- Australia

- /

- Specialty Stores

- /

- ASX:UNI

Universal Store Holdings (ASX:UNI) stock falls 11% in past week as one-year earnings and shareholder returns continue downward trend

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Universal Store Holdings Limited (ASX:UNI) have tasted that bitter downside in the last year, as the share price dropped 39%. That falls noticeably short of the market decline of around 0.2%. Because Universal Store Holdings hasn't been listed for many years, the market is still learning about how the business performs. On top of that, the share price is down 11% in the last week.

If the past week is anything to go by, investor sentiment for Universal Store Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out the opportunities and risks within the AU Specialty Retail industry.

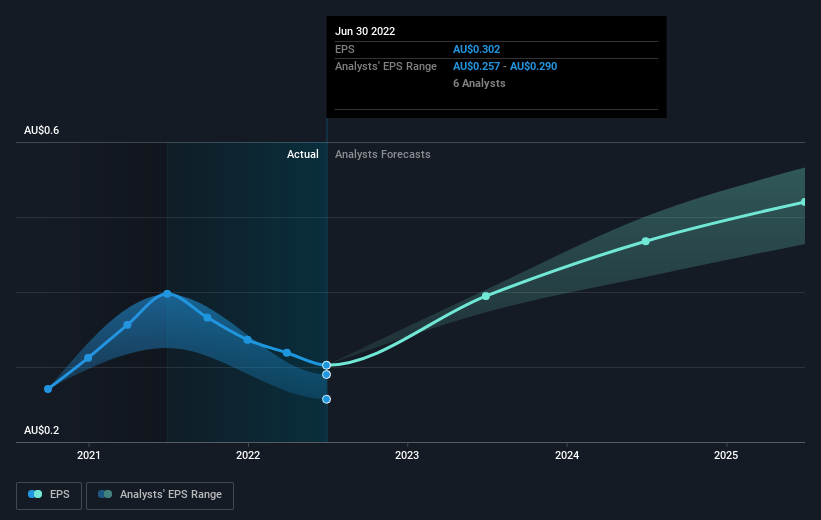

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Unhappily, Universal Store Holdings had to report a 24% decline in EPS over the last year. This reduction in EPS is not as bad as the 39% share price fall. So it seems the market was too confident about the business, a year ago.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Universal Store Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Universal Store Holdings, it has a TSR of -36% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While Universal Store Holdings shareholders are down 36% for the year (even including dividends), the market itself is up 0.2%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. With the stock down 7.3% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Universal Store Holdings better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Universal Store Holdings .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:UNI

Universal Store Holdings

Engages in the retail operations in the fashion market in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success