- Australia

- /

- Real Estate

- /

- ASX:UOS

3 Undiscovered Gems In Australia With Strong Potential

Reviewed by Simply Wall St

The Australian market has shown signs of resilience, with the ASX200 making a modest recovery despite a challenging start to the week. Sectors like Real Estate, Utilities, and Telecommunications have led this rebound, highlighting opportunities even in uncertain times. In this environment, identifying stocks with strong potential involves looking for companies that demonstrate solid fundamentals and innovative strategies. Here are three undiscovered gems in Australia that could offer promising prospects amidst current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.00% | ★★★★★★ |

| Lycopodium | NA | 15.62% | 29.55% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| SKS Technologies Group | NA | 31.29% | 43.27% | ★★★★★★ |

| BSP Financial Group | 4.92% | 6.74% | 5.29% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Paragon Care | 340.88% | 28.05% | 68.37% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Supply Network (ASX:SNL)

Simply Wall St Value Rating: ★★★★★★

Overview: Supply Network Limited supplies aftermarket parts to the commercial vehicle industry in Australia and New Zealand, with a market cap of A$1.06 billion.

Operations: Supply Network Limited generated A$278.41 million in revenue from providing aftermarket parts for the commercial vehicle market in Australia and New Zealand.

Supply Network Limited (SNL) has seen impressive earnings growth of 27.9% over the past year, outpacing the Retail Distributors industry’s 3.4%. The company forecasts consolidated sales revenue of A$302.6 million and a profit after income tax of A$33.1 million for the year ended June 2024. SNL's debt to equity ratio has improved from 18.1% to 12.9% over five years, with interest payments well covered by EBIT at a ratio of 23x, and net debt to equity at a satisfactory level of 6%.

- Get an in-depth perspective on Supply Network's performance by reading our health report here.

Review our historical performance report to gain insights into Supply Network's's past performance.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, with a market cap of A$934.13 million, engages in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia.

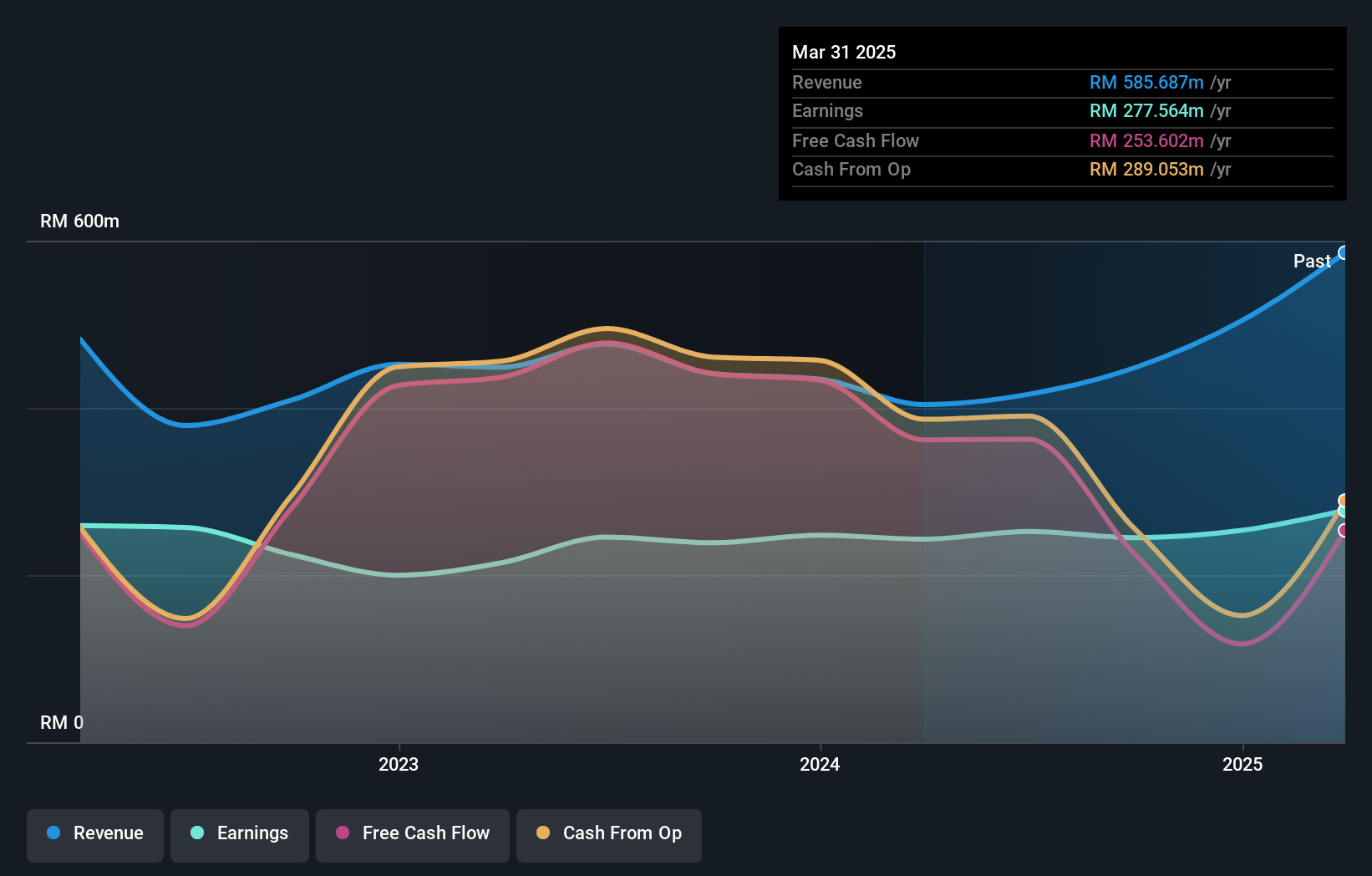

Operations: UOS generates revenue primarily from land development and resale (A$219.34 million) and investments (A$650.20 million). The company has a market cap of A$934.13 million.

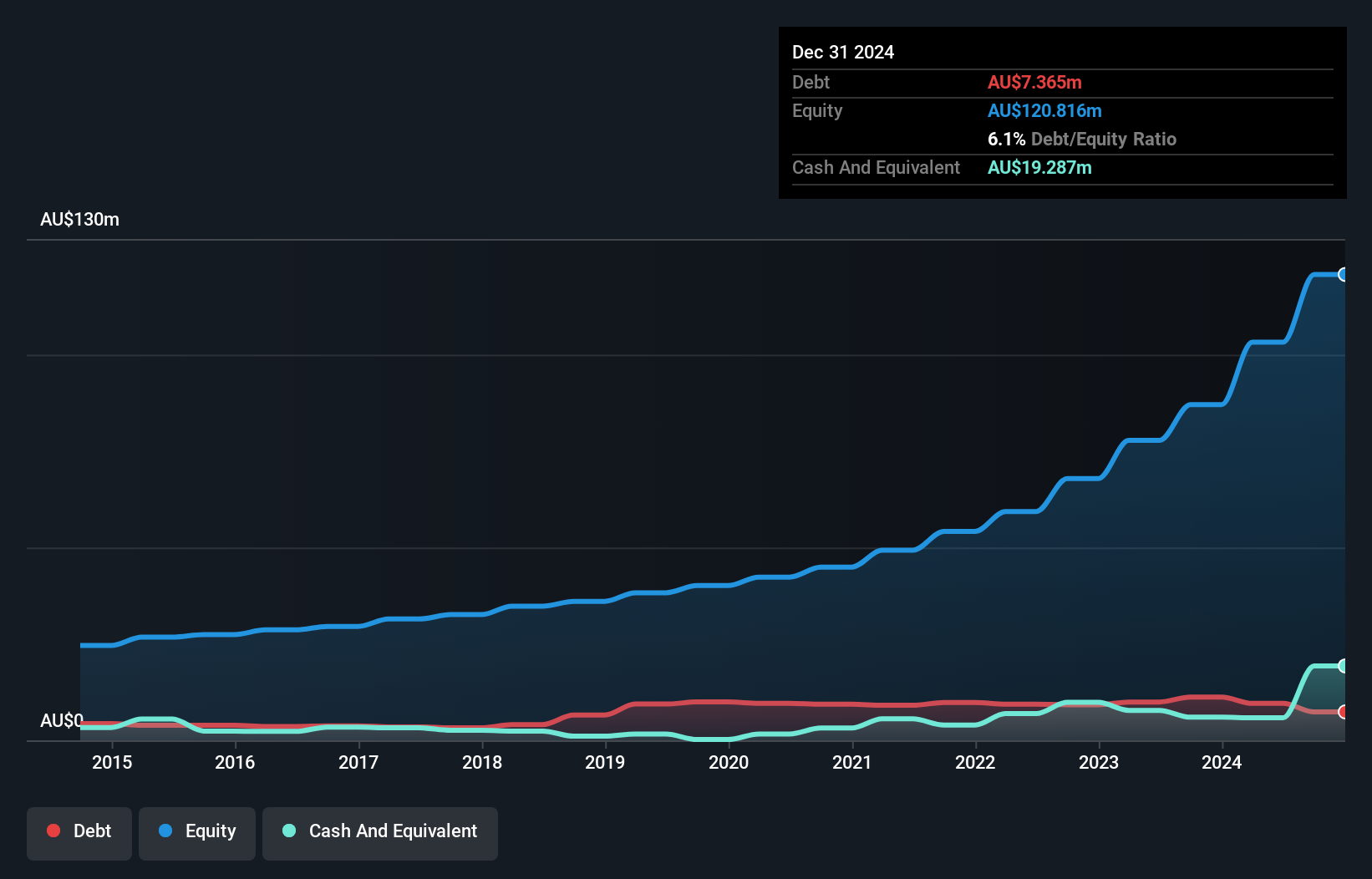

United Overseas Australia (UOA) has shown impressive earnings growth of 18.5% over the past year, outpacing the Real Estate industry's -10.6%. The company reported a significant one-off gain of A$31.1M affecting its recent financials to 31st December 2023. Despite an increase in debt to equity ratio from 5.8% to 9.6% over five years, UOA trades at 52.1% below its estimated fair value and remains profitable with sufficient interest coverage and positive free cash flow.

- Navigate through the intricacies of United Overseas Australia with our comprehensive health report here.

Understand United Overseas Australia's track record by examining our Past report.

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited is involved in the exploration, operation, development, mining, and treatment of gold assets primarily in Western Australia with a market cap of A$2.66 billion.

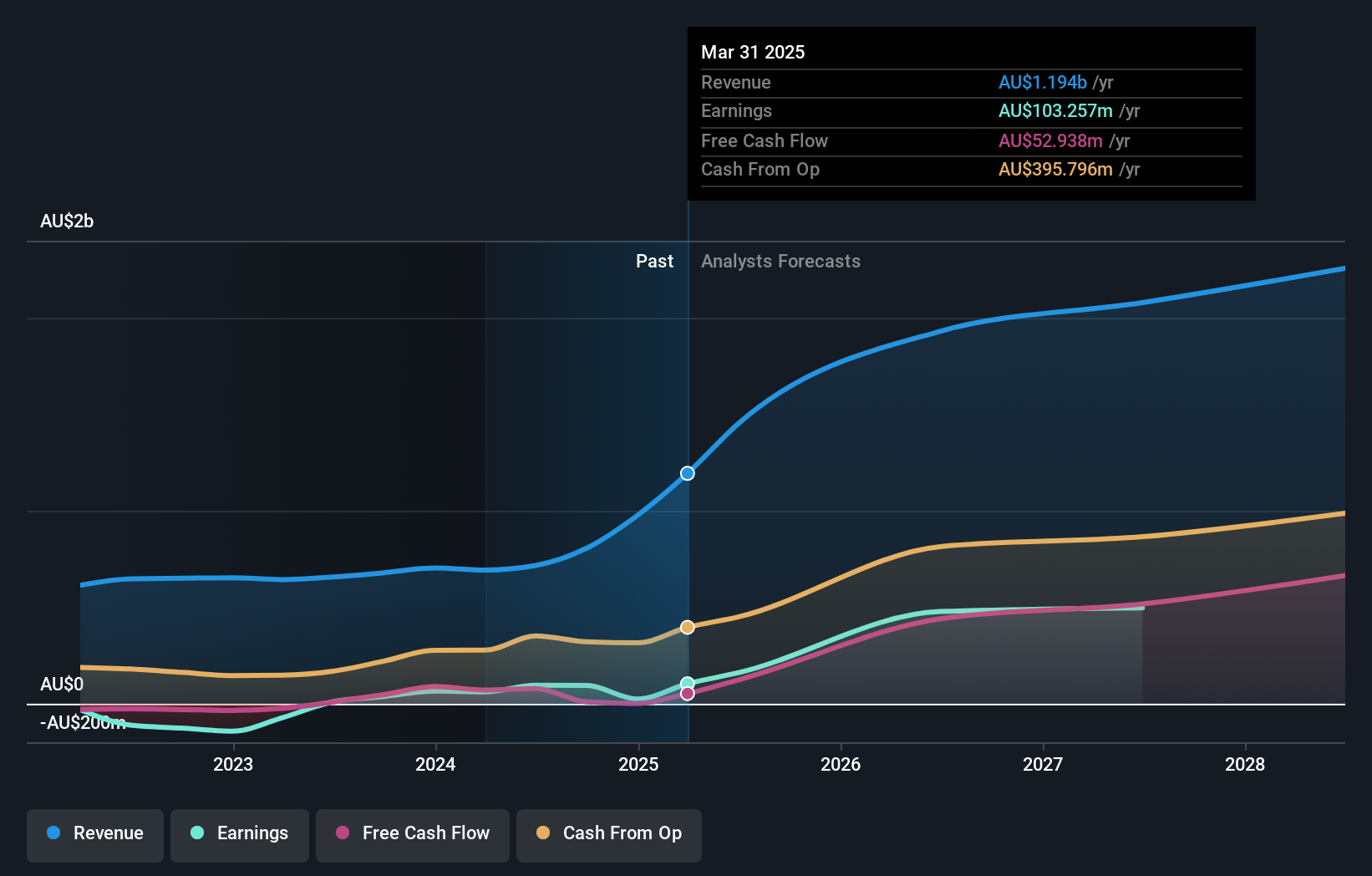

Operations: Westgold Resources generates revenue primarily from its Bryah (A$153.05 million) and Murchison (A$537.63 million) segments. The company has a market cap of A$2.66 billion.

Westgold Resources, a promising player in Australia's mining sector, has recently become profitable and is trading at 60.5% below its estimated fair value. With no debt over the past five years and a forecasted revenue growth of 43.4% annually, it stands out despite substantial shareholder dilution last year. The company reported Q3 sales of A$148 million with net income at A$0.28 million compared to A$4.09 million the previous year, reflecting its volatile earnings trajectory but potential for future gains.

Taking Advantage

- Reveal the 54 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UOS

United Overseas Australia

Engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives