- Australia

- /

- Diversified Financial

- /

- ASX:AFG

ASX Growth Opportunities With High Insider Ownership

Reviewed by Simply Wall St

As the Australian market navigates a risk-off mood with inflation returning to 3%, investors are keenly watching for opportunities that might defy the broader economic trends, particularly in growth companies with high insider ownership. In such an environment, stocks where insiders hold significant stakes can signal confidence and alignment with shareholder interests, making them intriguing prospects for those seeking resilient investment opportunities on the ASX.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.2% | 91.2% |

| Pointerra (ASX:3DP) | 23.4% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IperionX (ASX:IPX) | 18.2% | 79.7% |

| Image Resources (ASX:IMA) | 22.2% | 92.5% |

| Findi (ASX:FND) | 33.6% | 91.2% |

| Emerald Resources (ASX:EMR) | 18.1% | 35.6% |

| Echo IQ (ASX:EIQ) | 18% | 49.9% |

| Adveritas (ASX:AV1) | 18.8% | 96.8% |

| Acrux (ASX:ACR) | 15.1% | 121.1% |

Here's a peek at a few of the choices from the screener.

Australian Finance Group (ASX:AFG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Finance Group Limited, with a market cap of A$712.01 million, operates in the mortgage broking business through its subsidiaries in Australia.

Operations: The company's revenue is primarily derived from its Distribution segment, contributing A$934.50 million, and its Manufacturing segment, adding A$330.30 million.

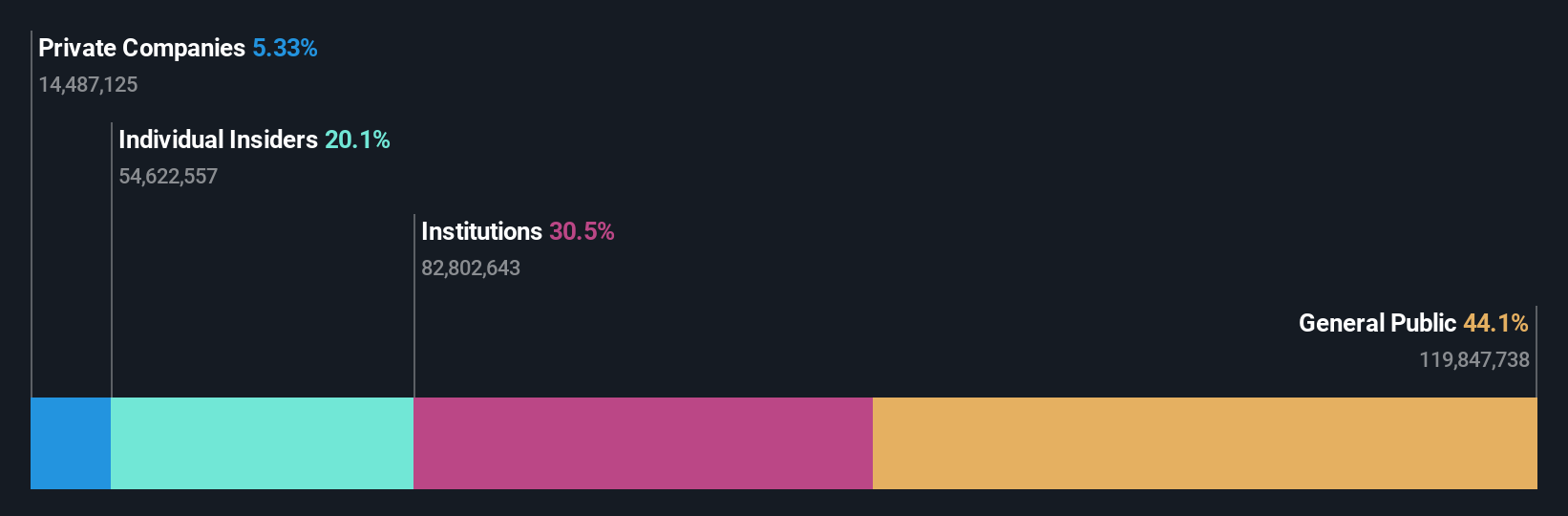

Insider Ownership: 20.1%

Earnings Growth Forecast: 18.1% p.a.

Australian Finance Group is forecast to achieve earnings growth of 18.1% annually, outpacing the broader Australian market. Recent financial results show revenue rising to A$1.24 billion and net income increasing to A$35 million for the year ended June 2025. Despite a high forecasted return on equity of 22%, significant insider selling has occurred over the past three months, which may warrant caution for potential investors seeking growth opportunities with strong insider alignment.

- Click here and access our complete growth analysis report to understand the dynamics of Australian Finance Group.

- Our valuation report unveils the possibility Australian Finance Group's shares may be trading at a premium.

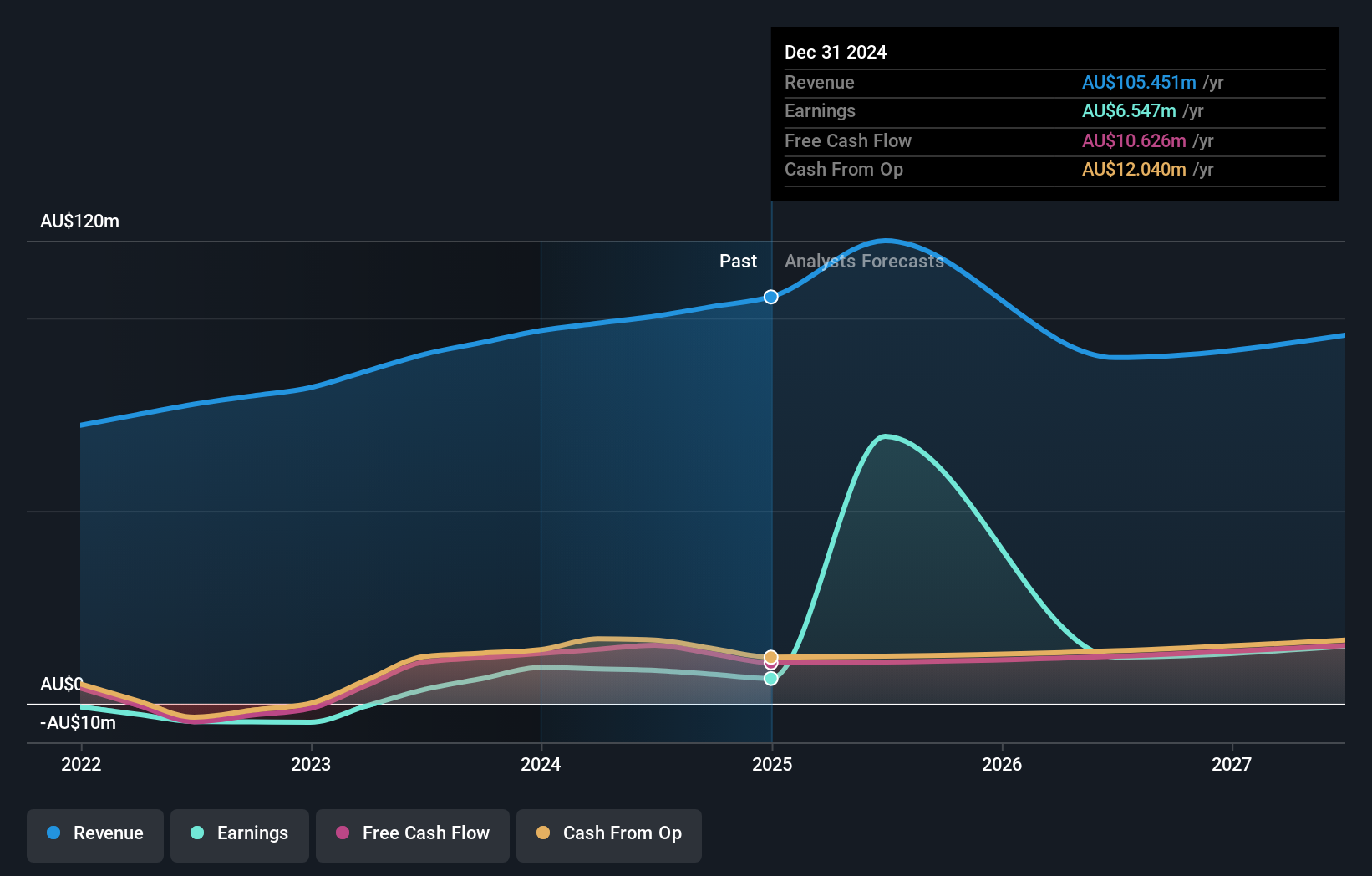

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across various continents, including Australia, Asia, the Americas, Africa, and Europe, with a market cap of A$1.02 billion.

Operations: The company's revenue is derived from two main segments: Advisory, contributing A$24.77 million, and Software, generating A$73.96 million.

Insider Ownership: 12.1%

Earnings Growth Forecast: 55.0% p.a.

RPMGlobal Holdings is experiencing robust growth, with earnings expected to increase significantly at 55% annually, surpassing the Australian market's average. Recent financials reveal a substantial rise in net income to A$47.46 million from A$8.66 million year-over-year. The company is currently involved in a potential acquisition by Caterpillar Inc., valued at A$1.1 billion, which could impact future operations and ownership dynamics. Despite low profit margins and large one-off items affecting results, insider ownership remains strong without recent selling activity reported.

- Click to explore a detailed breakdown of our findings in RPMGlobal Holdings' earnings growth report.

- In light of our recent valuation report, it seems possible that RPMGlobal Holdings is trading beyond its estimated value.

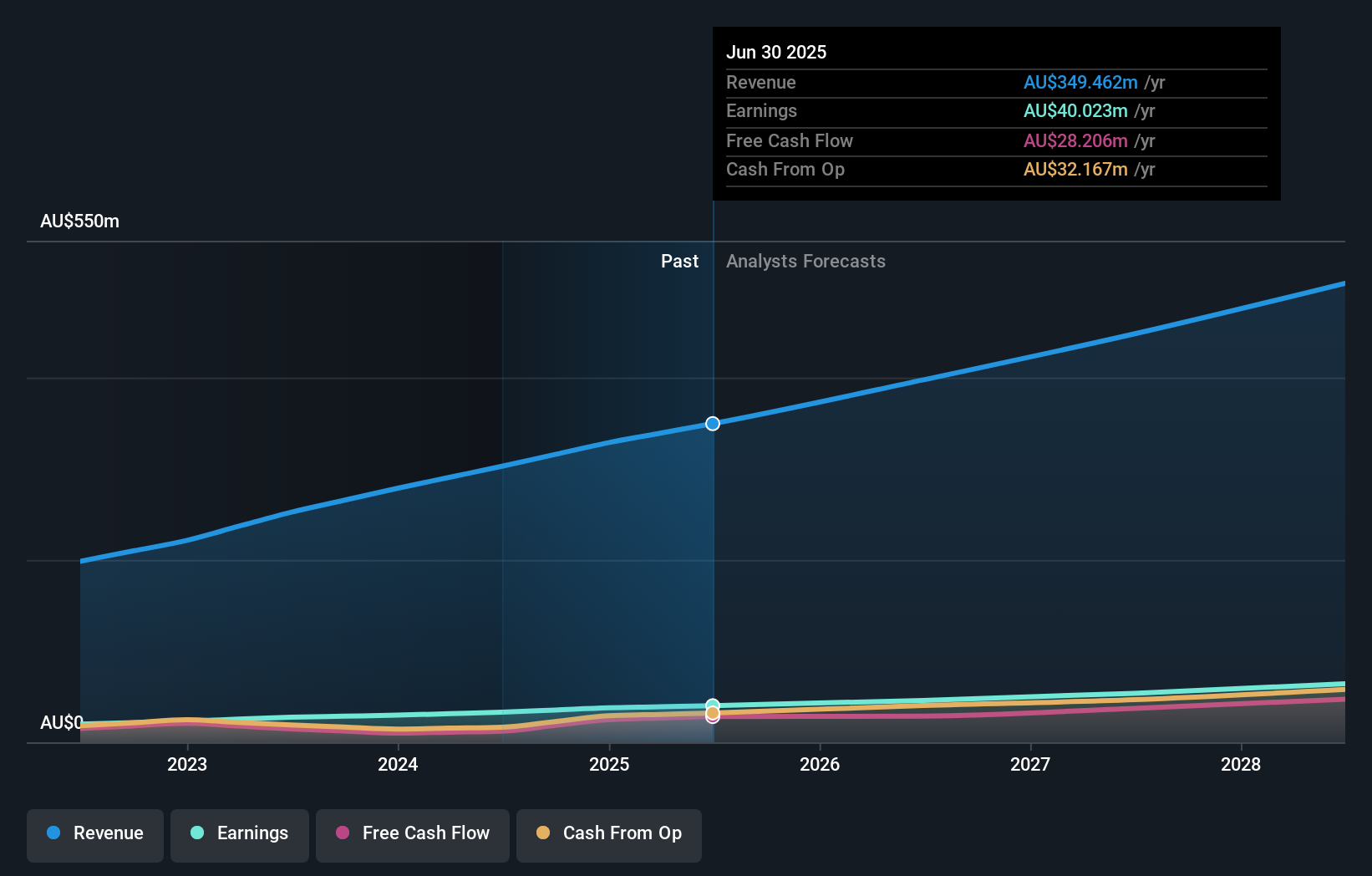

Supply Network (ASX:SNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Supply Network Limited supplies aftermarket parts for commercial vehicles in Australia and New Zealand, with a market cap of A$1.49 billion.

Operations: The company's revenue segment focuses on the provision of aftermarket parts for the commercial vehicle market, generating A$349.46 million.

Insider Ownership: 39.4%

Earnings Growth Forecast: 14.3% p.a.

Supply Network Limited's earnings are forecast to grow at 14.3% annually, outpacing the Australian market average. Recent financials show a rise in net income to A$40.02 million from A$33.03 million year-over-year, reflecting robust growth with revenue reaching A$348.83 million. The company was recently added to the S&P Global BMI Index and announced a change in auditors from HLB Mann Judd to BDO Audit Pty Ltd, while maintaining strong insider ownership without recent selling activity reported.

- Take a closer look at Supply Network's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Supply Network's share price might be too optimistic.

Seize The Opportunity

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 104 more companies for you to explore.Click here to unveil our expertly curated list of 107 Fast Growing ASX Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AFG

Australian Finance Group

Engages in the mortgage broking business in Australia.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives