Here's Why We're Watching WhiteHawk's (ASX:WHK) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether WhiteHawk (ASX:WHK) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for WhiteHawk

How Long Is WhiteHawk's Cash Runway?

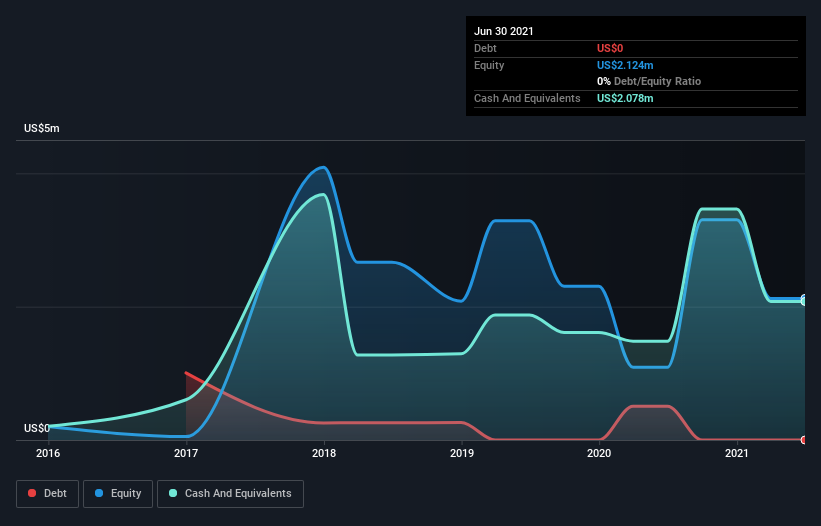

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When WhiteHawk last reported its balance sheet in June 2021, it had zero debt and cash worth US$2.1m. Importantly, its cash burn was US$1.7m over the trailing twelve months. That means it had a cash runway of around 15 months as of June 2021. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Is WhiteHawk's Cash Burn Changing Over Time?

In our view, WhiteHawk doesn't yet produce significant amounts of operating revenue, since it reported just US$2.4m in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. During the last twelve months, its cash burn actually ramped up 53%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. In reality, this article only makes a short study of the company's growth data. You can take a look at how WhiteHawk is growing revenue over time by checking this visualization of past revenue growth.

How Easily Can WhiteHawk Raise Cash?

While WhiteHawk does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

WhiteHawk's cash burn of US$1.7m is about 7.8% of its US$22m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is WhiteHawk's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought WhiteHawk's cash burn relative to its market cap was relatively promising. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Separately, we looked at different risks affecting the company and spotted 4 warning signs for WhiteHawk (of which 1 is concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if WhiteHawk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:WHK

WhiteHawk

Operates an online cybersecurity exchange platform of end-to-end Cyber Risk Software as a Service (SaaS) and Platform as a Service (PaaS) products and services in Australia and the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success