- Australia

- /

- Specialty Stores

- /

- ASX:TPW

Temple & Webster Group Ltd's (ASX:TPW) 31% Jump Shows Its Popularity With Investors

The Temple & Webster Group Ltd (ASX:TPW) share price has done very well over the last month, posting an excellent gain of 31%. The last 30 days bring the annual gain to a very sharp 47%.

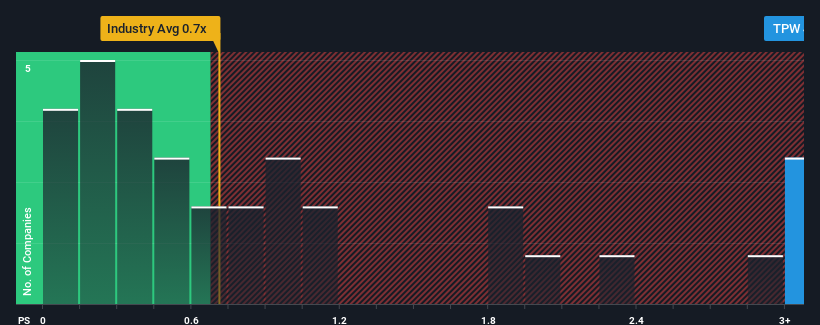

After such a large jump in price, given around half the companies in Australia's Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Temple & Webster Group as a stock to avoid entirely with its 4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Temple & Webster Group. View them for free.See our latest analysis for Temple & Webster Group

How Has Temple & Webster Group Performed Recently?

Recent times have been advantageous for Temple & Webster Group as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Temple & Webster Group will help you uncover what's on the horizon.How Is Temple & Webster Group's Revenue Growth Trending?

In order to justify its P/S ratio, Temple & Webster Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% per annum during the coming three years according to the eleven analysts following the company. That's shaping up to be materially higher than the 5.7% per year growth forecast for the broader industry.

With this information, we can see why Temple & Webster Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Temple & Webster Group's P/S

The strong share price surge has lead to Temple & Webster Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Temple & Webster Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Temple & Webster Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products through its online platform in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026