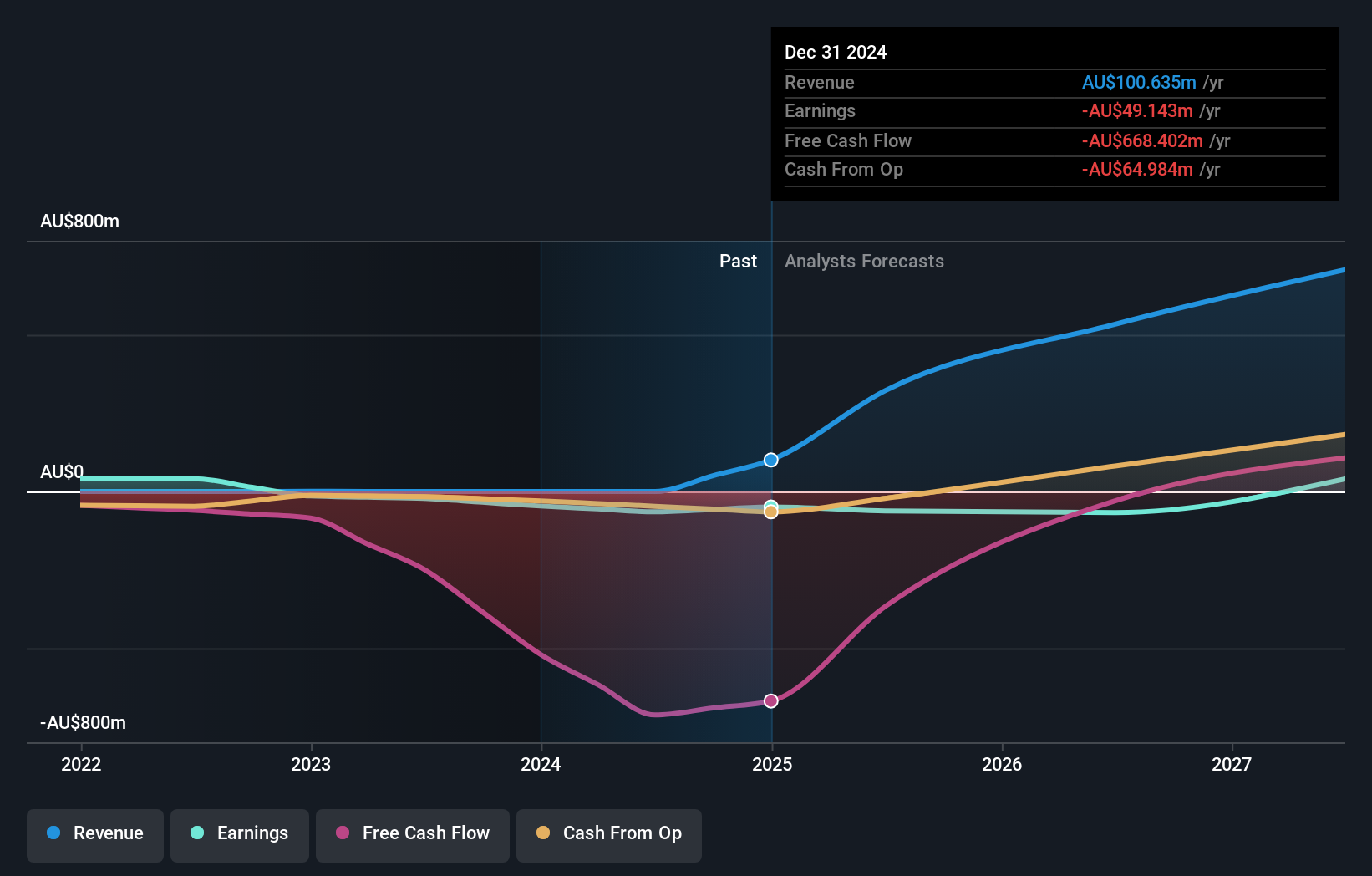

Overview: Liontown Resources Limited (ASX:LTR) focuses on the exploration, evaluation, and development of mineral properties in Australia, with a market cap of A$1.90 billion.

Operations: Liontown Resources Limited's revenue segments primarily involve the exploration, evaluation, and development of mineral properties in Australia.

Insider Ownership: 16.4%

Liontown Resources, a growth company with high insider ownership in Australia, is forecast to grow revenue by 39.2% per year, significantly outpacing the market. Recent strategic partnerships with LG Energy Solution and substantial funding of A$379 million bolster its Kathleen Valley lithium project. Despite reporting a net loss of A$64.92 million for FY2024, Liontown's projected profitability within three years and strong corporate governance improvements highlight its potential for long-term value creation.

- Click to explore a detailed breakdown of our findings in Liontown Resources' earnings growth report.

- In light of our recent valuation report, it seems possible that Liontown Resources is trading behind its estimated value.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

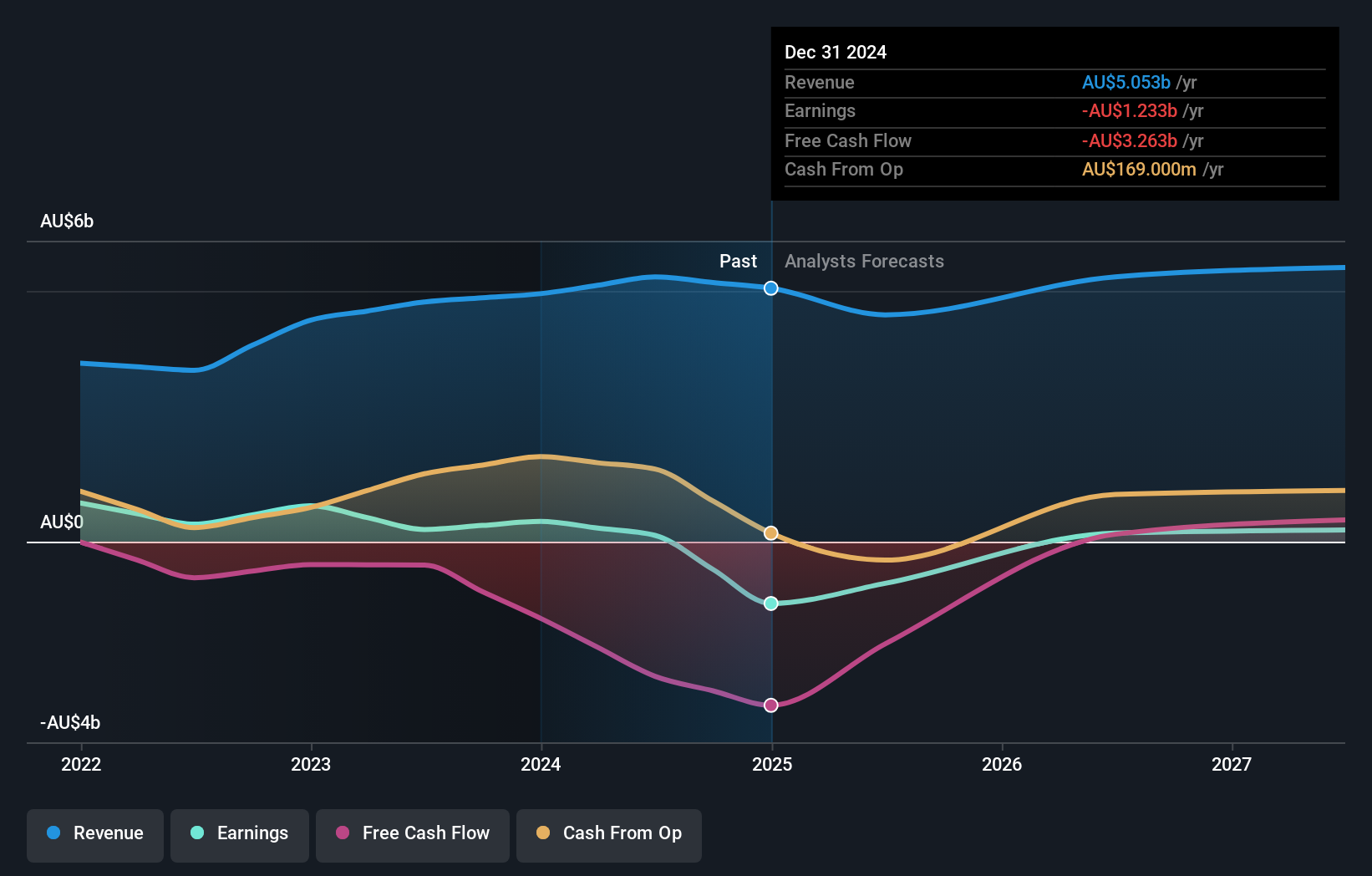

Overview: Mineral Resources Limited, with a market cap of A$9.58 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

Operations: Mineral Resources Limited generates revenue from several segments, including Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), Mining Services (A$3.38 billion), and Other Commodities (A$19 million).

Insider Ownership: 11.7%

Mineral Resources, with high insider ownership, is forecast to grow earnings significantly at 38.3% per year, outpacing the Australian market. Despite a decline in net income from A$243 million to A$125 million for FY2024 and lower profit margins compared to last year, the company trades at 48.4% below its estimated fair value. Revenue growth of 7.1% per year is expected to surpass the market average of 5.5%. Recent insider buying suggests confidence in future prospects.

- Dive into the specifics of Mineral Resources here with our thorough growth forecast report.

- The analysis detailed in our Mineral Resources valuation report hints at an inflated share price compared to its estimated value.

SiteMinder (ASX:SDR)

Simply Wall St Growth Rating: ★★★★★☆

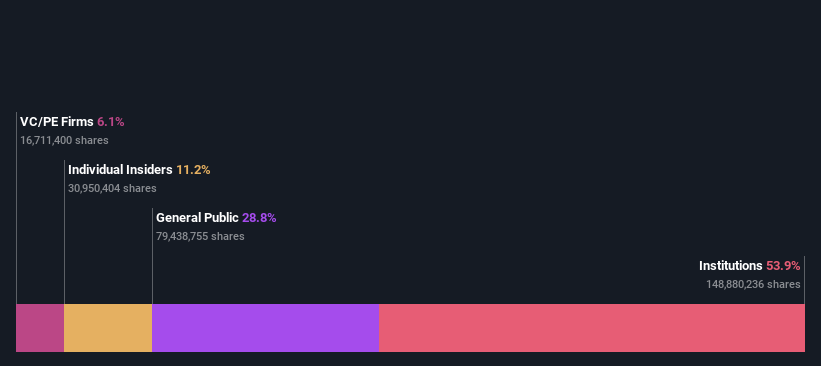

Overview: SiteMinder Limited (ASX:SDR) develops, markets, and sells online guest acquisition platforms and commerce solutions for accommodation providers in Australia and internationally, with a market cap of A$1.71 billion.

Operations: SiteMinder's revenue primarily comes from its software and programming segment, which generated A$190.84 million.

Insider Ownership: 11.2%

SiteMinder reported a significant revenue increase to A$190.67 million for FY2024, up from A$151.38 million the previous year, while reducing its net loss from A$49.3 million to A$25.13 million. Earnings are forecast to grow 60.31% annually, with revenue expected to outpace the Australian market at 19.4% per year and anticipated profitability within three years. The stock trades at 15.9% below its estimated fair value, reflecting strong growth potential despite current losses.

- Delve into the full analysis future growth report here for a deeper understanding of SiteMinder.

- The valuation report we've compiled suggests that SiteMinder's current price could be inflated.

Key Takeaways

- Embark on your investment journey to our 102 Fast Growing ASX Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LTR

Liontown Resources

Engages in the exploration, evaluation, and development of mineral properties in Australia.

Exceptional growth potential with adequate balance sheet.