- Australia

- /

- Specialty Stores

- /

- ASX:UNI

ASX Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As the Australian market navigates a mix of inflationary pressures and sector-specific fluctuations, with the XJO hovering around 8,600 points following Wall Street's recovery, investors are keenly observing growth opportunities. In such an environment, companies with high insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 23.5% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 94.9% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.2% |

| Elsight (ASX:ELS) | 17.3% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 51.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cromwell Property Group (ASX:CMW)

Simply Wall St Growth Rating: ★★★★☆☆

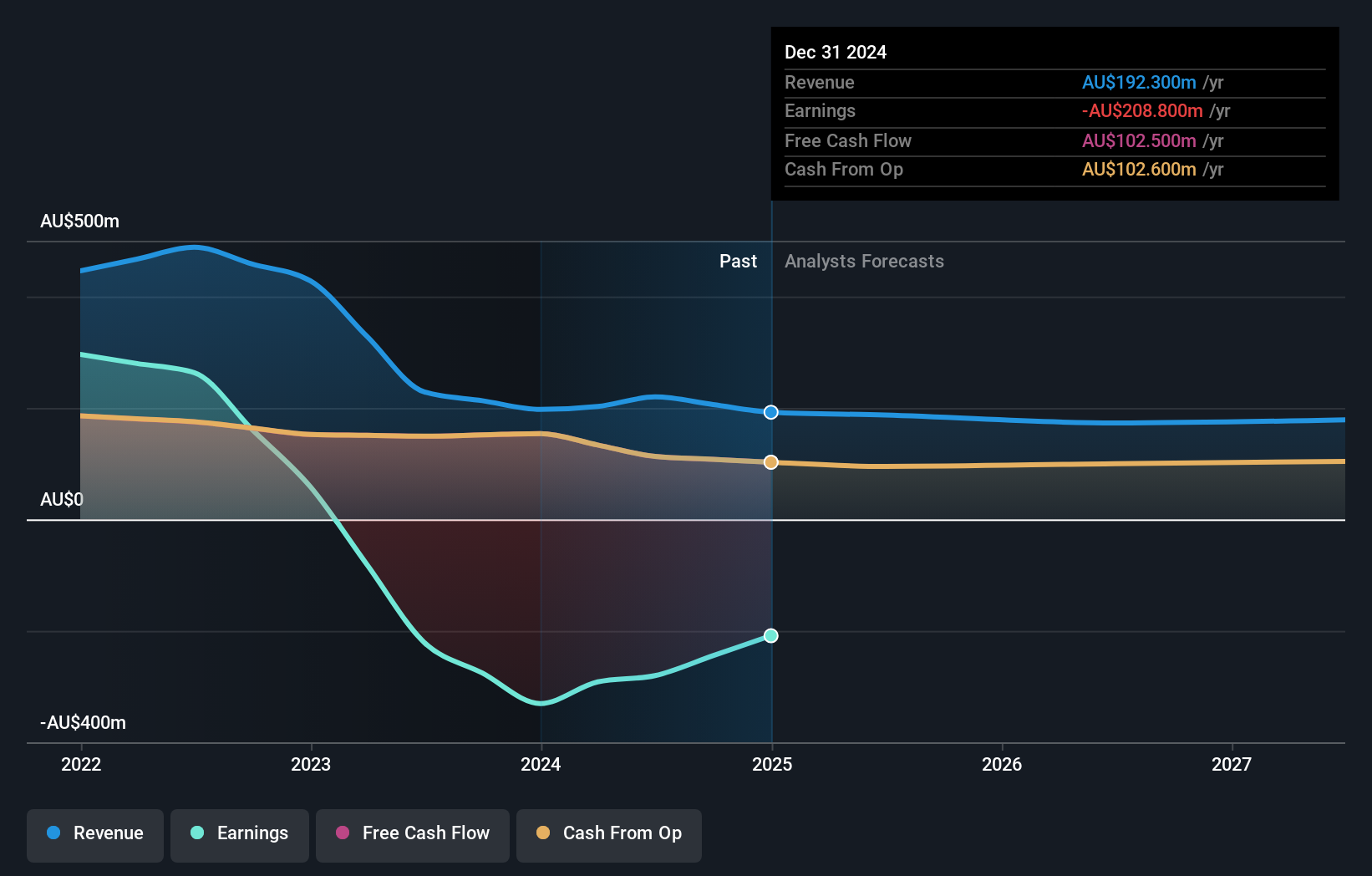

Overview: Cromwell Property Group (ASX:CMW) is a real estate investment manager with $4.2 billion of assets under management in Australia and New Zealand, and it has a market cap of approximately A$1.22 billion.

Operations: The company's revenue segments consist of Co-Investments generating A$19.50 million, an Investment Portfolio contributing A$194 million, and Funds and Asset Management bringing in A$54.70 million.

Insider Ownership: 14.9%

Cromwell Property Group, trading at 45.4% below its estimated fair value, is forecast to become profitable in the next three years with earnings growing at 29.67% annually, surpassing market expectations. Despite revenue growth of 7.3% per year being slower than desired for high-growth companies, it exceeds the Australian market average of 5.9%. However, interest payments are not well covered by earnings and dividends remain unsustainably high at 6.45%, highlighting financial challenges despite improved net loss figures from last year.

- Take a closer look at Cromwell Property Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Cromwell Property Group shares in the market.

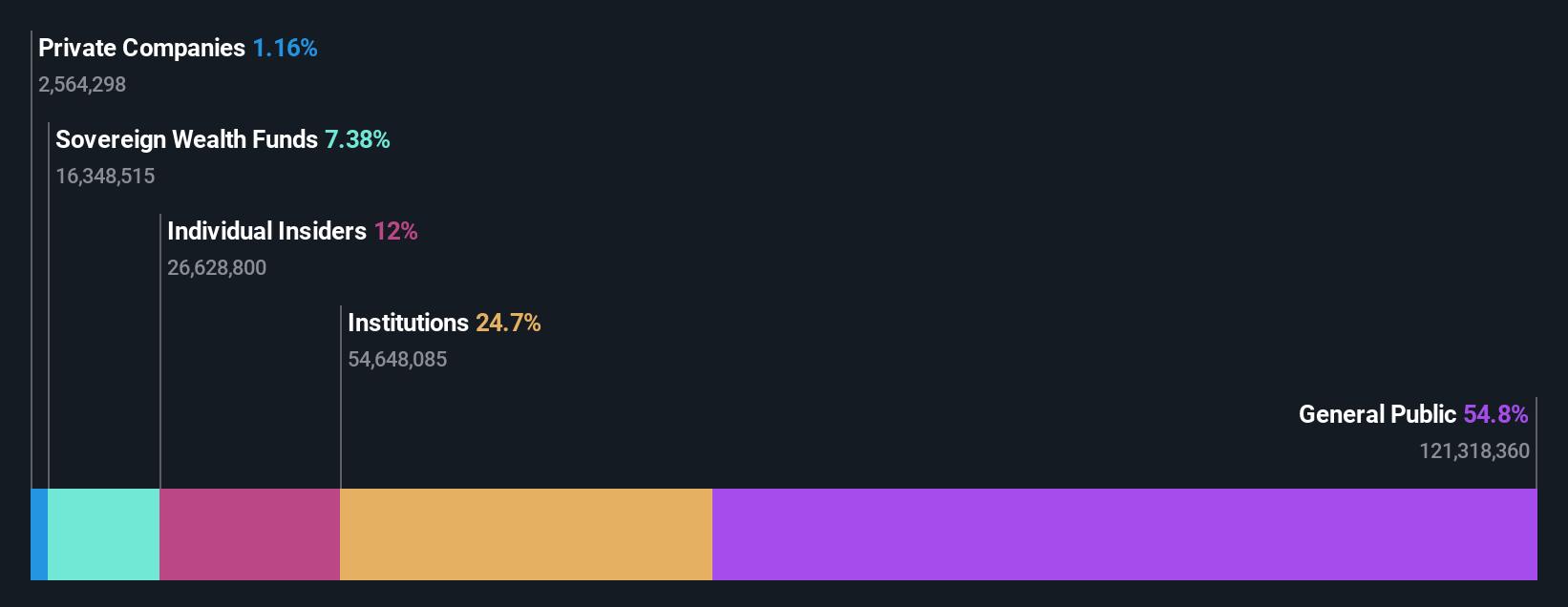

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various regions including Australia, Asia, the Americas, Africa, and Europe, with a market cap of A$1.09 billion.

Operations: The company's revenue is derived from its Advisory segment, contributing A$24.77 million, and its Software segment, generating A$73.96 million.

Insider Ownership: 12%

RPMGlobal Holdings has seen substantial earnings growth, with net income rising to A$47.46 million from A$8.66 million the previous year, and basic earnings per share increasing significantly. Despite this, profit margins have decreased compared to last year. The company is expected to experience robust annual earnings growth of 55%, outpacing the Australian market average. Recent developments include a proposed acquisition by Caterpillar Inc., valuing RPMGlobal at A$1.1 billion, pending regulatory and shareholder approvals.

- Dive into the specifics of RPMGlobal Holdings here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that RPMGlobal Holdings is trading beyond its estimated value.

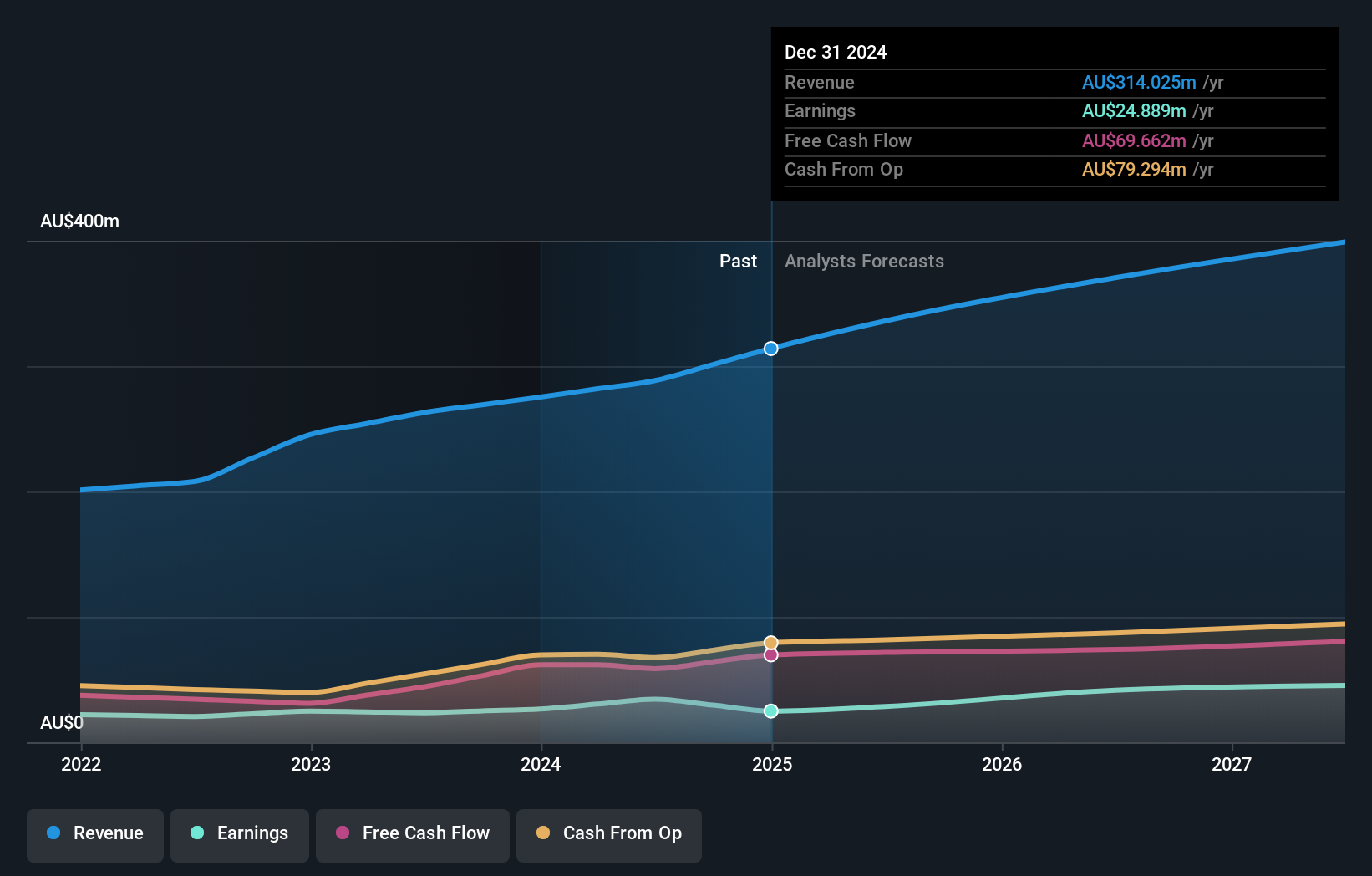

Universal Store Holdings (ASX:UNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Universal Store Holdings Limited operates in the Australian fashion retail market with a market capitalization of A$663.64 million.

Operations: The company's revenue is primarily derived from its US & PS segment, contributing A$306.41 million, and the CTC segment, which adds A$40.06 million.

Insider Ownership: 12.7%

Universal Store Holdings has been added to several indices, highlighting its market presence. Despite a forecasted revenue growth of 8.1% and earnings growth of 16.8%, insider selling has been significant recently, with more shares sold than bought by insiders over the past three months. The company trades at a substantial discount to estimated fair value but faces challenges with lower profit margins compared to last year and a dividend not well covered by earnings.

- Navigate through the intricacies of Universal Store Holdings with our comprehensive analyst estimates report here.

- Our valuation report here indicates Universal Store Holdings may be overvalued.

Next Steps

- Click this link to deep-dive into the 107 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

- Want To Explore Some Alternatives? Uncover 12 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UNI

Universal Store Holdings

Engages in the retail operations in the fashion market in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success